PG&E 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 12: NUCLEAR

DECOMMISSIONING

The Utility’s nuclear power facilities consist of two units at

Diablo Canyon and the retired facility at Humboldt Bay.

Nuclear decommissioning requires the safe removal of

nuclear facilities from service and the reduction of residual

radioactivity to a level that permits termination of the

Nuclear Regulatory Commission (“NRC”) license and

release of the property for unrestricted use. The Utility

makes contributions to trust funds (described below) to

provide for the eventual decommissioning of each nuclear

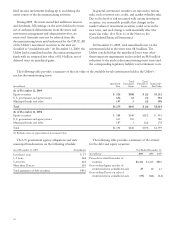

unit. The CPUC conducts a NDCTP every three years to

review the Utility’s updated nuclear decommissioning cost

study and to determine the level of Utility trust

contributions and related revenue requirements.

In April 2009, the Utility filed its 2009 NDCTP with

new decommissioning cost estimates and other funding

assumptions, such as projected cost escalation factors and

projected earnings of the funds for 2010, 2011, and 2012.

Hearings were completed in October 2009 and a CPUC

decision is expected in the second quarter of 2010. The

Utility filed a partial settlement in the 2009 NDCTP with

The Utility Reform Network, Southern California Edison,

and San Diego Gas & Electric on December 18, 2009.

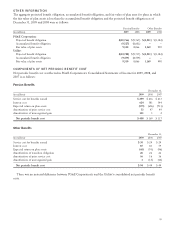

In the Utility’s 2009 NDCTP, the CPUC assumed that

the eventual decommissioning of Diablo Canyon Unit 1

would be scheduled to begin in 2024 and be completed in

2052; that decommissioning of Diablo Canyon Unit 2

would be scheduled to begin in 2025 and be completed in

2052; and that decommissioning of Humboldt Bay Unit 3

would be scheduled to begin in 2010 and be completed in

2020. As presented in the Utility’s 2009 NDCTP, the

estimated nuclear decommissioning cost for Diablo

Canyon Units 1 and 2 and Humboldt Bay Unit 3 is

approximately $2.26 billion in 2009 dollars (or

approximately $4.56 billion in future dollars). These

estimates are based on the 2009 decommissioning cost

studies, prepared in accordance with CPUC requirements.

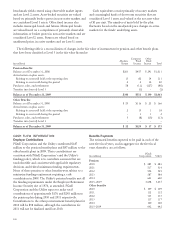

The Utility’s revenue requirements for nuclear

decommissioning costs (i.e., the revenue requirements used

by the Utility to make contributions to the

decommissioning trust funds) are recovered from

customers through a non-bypassable charge that the Utility

expects will continue until those costs are fully recovered.

The decommissioning cost estimates are based on the plant

location and cost characteristics for the Utility’s nuclear

power plants. Actual decommissioning costs may vary from

these estimates as a result of changes in assumptions such

as decommissioning dates; regulatory requirements;

technology; and costs of labor, materials, and equipment.

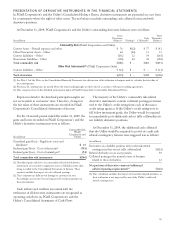

The estimated nuclear decommissioning cost described

above is used for regulatory purposes. However, for GAAP

purposes, the Utility adjusts its nuclear decommissioning

obligation to reflect the fair value of decommissioning its

nuclear power facilities and records this as an ARO on its

Consolidated Balance Sheets. The total nuclear

decommissioning obligation accrued in accordance with

GAAP was $1.4 billion at December 31, 2009 and

December 31, 2008. Differences between amounts

collected in rates for decommissioning the Utility’s nuclear

power facilities and the decommissioning obligation

recorded in accordance with GAAP are reflected as a

regulatory liability. (See Note 3 of the Notes to the

Consolidated Financial Statements.)

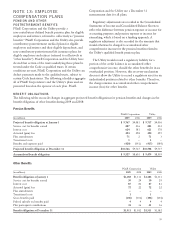

NUCLEAR DECOMMISSIONING TRUSTS

Decommissioning costs recovered in rates are placed in

nuclear decommissioning trusts. The Utility has three

decommissioning trusts for its two Diablo Canyon and

Humboldt Bay nuclear facilities. The Utility has elected

that two of these trusts be treated under the Internal

Revenue Code as qualified trusts. If certain conditions are

met, the Utility is allowed a deduction for the payments

made to the qualified trusts. The qualified trusts are subject

to a lower tax rate on income and capital gains, thereby

increasing the trusts’ after-tax returns. Among other

requirements, in order to maintain the qualified trust

status, the IRS must approve the amount to be contributed

to the qualified trusts for any taxable year. The remaining

non-qualified trust is exclusively for decommissioning the

facility at Humboldt Bay. The Utility cannot deduct

amounts contributed to the non-qualified trust until such

decommissioning costs are actually incurred.

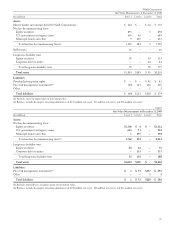

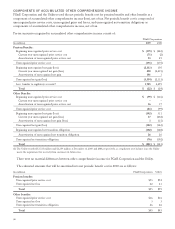

The funds in the decommissioning trusts, along with

accumulated earnings, will be used exclusively for

decommissioning and dismantling the Utility’s nuclear

facilities. The trusts maintain substantially all of their

investments in debt and equity securities. The CPUC has

authorized the qualified and non-qualified trusts to invest a

maximum of 60% of its funds in publicly traded equity

securities, of which up to 20% may be invested in publicly

traded non-U.S. equity securities. The allocation of the

trust funds is monitored monthly. To the extent that

market movements cause the asset allocation to move

outside these ranges, the investments are rebalanced toward

the target allocation.

Trust earnings are included in the nuclear

decommissioning trust assets and the corresponding

regulatory liability for asset retirement costs. There is no

impact on the Utility’s earnings. Annual returns decrease in

later years as higher portions of the trusts are dedicated to

91