PG&E 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

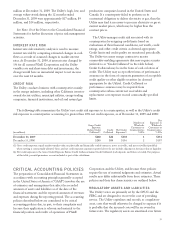

The following reflects the sensitivity of pension costs

and projected benefit obligation to changes in certain

actuarial assumptions:

(in millions)

Increase

(Decrease) in

Assumption

Increase

in 2009

Pension

Costs

Increase in

Projected

Benefit

Obligation at

December 31,

2009

Discount rate (0.5)% $70 $746

Rate of return on

plan assets (0.5)% 40 –

Rate of increase in

compensation 0.5% 32 176

The following reflects the sensitivity of other

postretirement benefit costs and accumulated benefit

obligation to changes in certain actuarial assumptions:

(in millions)

Increase

(Decrease) in

Assumption

Increase

in 2009

Other

Postretirement

Benefit Costs

Increase in

Accumulated

Benefit

Obligation at

December 31,

2009

Health care cost

trend rate 0.5% $6 $39

Discount rate (0.5)% 6 84

Rate of return on

plan assets (0.5)% 5 –

ACCOUNTING PRONOUNCEMENTS

ISSUED BUT NOT YET ADOPTED

TRANSFERS AND SERVICING (TOPIC 860) —

ACCOUNTING FOR TRANSFERS OF FINANCIAL

ASSETS

In December 2009, the Financial Accounting Standards

Board (“FASB”) issued Accounting Standards Update

(“ASU”) No. 2009-16, “Transfers and Servicing (Topic 860)

— Accounting for Transfers of Financial Assets” (“ASU

No. 2009-16”). ASU No. 2009-16 eliminates the concept of

a qualifying special-purpose entity and clarifies the

requirements for derecognizing a financial asset and for

applying sale accounting to a transfer of a financial asset. In

addition, ASU No. 2009-16 requires an entity to disclose

more information about transfers of financial assets; the

entity’s continuing involvement, if any, with transferred

financial assets; and the entity’s continuing risks, if any,

from transferred financial assets. ASU No. 2009-16 is

effective prospectively for PG&E Corporation and the

Utility beginning on January 1, 2010. PG&E Corporation

and the Utility are currently evaluating the impact of ASU

No. 2009-16.

CONSOLIDATIONS (TOPIC 810) —

IMPROVEMENTS TO FINANCIAL REPORTING BY

ENTERPRISES INVOLVED WITH VARIABLE

INTEREST ENTITIES

In December 2009, the FASB issued ASU No. 2009-17,

“Consolidations (Topic 810) — Improvements to Financial

Reporting by Enterprises Involved with Variable Interest

Entities” (“ASU No. 2009-17”). ASU No. 2009-17 amends

the Consolidation Topic of the FASB Accounting

Standards Codification (“ASC”) regarding when and how

to determine, or re-determine, whether an entity is a

variable interest entity (“VIE”). In addition, ASU

No. 2009-17 replaces the Consolidation Topic of the FASB

ASC’s quantitative approach for determining who has a

controlling financial interest in a VIE with a qualitative

approach. Furthermore, ASU No. 2009-17 requires ongoing

assessments of whether an entity is the primary beneficiary

of a VIE. ASU No. 2009-17 is effective prospectively for

PG&E Corporation and the Utility beginning on January 1,

2010. PG&E Corporation and the Utility are currently

evaluating the impact of ASU No. 2009-17.

RISK FACTORS

RISKS RELATED TO PG&E CORPORATION

As a holding company, PG&E Corporation depends on

cash distributions and reimbursements from the Utility

to meet its debt service and other financial obligations

and to pay dividends on its common stock.

PG&E Corporation is a holding company with no revenue

generating operations of its own. PG&E Corporation’s

ability to pay interest on its $247 million of Convertible

Subordinated Notes and to pay dividends on its common

stock, as well as satisfy its other financial obligations,

primarily depends on the earnings and cash flows of the

Utility and the ability of the Utility to distribute cash to

PG&E Corporation (in the form of dividends and share

repurchases) and reimburse PG&E Corporation for the

Utility’s share of applicable expenses. Before it can

distribute cash to PG&E Corporation, the Utility must use

its resources to satisfy its own obligations, including its

obligation to serve customers, to pay principal and interest

on outstanding debt, to pay preferred stock dividends, and

meet its obligations to employees and creditors. If the

Utility is not able to make distributions to PG&E

Corporation or to reimburse PG&E Corporation, PG&E

Corporation’s ability to meet its own obligations could be

impaired and its ability to pay dividends could be

restricted.

37