PG&E 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operational efficiencies and improve reliability while

creating future sustainable cost savings to offset these

higher anticipated expenses. (See “Results of Operations”

below.)

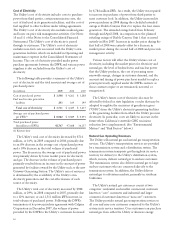

•Capital Structure and Financing. The CPUC has authorized

a capital structure for the Utility’s electric and natural gas

distribution and electric generation rate base that consists

of 52% common equity and 48% debt and preferred

stock. This authorized capital structure will remain in

effect through 2012. The CPUC also has authorized the

Utility to earn a rate of return on each component of its

capital structure, including an ROE of 11.35%. These

rates will remain in effect through 2010. The rates for

2011 and 2012 are subject to an annual adjustment

mechanism that will be triggered if the 12-month

October-through-September average yield for the

applicable Moody’s Investors Service (“Moody’s”) utility

bond index increases or decreases by more than 1% as

compared to the applicable benchmark. The amount of

the Utility’s authorized equity earnings is determined by

the 52% equity component, the 11.35% ROE, and the

aggregate amount of rate base authorized by the CPUC.

The rate of return that the Utility earns on its FERC-

jurisdictional rate base is not specifically authorized, but

rates are designed to allow the Utility to earn a reasonable

rate of return. The Utility’s actual equity earnings could

be more or less based on a number of factors, including

the timing and amount of operating costs and capital

expenditures. The CPUC periodically authorizes the

aggregate amount of long-term debt and short-term debt

that the Utility may issue and authorizes the Utility to

recover its related debt financing costs. The timing and

amount of the Utility’s future financing will depend on

various factors, as discussed in “Liquidity and Financial

Resources” below. PG&E Corporation regularly

contributes equity to the Utility to maintain the Utility’s

CPUC-authorized capital structure. PG&E Corporation

may issue debt or equity in the future to fund these

equity contributions.

FORWARD-LOOKING STATEMENTS

This combined annual report and the letter to shareholders

that accompanies it contain forward-looking statements

that are necessarily subject to various risks and

uncertainties. These statements are based on current

estimates, expectations, and projections about future events

and assumptions regarding these events and management’s

knowledge of facts as of the date of this report. These

forward-looking statements relate to, among other matters,

estimated capital expenditures, estimated environmental

remediation liabilities, estimated tax liabilities, the

anticipated outcome of various regulatory and legal

proceedings, estimated future cash flows, and the level of

future equity or debt issuances, and are also identified by

words such as “assume,” “expect,” “intend,” “plan,”

“project,” “believe,” “estimate,” “target,” “predict,”

“anticipate,” “aim,” “may,” “might,” “should,” “would,”

“could,” “goal,” “potential,” and similar expressions. PG&E

Corporation and the Utility are not able to predict all the

factors that may affect future results. Some of the factors

that could cause future results to differ materially from

those expressed or implied by the forward-looking

statements, or from historical results, include, but are not

limited to:

• the Utility’s ability to manage capital expenditures and its

operating and maintenance expenses within authorized

levels;

• the outcome of pending and future regulatory

proceedings and whether the Utility is able to timely

recover its costs through rates;

• the adequacy and price of electricity and natural gas

supplies, and the ability of the Utility to manage and

respond to the volatility of the electricity and natural gas

markets, including the ability of the Utility and its

counterparties to post or return collateral;

• explosions, fires, accidents, mechanical breakdowns, the

disruption of information technology and systems, and

similar events that may occur while operating and

maintaining an electric and natural gas system in a large

service territory with varying geographic conditions that

can cause unplanned outages, reduce generating output,

damage the Utility’s assets or operations, subject the

Utility to third-party claims for property damage or

personal injury, or result in the imposition of civil,

criminal, or regulatory fines or penalties on the Utility;

• the impact of storms, earthquakes, floods, drought,

wildfires, disease, and similar natural disasters, or acts of

terrorism or vandalism, that affect customer demand or

that damage or disrupt the facilities, operations, or

information technology and systems owned by the

Utility, its customers, or third parties on which the Utility

relies;

• the potential impacts of climate change on the Utility’s

electricity and natural gas businesses;

• changes in customer demand for electricity and natural

gas resulting from unanticipated population growth or

decline, general economic and financial market

conditions, changes in technology that include the

development of alternative technologies that enable

customers to increase their reliance on self-generation, or

other reasons;

• the occurrence of unplanned outages at the Utility’s two

nuclear generating units at the Diablo Canyon Power

12