PG&E 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

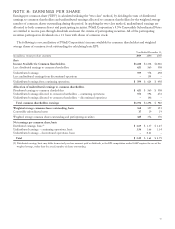

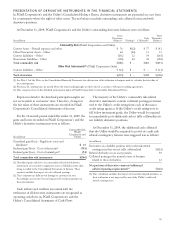

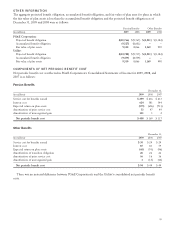

PG&E Corporation

Fair Value Measurements at December 31, 2008

(in millions) Level 1 Level 2 Level 3 Total

Assets:

Money market investments (held by PG&E Corporation) $ 164 $ — $ 12 $ 176

Nuclear decommissioning trusts

Equity securities 893 — 5 898

U.S. government and agency issues 603 86 — 689

Municipal bonds and other 9 203 — 212

Total nuclear decommissioning trusts(1) 1,505 289 5 1,799

Rabbi trusts 66 — — 66

Long-term disability trust

Equity securities 99 — 54 153

Corporate debt securities — — 24 24

Total long-term disability trust 99 — 78 177

Total assets $1,834 $289 $ 95 $2,218

Liabilities:

Dividend participation rights $ — $ — $ 42 $ 42

Price risk management instruments(2) (49) 123 156 230

Other —— 2 2

Total liabilities $ (49) $123 $200 $ 274

(1) Excludes taxes on appreciation of investment value.

(2) Balances include the impact of netting adjustments of $159 million to Level 1, $32 million to Level 2, and $76 million to Level 3.

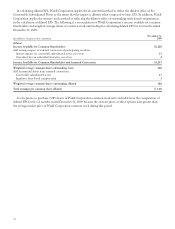

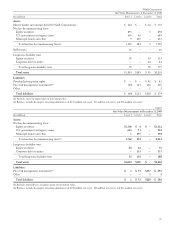

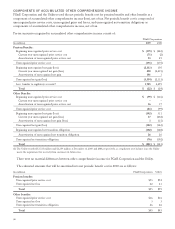

Utility

Fair Value Measurements at December 31, 2009

(in millions) Level 1 Level 2 Level 3 Total

Assets:

Nuclear decommissioning trusts

Equity securities $1,106 $ 6 $ — $1,112

U.S. government and agency issues 653 51 — 704

Municipal bonds and other 1 197 — 198

Total nuclear decommissioning trusts(1) 1,760 254 — 2,014

Long-term disability trust

Equity securities 52 23 — 75

Corporate debt securities — 113 — 113

Total long-term disability trust 52 136 — 188

Total assets $1,812 $390 $ — $2,202

Liabilities:

Price risk management instruments(2) $ 3 $ 73 $217 $ 293

Other —— 3 3

Total liabilities $ 3 $ 73 $220 $ 296

(1) Excludes deferred taxes on appreciation of investment value.

(2) Balances include the impact of netting adjustments of $108 million to Level 1, $48 million to Level 2, and $32 million to Level 3.

87