PG&E 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During 2009, the Utility paid cash dividends to holders

of its outstanding series of preferred stock totaling $14

million. On December 16, 2009, the Board of Directors of

the Utility declared a cash dividend on its outstanding

series of preferred stock totaling $4 million that was paid

on February 15, 2010 to preferred shareholders of record

on January 29, 2010. On February 17, 2010, the Board of

Directors of the Utility declared a cash dividend on its

outstanding series of preferred stock, payable on May 15,

2010, to shareholders of record on April 30, 2010.

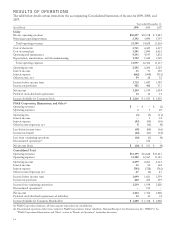

UTILITY

Operating Activities

The Utility’s cash flows from operating activities primarily

consist of receipts from customers less payments of

operating expenses, other than expenses such as

depreciation that do not require the use of cash.

The Utility’s cash flows from operating activities for

2009, 2008, and 2007 were as follows:

(in millions) 2009 2008 2007

Net income $1,250 $1,199 $1,024

Adjustments to reconcile net income

to net cash provided by operating

activities:

Depreciation, amortization, and

decommissioning 1,927 1,838 1,956

Allowance for equity funds used

during construction (94) (70) (64)

Deferred income taxes and tax

credits, net 787 593 43

Other changes in noncurrent assets

and liabilities 6(25) 188

Effect of changes in operating assets

and liabilities:

Accounts receivable 157 (83) (6)

Inventories 109 (59) (41)

Accounts payable (33) (137) (196)

Disputed claims and customer

refunds (700) ––

Income taxes receivable/payable 21 43 56

Regulatory balancing accounts, net (521) (394) (567)

Other current assets (2) (223) 170

Other current liabilities 24 90 24

Other (27) (6) (46)

Net cash provided by

operating activities $2,904 $2,766 $2,541

During 2009, net cash provided by operating activities

increased $138 million compared to the same period in

2008, primarily due to the collection of $821 million in

rates to recover an under-collection in the Utility’s energy

resource recovery balancing account that was incurred in

2008 due to higher than expected energy procurement

costs. (See Note 3 of the Notes to the Consolidated

Financial Statements.) The increase in operating cash flows

also reflects a decline of $520 million in net collateral paid

by the Utility related to price risk management activities in

2009. Collateral payables and receivables are included in

Other changes in noncurrent assets and liabilities, Other

current assets, and Other current liabilities in the table

above. (See Note 10 of the Notes to the Consolidated

Financial Statements.) Operating cash flows in 2009 were

also favorably impacted by an increase of $75 million due

to the timing and amount of various tax settlements and

payments. (See Note 9 of the Notes to the Consolidated

Financial Statements for further discussion.)

Increases in operating cash flows in 2009 were partially

offset by a $700 million payment to the California Power

Exchange to reduce the Utility’s liability for the remaining

net disputed claims (see Note 14 of the Notes to the

Consolidated Financial Statements), a refund of $230

million received by the Utility in 2008 from the California

Energy Commission with no similar refund in 2009, and

the subsequent return of this $230 million refund to

customers in 2009 (see Note 3 of the Notes to the

Consolidated Financial Statements).

During 2008, net cash provided by operating activities

increased by $225 million compared to the same period in

2007, primarily due to an increase in net income tax

refunds received of $689 million and an increase of $230

million for a refund received by the Utility from the

California Energy Commission with no similar refund in

2007. These increases in operating cash flows were partially

offset by an increase of $459 million in net collateral paid

by the Utility related to price risk management activities in

2008 reflecting declining natural gas prices.

Various factors can affect the Utility’s future operating

cash flows, including the timing of cash collateral payments

and receipts related to price risk management activity. The

Utility’s cash collateral activity will fluctuate based on

changes in the Utility’s net credit exposure to

counterparties, which primarily depends on electricity and

gas price movement. The Utility’s operating cash flows also

will be impacted by electricity procurement costs and the

timing of rate adjustments authorized to recover these

costs. The CPUC has established a balancing account

mechanism to adjust the Utility’s electric rates whenever

the forecasted aggregate over-collections or under-

collections of the Utility’s electric procurement costs for

the current year exceed 5% of the Utility’s prior-year

generation revenues, excluding generation revenues for

DWR contracts.

23