PG&E 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PROVIDING VALUE FOR INVESTORS

Ensuring that PG&E Corporation represents a solid value

for investors is an essential prerequisite for our success.

Utilities that are financially sound and healthy have the

wherewithal to attract new capital at reasonable costs and

fund smart long-term investments for customers.

Last year’s financial results showed that we continue to

provide the kinds of opportunities that investors are

seeking. We grew core earnings primarily through a

combination of new capital investments in PG&E’s utility

asset base, along with incentives earned by helping

customers realize aggressive energy efficiency targets and

efficiencies realized by effectively managing our resources.

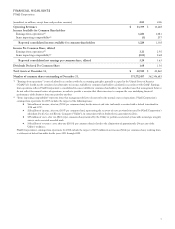

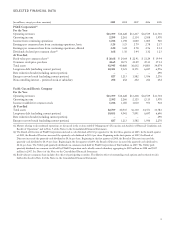

Total net income for 2009 was solid at $1.22 billion, or

$3.20 per share, as reported under generally accepted

accounting principles (GAAP). This compared with net

income of $1.34 billion for 2008, which was enlarged

significantly by the one-time benefits of a multiyear tax

settlement.

Earnings per share from operations, a non-GAAP

measure adjusted to reflect normal operations and exclude

unusual items like last year’s tax settlement, were $3.21 per

share, up almost 9 percent over 2008 levels. (The “Financial

Highlights” table on page 7 reconciles GAAP total net

income with non-GAAP earnings from operations.)

These results were just above the midpoint of our

earnings guidance range, and they exceeded Wall Street’s

consensus expectation.

In addition to earnings growth, in early 2009 we raised

PG&E Corporation’s common stock dividend. The

8 percent increase was in keeping with our view that

dividend growth should accompany growth in earnings

over time. In fact, we raised the dividend again in early

2010 on the strength of our full-year 2009 results and our

confidence in the outlook for 2010.

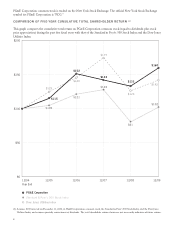

Total shareholder return for 2009—stock price

appreciation plus dividends—was 20 percent. As strong as

PG&E’s return was, however, it put us in the middle of the

pack last year relative to comparable utilities, many of which

were rebounding from the dramatic decline in late 2008.

But if some of our peers bounced back more strongly, it

is also the case that in many instances their shares had

fallen further. As we noted last year, PG&E shares held

their value better than many other utilities during the

downturn.

A truer indication of PG&E’s relative strength is the

company’s two- and three-year total shareholder returns.

Over the past three years, our return put the company

firmly in the top half of the peers we track. And over the

past two years, our return has been the best in the group.

More importantly, our financial forecasts for 2010 and

2011 reflect expectations that earnings will keep growing at

a competitive pace. Indeed, our goal is to deliver total

shareholder returns that are in the top 25 percent among

comparable utilities.

INVESTING IN CALIFORNIA’S ENERGY FUTURE

Last year’s capital investment once again focused

principally on increasing reliability and capacity across the

extensive network of wires, pipes, generating stations, and

other essential assets at the heart of California’s energy

infrastructure.

PG&E’s total capital expenditures in 2009 were

$3.9 billion. This exceeded our initial capital spending

goals for the year, but remained consistent with our

projected range for annual average capital expenditures

over the 2008 through 2011 time frame.

The majority of these resources supported ongoing

efforts to strengthen local electric and natural gas

distribution systems. For example, we made improvements

to a number of our least reliable electric circuits, we added

new protective equipment to lines, and we installed new

hardware to enhance power restoration capabilities in

certain reliability hot spots.

We also proceeded with efforts to lay the foundation for

the emerging smart grid, through the ongoing transition to

SmartMeter™technology. By year’s end, total installations

of new gas and electric meters reached approximately

4.5 million out of a total of 10 million that will be in place

by mid-2012.

With its ability to send timely energy-usage data and its

Web-like connectivity options, SmartMeter™technology

will be the basis for a range of new energy management

tools and capabilities, which are key to improving customer

service, increasing reliability, expanding energy efficiency

and demand response, and optimizing the use of renewable

energy sources and, soon, electric vehicles.

Last year also saw further heavy investment in electric

transmission, with a focus on asset replacement and

alleviating grid congestion. Other projects in this area were

aimed at interconnecting new generation, including new

renewable power sources, and improving reliability through

automation.

PG&E also won federal support for a project to install

new monitoring and communications technology within

our electric transmission system. Known as

synchrophasors, the devices will help identify and address

potential reliability concerns and improve our ability to

integrate intermittent renewable power resources.

2