PG&E 2009 Annual Report Download - page 69

Download and view the complete annual report

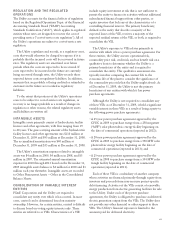

Please find page 69 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.market participants would use in pricing the assets or

liabilities. Fair value is defined as the price that would be

received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the

measurement date, or the “exit price.” PG&E Corporation

and the Utility utilize a fair value hierarchy that prioritizes

the inputs to valuation techniques used to measure fair

value and give precedence to observable inputs in

determining fair value. An instrument’s level within the

hierarchy is based on the lowest level of any significant

input to the fair value measurement. The hierarchy gives

the highest priority to unadjusted quoted prices in active

markets for identical assets or liabilities (Level 1

measurements) and the lowest priority to unobservable

inputs (Level 3 measurements). Assets and liabilities are

classified based on the lowest level of input that is

significant to the fair value measurement. (See Note 11 of

the Notes to the Consolidated Financial Statements for

further discussion.)

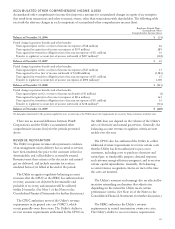

FAIR VALUE OPTION

PG&E Corporation and the Utility have not elected the fair

value option for any assets or liabilities during the years

ended December 31, 2009 and 2008.

ADOPTION OF NEW ACCOUNTING

PRONOUNCEMENTS

Disclosures about Derivative Instruments and Hedging

Activities — an amendment of FASB Statement No. 133

On January 1, 2009, PG&E Corporation and the Utility

adopted Statement of Financial Accounting Standards

(“SFAS”) No. 161, “Disclosures about Derivative

Instruments and Hedging Activities — an amendment of

FASB Statement No. 133” (“SFAS No. 161”), which is

codified in the Derivatives and Hedging Topic of the FASB

ASC. SFAS No. 161 requires an entity to provide

qualitative disclosures about its objectives and strategies for

using derivative instruments and quantitative disclosures

that detail the fair value amounts of, and gains and losses

on, derivative instruments. SFAS No. 161 also requires

disclosures about credit risk-related contingent features of

derivative instruments. (See Note 10 of the Notes to the

Consolidated Financial Statements.)

Noncontrolling Interests in Consolidated Financial

Statements — an amendment of ARB No. 51

On January 1, 2009, PG&E Corporation and the Utility

adopted SFAS No. 160, “Noncontrolling Interests in

Consolidated Financial Statements — an amendment of

Accounting Research Bulletin No. 51” (“SFAS No. 160”),

which is codified in the Consolidation Topic of the FASB

ASC. SFAS No. 160 establishes accounting and reporting

standards for a noncontrolling interest in a subsidiary and

for the deconsolidation of a subsidiary. SFAS No. 160

defines a “noncontrolling interest,” previously called a

“minority interest,” as the portion of equity in a subsidiary

not attributable, directly or indirectly, to a parent. Among

other items, SFAS No. 160 requires that an entity

(1) include a noncontrolling interest in its consolidated

statement of financial position within equity separate from

the parent’s equity, (2) report amounts inclusive of both

the parent’s and noncontrolling interest’s shares in

consolidated net income, and (3) separately report the

amounts of consolidated net income attributable to the

parent and noncontrolling interest on the consolidated

statement of operations. If a subsidiary is deconsolidated,

any retained noncontrolling equity investment in the

former subsidiary must be measured at fair value, and a

gain or loss must be recognized in net income based on

such fair value.

PG&E Corporation has reclassified its noncontrolling

interest in the Utility from Preferred Stock of Subsidiaries

to equity in PG&E Corporation’s Consolidated Financial

Statements in accordance with SFAS No. 160 for all

periods presented. The Utility had no material

noncontrolling interests in consolidated subsidiaries as of

December 31, 2009 and December 31, 2008.

PG&E Corporation and the Utility applied the

presentation and disclosure requirements of SFAS No. 160

retrospectively. Other than the change in presentation of

noncontrolling interests, adoption of SFAS No. 160 did

not have a material impact on PG&E Corporation’s or the

Utility’s Consolidated Financial Statements.

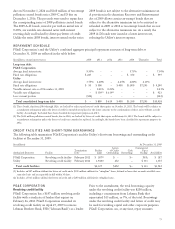

Subsequent Events

On June 30, 2009, PG&E Corporation and the Utility

adopted SFAS No. 165, “Subsequent Events” (“SFAS

No. 165”), which is codified in the Subsequent Events

Topic of the FASB ASC. SFAS No. 165 does not

significantly change the prior accounting practice for

subsequent events, except for the requirement to disclose

the date through which an entity has evaluated subsequent

events and the basis for that date. PG&E Corporation and

the Utility have evaluated material subsequent events

through February 19, 2010, the issue date of PG&E

Corporation’s and the Utility’s Consolidated Financial

Statements. Other than this disclosure, adoption of SFAS

No. 165 did not have a material impact on PG&E

Corporation’s or the Utility’s Consolidated Financial

Statements.

Recognition and Presentation of Other-Than-Temporary

Impairments

On June 30, 2009, PG&E Corporation and the Utility

adopted FASB Staff Position (“FSP”) SFAS 115-2 and SFAS

65