PG&E 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

due on November 1, 2026 and $160 million of tax-exempt

pollution control bonds series 2009 C and D due on

December 1, 2016. The proceeds were used to repurchase

the corresponding series of 2008 pollution control bonds.

The 2009 A–D bonds, issued at par with an initial rate of

0.20%, are variable rate demand notes with interest

resetting daily and backed by direct-pay letters of credit.

Unlike the series 2008 bonds, interest earned on the series

2009 bonds is not subject to the alternative minimum tax.

A provision in the American Recovery and Reinvestment

Act of 2009 allows certain tax-exempt bonds that are

subject to the alternative minimum tax to be reissued or

refunded in 2009 or 2010 as tax-exempt bonds that are not

subject to the alternative minimum tax. As a result, the

2009 A–D bonds were issued at a lower interest rate,

reducing the Utility’s interest expense.

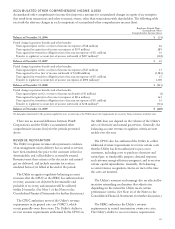

REPAYMENT SCHEDULE

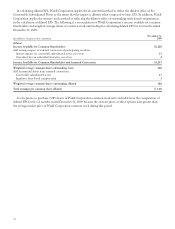

PG&E Corporation’s and the Utility’s combined aggregate principal repayment amounts of long-term debt at

December 31, 2009 are reflected in the table below:

(in millions, except interest rates) 2010 2011 2012 2013 2014 Thereafter Total

Long-term debt:

PG&E Corporation

Average fixed interest rate 9.50% – – – 5.75% – 7.30%

Fixed rate obligations $ 247–––$350 –$597

Utility

Average fixed interest rate 3.75% 4.20% – 6.25% 4.80% 6.13%

Fixed rate obligations $ 95 $ 500 – $ 400 $1,000 $7,245 $ 9,240

Variable interest rate as of December 31, 2009 – 0.21% 0.21% – – – 0.21%

Variable rate obligations – $ 309(1) $ 614(2) – – – $ 923

Less: current portion (342) – – – – – (342)

Total consolidated long-term debt $ – $ 809 $ 614 $ 400 $1,350 $7,245 $10,418

(1) These bonds, due from 2016 through 2026, are backed by a direct-pay letter of credit that expires on October 29, 2011. The bonds will be subject to

a mandatory redemption unless the letter of credit is extended or replaced or the issuer consents to the continuation of these series without a credit

facility. Accordingly, the bonds have been classified for repayment purposes in 2011.

(2) The $614 million pollution control bonds, due in 2026, are backed by letters of credit that expire on February 26, 2012. The bonds will be subject to

a mandatory redemption unless the letters of credit are extended or replaced. Accordingly, the bonds have been classified for repayment purposes in

2012.

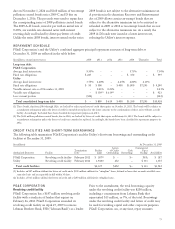

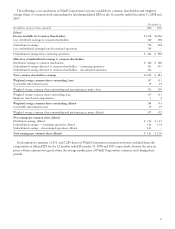

CREDIT FACILITIES AND SHORT-TERM BORROWINGS

The following table summarizes PG&E Corporation’s and the Utility’s short-term borrowings and outstanding credit

facilities at December 31, 2009:

(in millions) At December 31, 2009

Authorized Borrower Facility Termination

Date Facility

Limit

Letters

of Credit

Outstanding Cash

Borrowings

Commercial

Paper

Backup Availability

PG&E Corporation Revolving credit facility February 2012 $ 187(1) $ – $— N/A $ 187

Utility Revolving credit facility February 2012 1,940(2) 252 — $ 333 1,355

Total credit facilities $2,127 $252 $— $ 333 $1,542

(1) Includes an $87 million sublimit for letters of credit and a $100 million sublimit for “swingline” loans, defined as loans that are made available ona

same-day basis and are repayable in full within 30 days.

(2) Includes a $921 million sublimit for letters of credit and a $200 million sublimit for swingline loans.

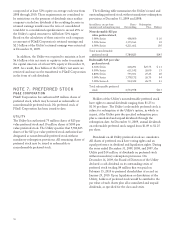

PG&E CORPORATION

Revolving credit facility

PG&E Corporation has a $187 million revolving credit

facility with a syndicate of lenders that expires on

February 26, 2012. PG&E Corporation amended its

revolving credit facility on April 27, 2009 to remove

Lehman Brothers Bank, FSB (“Lehman Bank”) as a lender.

Prior to the amendment, the total borrowing capacity

under the revolving credit facility was $200 million,

including a commitment from Lehman Bank that

represented $13 million, or 7%, of the total. Borrowings

under the revolving credit facility and letters of credit may

be used for working capital and other corporate purposes.

PG&E Corporation can, at any time, repay amounts

73