PG&E 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

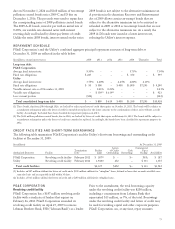

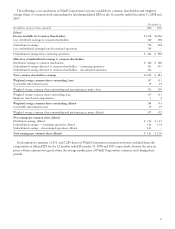

The total amount of ERB principal outstanding was $1.2 billion at December 31, 2009 and $1.6 billion at

December 31, 2008. The scheduled principal repayments for ERBs are reflected in the table below:

(in millions) 2010 2011 2012 Total

Utility

Average fixed interest rate 4.49% 4.59% 4.66% 4.58%

Energy recovery bonds $ 386 $ 404 $ 423 $1,213

While PERF is a wholly owned consolidated subsidiary

of the Utility, it is legally separate from the Utility. The

assets (including the recovery property) of PERF are not

available to creditors of the Utility or PG&E Corporation,

and the recovery property is not legally an asset of the

Utility or PG&E Corporation.

NOTE 6: COMMON STOCK

PG&E CORPORATION

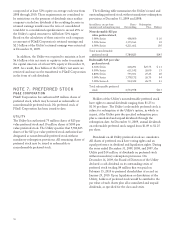

PG&E Corporation has authorized 800 million shares of

no-par common stock, of which 371,272,457 shares were

issued and outstanding at December 31, 2009 and

362,346,685 shares were issued and outstanding at

December 31, 2008.

Of the 371,272,457 shares issued and outstanding at

December 31, 2009, 670,552 shares were granted as

restricted stock as share-based compensation awarded

under the PG&E Corporation Long-Term Incentive

Program and the 2006 Long-Term Incentive Plan (“2006

LTIP”), and 6,773,290 shares were issued upon the exercise

of employee stock options, for the account of 401(k) plan

participants, and to participants in the Dividend

Reinvestment and Stock Purchase Plan (“DRSPP”). (See

Note 13 of the Notes to the Consolidated Financial

Statements.) In addition, 2,187,269 shares were issued upon

the conversion of Convertible Subordinated Notes. (See

Note 4 of the Notes to the Consolidated Financial

Statements.)

UTILITY

The Utility is authorized to issue 800 million shares of its

$5 par value common stock, of which 264,374,809 shares

were issued and outstanding as of December 31, 2009 and

2008. As of December 31, 2009, PG&E Corporation held

all of the Utility’s outstanding common stock.

The Utility may pay common stock dividends and

repurchase its common stock provided that cumulative

preferred dividends on its preferred stock are paid.

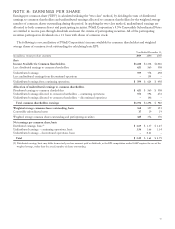

DIVIDENDS

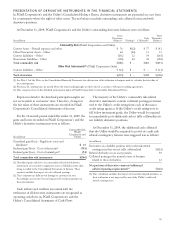

During 2009, the Utility paid common stock dividends

totaling $624 million to PG&E Corporation. During 2009,

PG&E Corporation paid common stock dividends of $1.65

per share, totaling $590 million, net of $17 million that

was reinvested in additional shares of common stock by

participants in the DRSPP. On December 16, 2009, the

Board of Directors of PG&E Corporation declared a

quarterly dividend of $0.42 per share, totaling $157

million, which was paid on January 15, 2010 to

shareholders of record on December 31, 2009.

During 2008, the Utility paid common stock dividends

totaling $589 million, including $568 million of common

stock dividends paid to PG&E Corporation and $21

million paid to PG&E Holdings, LLC. During 2008, PG&E

Corporation paid common stock dividends of $1.53 per

share, totaling $554 million, net of $20 million that was

reinvested in additional shares of common stock by

participants in the DRSPP, and including $28 million that

was paid to Elm Power Corporation.

During 2007, the Utility paid common stock dividends

of $547 million, including $509 million of common stock

dividends paid to PG&E Corporation and $38 million paid

to PG&E Holdings, LLC. During 2007, PG&E Corporation

paid common stock dividends of $1.41 per share totaling

$526 million, net of $5 million that was reinvested in

additional shares of common stock by participants in the

DRSPP, and including $35 million that was paid to Elm

Power Corporation.

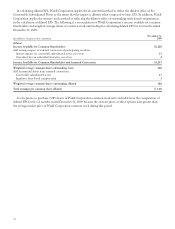

Effective August 29, 2008, PG&E Holdings, LLC, and

Elm Power Corporation, wholly owned subsidiaries of the

Utility and PG&E Corporation, respectively, were

dissolved, and the shares of each entity were subsequently

cancelled.

PG&E Corporation and the Utility each have a

revolving credit facility that requires the company to

maintain a ratio of consolidated total debt to consolidated

capitalization of at most 65%. In addition, the CPUC

requires the Utility to maintain a capital structure

75