PG&E 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

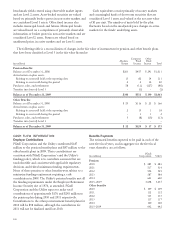

fixed income investments leading up to and during the

entire course of the decommissioning activities.

During 2009, the trusts earned $63 million in interest

and dividends. All earnings on the assets held in the trusts,

net of authorized disbursements from the trusts and

investment management and administrative fees, are

reinvested. Amounts may not be released from the

decommissioning trusts until authorized by the CPUC. All

of the Utility’s investment securities in the trust are

classified as “available-for-sale.” At December 31, 2009, the

Utility had accumulated nuclear decommissioning trust

funds with an estimated fair value of $1.9 billion, net of

deferred taxes on unrealized gains.

In general, investment securities are exposed to various

risks, such as interest rate, credit, and market volatility risks.

Due to the level of risk associated with certain investment

securities, it is reasonably possible that changes in the

market values of investment securities could occur in the

near term, and such changes could materially affect the

trusts’ fair value. (See Note 11 of the Notes to the

Consolidated Financial Statements.)

At December 31, 2009, total unrealized losses on the

investments held in the trusts were $8.0 million. The

Utility concluded that the unrealized losses were other-

than-temporary impairments and recorded an $8.0 million

reduction to the nuclear decommissioning trusts assets and

the corresponding regulatory liability asset retirement costs.

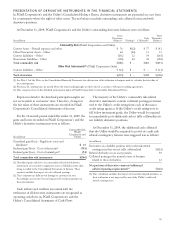

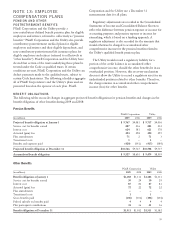

The following table provides a summary of the fair value of the available-for-sale investments held in the Utility’s

nuclear decommissioning trusts:

(in millions) Amortized

Cost

Total

Unrealized

Gains

Total

Unrealized

Losses Estimated(1)

Fair Value

As of December 31, 2009

Equity securities $ 526 $588 $ (2) $1,112

U.S. government and agency issues 656 52 (4) 704

Municipal bonds and other 197 3 (2) 198

Total $1,379 $643 $ (8) $2,014

As of December 31, 2008

Equity securities $ 588 $340 $(27) $ 901

U.S. government and agency issues 617 103 — 720

Municipal bonds and other 187 3 (12) 178

Total $1,392 $446 $(39) $1,799

(1) Excludes taxes on appreciation of investment value.

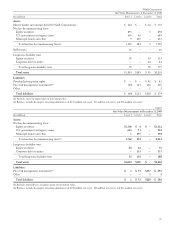

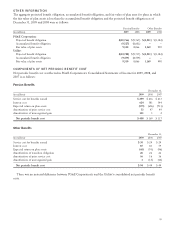

The U.S government agency obligations and state

municipal bonds mature on the following schedule:

As of December 31, 2009 (in millions)

Less than 1 year $ 57

1–5 years 368

5–10 years 238

More than 10 years 238

Total maturities of debt securities $901

The following table provides a summary of the activity

for the debt and equity securities:

Year Ended December 31,

(in millions) 2009 2008 2007

Proceeds received from sales of

securities $1,351 $1,635 $830

Gross realized gains on sales of

securities held as available-for-sale 27 30 61

Gross realized losses on sales of

securities held as available-for-sale (55) (142) (42)

92