PG&E 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Statements for each of these two entities. PG&E

Corporation’s Consolidated Financial Statements include

the accounts of PG&E Corporation, the Utility, and other

wholly owned and controlled subsidiaries. The Utility’s

Consolidated Financial Statements include the accounts of

the Utility and its wholly owned and controlled

subsidiaries as well as the accounts of variable interest

entities for which the Utility absorbs a majority of the risk

of loss or gain. This combined Management’s Discussion

and Analysis of Financial Condition and Results of

Operations (“MD&A”) of PG&E Corporation and the

Utility should be read in conjunction with the

Consolidated Financial Statements and the Notes to the

Consolidated Financial Statements included in this annual

report.

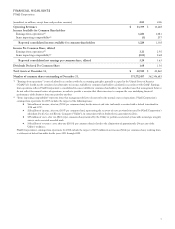

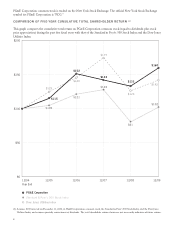

SUMMARY OF CHANGES IN EARNINGS PER

COMMON SHARE AND INCOME AVAILABLE FOR

COMMON SHAREHOLDERS FOR 2009

PG&E Corporation’s diluted earnings per common share

(“EPS”) for 2009 were $3.20 per share, compared to $3.63

per share for 2008. PG&E Corporation’s 2009 income

available for common shareholders decreased by $118

million, or 9%, to $1,220 million, compared to 2008

income available for common shareholders of $1,338

million. The decrease in diluted EPS and income available

for common shareholders in 2009 as compared to 2008 is

primarily due to (1) $257 million of net income recognized

in 2008 resulting from a settlement of tax audits for 2001

through 2004, and (2) $59 million, after tax, attributable to

costs to perform accelerated natural gas leak surveys and

associated remedial work. These decreases were partially

offset by (1) a $91 million, after tax, increase due to the

Utility’s return on equity (“ROE”) earned on higher

authorized capital investment, and (2) a tax benefit of $66

million associated with the settlement of tax refund claims

involving the 1998 and 1999 tax years.

KEY FACTORS AFFECTING RESULTS OF

OPERATIONS AND FINANCIAL CONDITION

PG&E Corporation’s and the Utility’s results of operations

and financial condition depend primarily on whether the

Utility is able to operate its business within authorized

revenue requirements, recover its authorized costs timely,

and earn its authorized rate of return. A number of factors

have had, or are expected to have, a significant impact on

PG&E Corporation’s and the Utility’s results of operations

and financial condition, including:

•The Outcome of Regulatory Proceedings and the Impact of

Ratemaking Mechanisms. Most of the Utility’s revenue

requirements are set by the CPUC in the GRC, which

occurs generally every three years. The FERC authorizes

the Utility’s revenue requirements in annual transmission

owner (“TO”) rate cases. During 2010, the CPUC will

determine the amount of revenue requirements the

Utility is authorized to recover beginning in 2011 for its

electric and natural gas distribution operations and its

electric generation operations in the 2011 GRC, and for

its natural gas transportation and storage services in the

Gas Transmission and Storage Rate Case. In addition, the

FERC will determine the amount of electric transmission

revenues the Utility can recover beginning in March

2011. The decisions issued in the three associated rate

cases will determine the majority of the Utility’s revenue

requirements for 2011 and future years. (See “Regulatory

Matters” below for a discussion of the Utility’s 2011–2013

GRC, the 2011–2014 Gas Transmission and Storage Rate

Case, the 2011 TO rate case, and other proceedings.) In

addition, the Utility frequently files separate applications

requesting the CPUC or the FERC to authorize

additional revenue requirements for specific capital

expenditure projects such as new power plants, new or

upgraded natural gas or electric transmission facilities, the

installation of an advanced metering infrastructure, and

other infrastructure improvements. (See “Capital

Expenditures” below.) The outcome of these regulatory

proceedings can be affected by many factors, including

general economic conditions, the level of rates, and

political and regulatory policies.

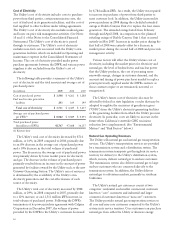

•The Ability of the Utility to Control Costs While Improving

Operational Efficiency and Reliability. The Utility’s revenue

requirements in the GRC and TO rate case are generally

set at a level to allow the Utility the opportunity to

recover its basic forecasted operating expenses as well as

to earn an ROE and recover depreciation, tax, and

interest expense associated with authorized capital

expenditures. Differences in the amount or timing of

forecasted and actual operating expenses and capital

expenditures can affect the Utility’s ability to earn its

CPUC-authorized rate of return and the amount of

PG&E Corporation’s income available for common

shareholders. The Utility also seeks to make the amount

and timing of its capital expenditures consistent with

budgeted amounts and timing. When capital expenditures

are higher than authorized levels, the Utility incurs

associated depreciation, property tax, and interest expense

but does not recover GRC or TO revenues to fully offset

these expenses or earn an ROE until the increased capital

expenditures are added to rate base in future rate cases.

Items that could cause higher expenses than provided for

in the last GRC primarily relate to the Utility’s efforts to

maintain its aging electric and natural gas systems’

infrastructure, to improve the reliability and safety of its

electric and natural gas system, and to improve its

information technology infrastructure, support, and

security. The Utility continually seeks to achieve

11