PG&E 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Investing Activities

The Utility’s investing activities consist of construction of

new and replacement facilities necessary to deliver safe and

reliable electricity and natural gas services to its customers.

Cash used in investing activities depends primarily upon

the amount and timing of the Utility’s capital expenditures,

which can be affected by many factors, including the

timing of regulatory approvals, the occurrence of storms

and other events causing outages or damages to the

Utility’s infrastructure, and the completion of electricity

and natural gas reliability improvement projects.

Net cash used in investing activities also includes the

proceeds from sales of nuclear decommissioning trust

investments largely offset by the amount of cash used to

purchase new nuclear decommissioning trust investments.

The Utility’s nuclear power facilities consist of two units at

Diablo Canyon and the retired facility at Humboldt Bay.

Nuclear decommissioning requires the safe removal of the

nuclear facilities from service and the reduction of residual

radioactivity to a level that permits termination of the NRC

license and release of the property for unrestricted use. The

Utility makes contributions to trust funds to provide for the

eventual decommissioning of each nuclear unit.

The Utility’s cash flows from investing activities for

2009, 2008, and 2007 were as follows:

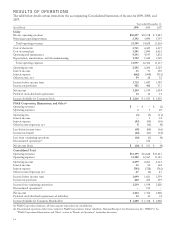

(in millions) 2009 2008 2007

Capital expenditures $(3,958) $(3,628) $(2,768)

Decrease in restricted cash 666 36 185

Proceeds from sales of nuclear

decommissioning trust

investments 1,351 1,635 830

Purchases of nuclear

decommissioning trust

investments (1,414) (1,684) (933)

Other 11 121

Net cash used in

investing activities $(3,344) $(3,640) $(2,665)

Net cash used in investing decreased by $296 million in

2009 compared to 2008, primarily due to a $700 million

decrease in the restricted cash balance that resulted from a

payment to the California Power Exchange to reduce the

Utility’s liability for the remaining net disputed claims (see

Note 14 of the Notes to the Consolidated Financial

Statements), partially offset by an increase of $330 million in

capital expenditures. Net cash used in investing activities

increased $975 million in 2008 compared to 2007, primarily

due to an increase of $860 million in 2008 of capital

expenditures. The increase in capital expenditures for both

2009 and 2008 as compared to the prior year was for installing

the SmartMeter™ advanced metering infrastructure, generation

facility spending, replacing and expanding gas and electric

distribution systems, and improving the electric transmission

infrastructure. (See “Capital Expenditures” below.)

Future cash flows used in investing activities are largely

dependent on expected capital expenditures. (See “Capital

Expenditures” below for further discussion of expected

spending and significant capital projects.)

Financing Activities

The Utility’s cash flows from financing activities for 2009,

2008, and 2007 were as follows:

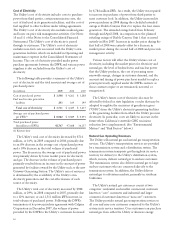

(in millions) 2009 2008 2007

Borrowings under accounts receivable

facility and revolving credit facility $ 300 $ 533 $ 850

Repayments under accounts

receivable facility and revolving

credit facility (300) (783) (900)

Net issuance (repayments) of

commercial paper, net of discount

of $3 million in 2009, $11 million

in 2008, and $1 million in 2007 43 6 (209)

Proceeds from issuance of short-term

debt, net of issuance costs of $1

million in 2009 499 ––

Proceeds from issuance of long-term

debt, net of premium, discount,

and issuance costs of $25 million

in 2009, $19 million in 2008, and

$16 million in 2007 1,384 2,185 1,184

Long-term debt matured or

repurchased (909) (454) –

Rate reduction bonds matured –– (290)

Energy recovery bonds matured (370) (354) (340)

Preferred stock dividends paid (14) (14) (14)

Common stock dividends paid (624) (568) (509)

Equity contribution 718 270 400

Other (5) (36) 23

Net cash provided by

financing activities $ 722 $ 785 $ 195

In 2009, net cash provided by financing activities

decreased by $63 million compared to 2008. In 2008, net

cash provided by financing activities increased by $590

million compared to 2007. Cash provided by or used in

financing activities is driven by the Utility’s financing

needs, which depend on the level of cash provided by or

used in operating activities and the level of cash provided

by or used in investing activities. The Utility generally

utilizes long-term senior unsecured debt issuances and

equity contributions from PG&E Corporation to fund debt

maturities and capital expenditures and to maintain its

CPUC-authorized capital structure, and relies on short-

term debt to fund temporary financing needs.

PG&E CORPORATION

With the exception of dividend payments, interest,

common stock issuance, the senior note issuance of $350

million in March 2009, net tax refunds of $189 million,

and transactions between PG&E Corporation and the

Utility, PG&E Corporation had no material cash flows on a

stand-alone basis for the years ended December 31, 2009,

2008, and 2007.

24