PG&E 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

These financial instruments are considered derivative

instruments and are recorded at fair value within the

Consolidated Balance Sheets.

The Utility manages natural gas price risk associated

with its electric procurement portfolio in accordance with

its risk management strategies included in electricity

procurement plans approved by the CPUC. The CPUC did

not approve the Utility’s proposed electric portfolio gas

hedging plan that was included in the Utility’s long-term

procurement plan. Instead, the CPUC deferred

consideration of the proposal to another proceeding. The

CPUC ordered the Utility to continue operating under the

previously approved gas hedging plan. The expenses

associated with the hedging plan are expected to be

recovered through rates.

Natural Gas Procurement (Small Commercial and

Residential Customers)

The Utility enters into physical natural gas commodity

contracts to fulfill the needs of its small commercial and

residential, or “core,” customers. (The Utility does not

procure natural gas for industrial and large commercial, or

“non-core,” customers.) Changes in temperature cause

natural gas demand to vary daily, monthly, and seasonally.

Consequently, varying volumes of gas may be purchased or

sold in the monthly and, to a lesser extent, daily spot

market to balance such seasonal supply and demand.

The Utility manages its winter exposure to variable

natural gas prices in accordance with its CPUC-approved

annual core portfolio hedging implementation plans.

Accordingly, the Utility has entered into various financial

instruments, such as swaps and options, intended to reduce

the uncertainty associated with fluctuating natural gas

purchase prices. These financial instruments are considered

derivative instruments that are recorded at fair value within

the Consolidated Balance Sheets.

OTHER RISK

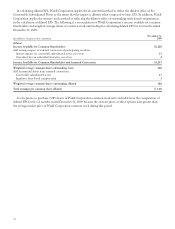

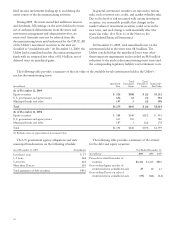

At December 31, 2009, PG&E Corporation had $247

million of Convertible Subordinated Notes outstanding

scheduled to mature on June 30, 2010. The holders of the

Convertible Subordinated Notes are entitled to receive

pass-through dividends determined by multiplying the cash

dividend paid by PG&E Corporation per share of common

stock by a number equal to the principal amount of the

Convertible Subordinated Notes divided by the conversion

prices. The dividend participation rights associated with the

Convertible Subordinated Notes are embedded derivative

instruments and, therefore, must be bifurcated from the

Convertible Subordinated Notes and recorded at fair value

in PG&E Corporation’s Consolidated Financial

Statements. Changes in fair value of the dividend

participation rights are recognized in PG&E Corporation’s

Consolidated Statements of Income as non-operating

expense or income (in Other income (expense), net).

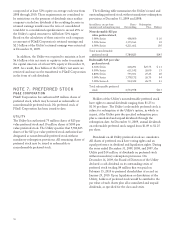

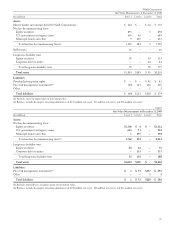

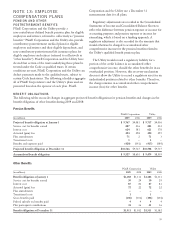

VOLUME OF DERIVATIVE ACTIVITY

At December 31, 2009, the volume of PG&E Corporation’s and the Utility’s outstanding derivative contracts was as

follows:

Contract Volume(1)

Underlying Product Instruments Less Than 1

Year

Greater Than

1 Year but

Less Than 3

Years

Greater

Than 3

Years but

Less Than 5

Years Greater Than

5 Years(2)

Natural Gas(3) (MMBtus(4)) Forwards, Futures, and Swaps 288,485,226 167,046,788 15,512,500 –

Options 175,269,728 99,834,308 – –

Electricity (Megawatt-hours) Forwards, Futures, and Swaps 3,830,256 7,787,609 4,652,112 4,233,696

Options 9,400 11,450 136,048 532,444

Congestion Revenue Rights 86,222,176 66,936,541 66,869,998 118,548,809

PG&E Corporation Equity

(Shares) Dividend Participation Rights 16,370,789 – – –

(1) Amounts shown reflect the total gross derivative volumes by commodity type that are expected to settle in each time period.

(2) Derivatives in this category expire between 2015 and 2022.

(3) Amounts shown are for the combined positions of the electric and core gas portfolios.

(4) Million British Thermal Units.

84