PG&E 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

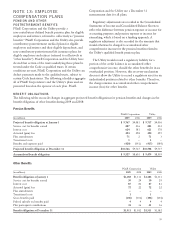

MEDICARE PRESCRIPTION DRUG,

IMPROVEMENT AND MODERNIZATION ACT OF

2003

The Medicare Prescription Drug, Improvement, and

Modernization Act of 2003 establishes a prescription drug

benefit under Medicare (“Medicare Part D”) and a

tax-exempt federal subsidy to sponsors of retiree health care

benefit plans that provide a benefit that actuarially is at

least equivalent to Medicare Part D. PG&E Corporation

and the Utility determined that benefits provided to certain

participants actuarially will be at least equivalent to

Medicare Part D. Therefore, PG&E Corporation and the

Utility are entitled to a tax-exempt subsidy that reduced the

accumulated postretirement benefit obligation under the

defined benefit medical plan at December 31, 2009 and

reduced the net periodic cost for 2009 by the following

amounts:

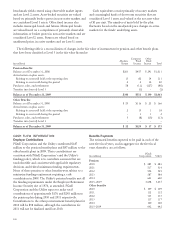

(in millions) PG&E Corporation

Accumulated postretirement benefit

obligation reduction $71

Net periodic benefit cost reduction 7

There was no material difference between PG&E

Corporation’s and the Utility’s Medicare Part D subsidy.

VALUATION ASSUMPTIONS

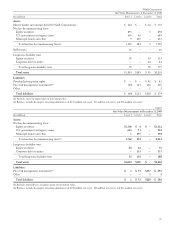

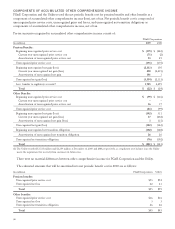

The following actuarial assumptions were used in determining the projected benefit obligations and the net periodic cost.

Weighted average year-end assumptions were used in determining the plans’ projected benefit obligations, while prior

year-end assumptions are used to compute net benefit cost.

Pension Benefits Other Benefits

December 31, December 31,

2009 2008 2007 2009 2008 2007

Discount rate 5.97% 6.31% 6.31% 5.66–6.09% 5.85–6.33% 5.52–6.42%

Average rate of future compensation increases 5.00% 5.00% 5.00% –––

Expected return on plan assets 6.80% 7.30% 7.40% 5.80–6.90% 7.00–7.30% 7.00–7.50%

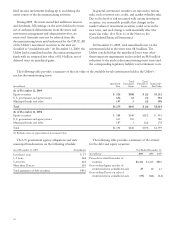

The assumed health care cost trend rate for 2009 is

7.5%, decreasing gradually to an ultimate trend rate in 2014

and beyond of approximately 5%. A one-percentage-point

change in assumed health care cost trend rate would have

the following effects:

(in millions) One-Percentage-

Point Increase One-Percentage-

Point Decrease

Effect on postretirement

benefit obligation $79 $(67)

Effect on service and interest

cost 8 (6)

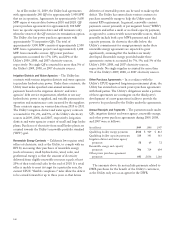

Expected rates of return on plan assets were developed

by determining projected stock and bond returns and then

applying these returns to the target asset allocations of the

employee benefit trusts, resulting in a weighted average rate

of return on plan assets. Fixed income returns were

projected based on real maturity and credit spreads added

to a long-term inflation rate. Equity returns were estimated

based on estimates of dividend yield and real earnings

growth added to a long-term rate of inflation. For the

Utility pension plan, the assumed return of 6.8% compares

to a ten-year actual return of 4.7%. The rate used to

discount pension and other post-retirement benefit plan

liabilities was based on a yield curve developed from

market data of over approximately 500 Aa-grade

non-callable bonds at December 31, 2009. This yield curve

has discount rates that vary based on the duration of the

obligations. The estimated future cash flows for the

pension and other benefit obligations were matched to the

corresponding rates on the yield curve to derive a weighted

average discount rate.

The difference between actual and expected return on

plan assets is included in unrecognized gain (loss), and is

considered in the determination of future net periodic

benefit income (cost). The actual return on plan assets was

above the expected return in 2008 and 2007. The actual

return on plan assets for 2009 was lower than the expected

return due to the significant decline in equity market values

that occurred in 2009.

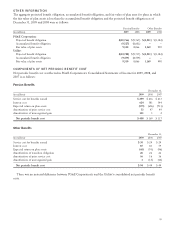

INVESTMENT POLICIES AND STRATEGIES

The financial position of PG&E Corporation’s and the

Utility’s funded employee benefit plans is driven by the

relationship between plan assets and liabilities. As noted

above, the funded status is the difference between the fair

value of plan assets and projected benefit obligations.

Volatility in funded status occurs when asset values change

differently from liability values and can result in

fluctuations in costs for financial reporting as well as the

amount of minimum contributions required under the

97