PG&E 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PG&E Corporation and the Utility recognize a tax

benefit if it is more likely than not that a tax position taken

or expected to be taken in a tax return will be sustained

upon examination by taxing authorities based on the

merits of the position. The tax benefit recognized in the

financial statements is measured based on the largest

amount of benefit that is greater than 50% likely of being

realized upon settlement. The difference between a tax

position taken or expected to be taken in a tax return and

the benefit recognized and measured pursuant to this

guidance represents an unrecognized tax benefit.

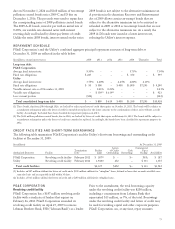

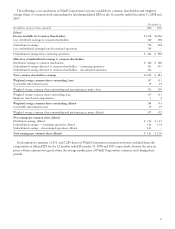

The following table reconciles the changes in

unrecognized tax benefits:

PG&E

Corporation Utility

(in millions)

Balance at January 1, 2007 $ 212 $ 90

Additions for tax position taken during a

prior year 15 4

Reductions for tax position taken during

a prior year (18) –

Balance at December 31, 2007 $ 209 $ 94

Additions for tax position taken during

the current year 43 20

Settlements (177) (77)

Balance at December 31, 2008 $75 $37

Additions for tax position taken during a

prior year 4 4

Additions of tax position taken during

the current year 624 623

Settlements (27) (12)

Reductions for tax position taken during

a prior year (3) –

Balance at December 31, 2009 $ 673 $652

The component of unrecognized tax benefits that, if

recognized, would affect the effective tax rate at

December 31, 2009 for PG&E Corporation and the Utility

is $36 million and $22 million, respectively, with the

remaining balance representing the probable deferral of

taxes to later years. It is reasonably possible that

unrecognized tax benefits could decrease in the next 12

months by an amount ranging from $0 to $30 million.

PG&E Corporation and the Utility recognize accrued

interest and penalties related to unrecognized tax benefits

as income tax expense in the Consolidated Statements of

Income. Interest income and penalties recognized in

income tax expense by PG&E Corporation in 2009 and

2008 was $19 million and $24 million, respectively. In

2007, interest expense recognized by PG&E Corporation

was $4 million. Interest income and penalties recognized in

income tax expense by the Utility in 2009 and 2008 was

$14 million and $11 million, respectively. In 2007, interest

expense recognized by the Utility was $1 million.

As of December 31, 2009, PG&E Corporation and the

Utility had accrued interest income and penalties of $11

million and $12 million, respectively. As of December 31,

2008, PG&E Corporation and the Utility had accrued

interest expense and penalties of $8 million and $3 million,

respectively.

In 2009, PG&E Corporation recognized an income tax

benefit of $56 million from settling a claim with the

Internal Revenue Service (“IRS”) related to 1998 and 1999.

Additionally during 2009, PG&E Corporation recognized

$12 million in California benefits, of which $10 million

was attributable to this settlement and $2 million was

attributable to the 2001–2004 IRS settlement. (The 2001–

2004 IRS settlement resulted in a $154 million tax benefit

related to National Energy & Gas Transmission, Inc.

(“NEGT”) and was recorded as discontinued operations in

2008.) PG&E Corporation received total cash refunds of

$605 million in 2009 related to these settlements.

The IRS is currently auditing PG&E Corporation’s

consolidated 2005–2007 income tax returns. The IRS has

not proposed any material adjustments. In September

2009, the IRS released standards related to the treatment of

indirect service costs for the 2005–2007 audit period,

enabling PG&E Corporation to recognize a net tax benefit

of $17 million.

PG&E Corporation also participates in the Compliance

Assurance Process (“CAP”), a real-time IRS audit intended

to expedite the resolution of tax years. PG&E Corporation

is under CAP for 2008 and 2009. In 2009, the IRS signed a

Partial Acceptance Letter accepting the 2008 tax return

except for several issues to be resolved in appeals or

through a field audit. The reserved items included a tax

accounting method change request related to the

deduction of repairs submitted by PG&E Corporation in

2008 that was approved in 2009 and resulted in the

recording of a $2 million benefit, including interest. The

IRS is conducting a field audit to examine the size of the

adjustment resulting from the method change. The IRS has

proposed no material adjustments for either 2008 or 2009.

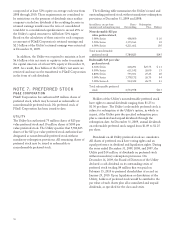

The primary impact to PG&E Corporation’s and the

Utility’s balance sheets from the events described above is

an increase in regulatory assets of $37 million, an increase

in noncurrent income tax receivables of $624 million, and

an increase in noncurrent deferred tax liabilities of $803

million in 2009.

81