PG&E 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

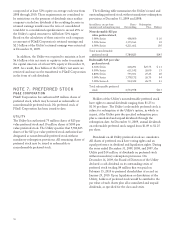

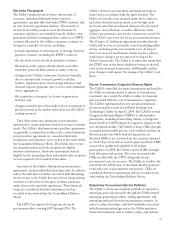

PRESENTATION OF DERIVATIVE INSTRUMENTS IN THE FINANCIAL STATEMENTS

In PG&E Corporation’s and the Utility’s Consolidated Balance Sheets, derivative instruments are presented on a net basis

by counterparty where the right of offset exists. The net balances include outstanding cash collateral associated with

derivative positions.

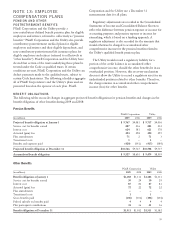

At December 31, 2009, PG&E Corporation’s and the Utility’s outstanding derivative balances were as follows:

(in millions)

Gross

Derivative

Balance(1) Netting(2)

Cash

Collateral(2)

Total

Derivative

Balances

Commodity Risk (PG&E Corporation and Utility)

Current Assets – Prepaid expenses and other $ 76 $(12) $ 77 $ 141

Other Noncurrent Assets – Other 64 (44) 13 33

Current Liabilities – Other (231) 12 54 (165)

Noncurrent Liabilities – Other (390) 44 44 (302)

Total commodity risk $(481) $ – $188 $(293)

Other Risk Instruments(3) (PG&E Corporation Only)

Current Liabilities – Other $ (13) $ – $ – $ (13)

Total derivatives $(494) $ – $188 $(306)

(1) See Note 11 of the Notes to the Consolidated Financial Statements for a discussion of the valuation techniques used to calculate the fair value of

these instruments.

(2) Positions, by counterparty, are netted where the intent and legal right to offset exist in accordance with master netting agreements.

(3) This category relates to the dividend participation rights of PG&E Corporation’s Convertible Subordinated Notes.

Expenses related to the dividend participation rights are

not recoverable in customers’ rates. Therefore, changes in

the fair value of these instruments are recorded in PG&E

Corporation’s Consolidated Statements of Income.

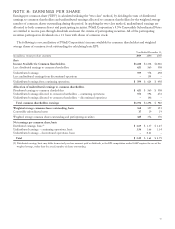

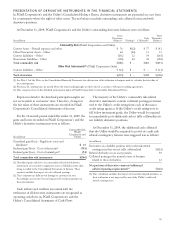

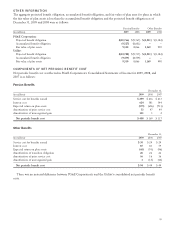

For the 12-month period ended December 31, 2009, the

gains and losses recorded on PG&E Corporation’s and the

Utility’s derivative instruments were as follows:

(in millions)

Commodity Risk

(PG&E

Corporation and

Utility)

Unrealized gain/(loss) – Regulatory assets and

liabilities(1) $15

Realized gain/(loss) – Cost of electricity(2) (701)

Realized gain/(loss) – Cost of natural gas(2) (54)

Total commodity risk instruments $(740)

(1) Unrealized gains and losses on commodity risk-related derivative

instruments are recorded to regulatory assets or liabilities rather than

being recorded to the Consolidated Statements of Income. These

amounts exclude the impact of cash collateral postings.

(2) These amounts are fully passed through to customers in rates.

Accordingly, net income was not impacted by realized amounts on

these instruments.

Cash inflows and outflows associated with the

settlement of all derivative instruments are recognized in

operating cash flows on PG&E Corporation’s and the

Utility’s Consolidated Statements of Cash Flows.

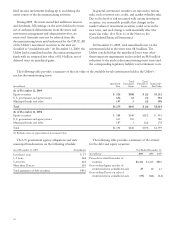

The majority of the Utility’s commodity risk-related

derivative instruments contain collateral posting provisions

tied to the Utility’s credit rating from each of the major

credit rating agencies. If the Utility’s credit rating were to

fall below investment grade, the Utility would be required

to immediately post additional cash to fully collateralize its

net liability derivative positions.

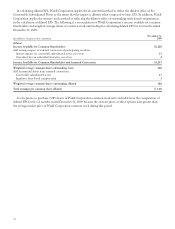

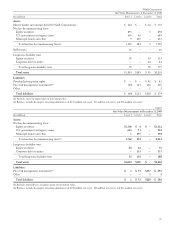

At December 31, 2009, the additional cash collateral

that the Utility would be required to post if its credit risk-

related contingency features were triggered was as follows:

(in millions)

Derivatives in a liability position with credit risk-related

contingencies that are not fully collateralized $(522)

Related derivatives in an asset position 50

Collateral posting in the normal course of business

related to these derivatives 12

Net position of derivative contracts/additional

collateral posting requirements(1) $(460)

(1) This calculation excludes the impact of closed but unpaid positions, as

their settlement is not impacted by any of the Utility’s credit risk-

related contingencies.

85