PG&E 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Electricity Procurement

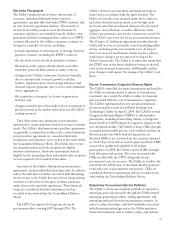

The Utility obtains electricity from a diverse mix of

resources, including third-party power purchase

agreements, amounts allocated under DWR contracts, and

its own electricity generation facilities. The amount of

electricity the Utility needs to meet the demands of

customers and that is not satisfied from the Utility’s own

generation facilities, existing purchase contracts, or DWR

contracts allocated to the Utility’s customers is subject to

change for a number of reasons, including:

• periodic expirations or terminations of existing electricity

purchase contracts, including the DWR’s contracts;

• the execution of new electricity purchase contracts;

• fluctuation in the output of hydroelectric and other

renewable power facilities owned or under contract;

• changes in the Utility’s customers’ electricity demands

due to customer and economic growth or decline,

weather, implementation of new energy efficiency and

demand response programs, direct access, and community

choice aggregation;

• the acquisition, retirement, or closure of generation

facilities; and

• changes in market prices that make it more economical to

purchase power in the market rather than use the Utility’s

existing resources.

The Utility enters into third-party power purchase

agreements to ensure sufficient electricity to meet customer

needs. The Utility’s third-party power purchase agreements

are generally accounted for as leases, but certain third-party

power purchase agreements are considered derivative

instruments and, therefore, are recorded at fair value within

the Consolidated Balance Sheets. The Utility elects to use

the normal purchase and sale exception for eligible

derivative instruments. Derivative instruments that are

eligible for the normal purchase and normal sales exception

are not required to be recorded at fair value.

A portion of the Utility’s third-party power purchase

agreements contain market-based pricing terms. In order to

reduce the cash flow variability associated with fluctuating

electricity prices, the Utility has entered into financial swap

contracts to effectively fix the price of future purchases

under those power purchase agreements. These financial

swaps are considered derivative instruments and are

recorded at fair value within the Consolidated Balance

Sheets.

The CPUC has approved a long-term electricity

procurement plan covering 2007 through 2016. The

Utility’s electricity procurement and financial swaps are

transacted in accordance with the approved plan. The

Utility recovers the costs incurred under these contracts

and other electricity procurement costs through retail

electricity rates that are adjusted whenever the forecasted

aggregate over-collections or under-collections of the

Utility’s procurement costs for the current year exceed 5%

of the Utility’s prior year electricity procurement revenues.

The Chapter 11 Settlement Agreement provides that the

Utility will recover its reasonable costs of providing utility

service, including power procurement costs. As long as

these cost recovery mechanisms remain in place, adverse

market price changes are not expected to impact the

Utility’s net income. The Utility is at risk to the extent that

the CPUC may in the future disallow portions or the full

costs of procurement transactions. Additionally, market

price changes could impact the timing of the Utility’s cash

flows.

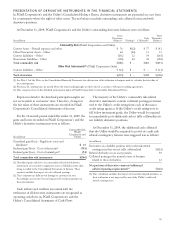

Electric Transmission Congestion Revenue Rights

The CAISO-controlled electricity transmission grid used by

the Utility to transmit power is subject to transmission

constraints. As a result, the Utility is subject to financial

risk associated with the cost of transmission congestion.

The CAISO implemented its new day-ahead wholesale

electricity market as part of its Market Redesign and

Technology Update on April 1, 2009. The CAISO created

Congestion Revenue Rights (“CRRs”) to allow market

participants, including load-serving entities, to hedge the

financial risk of CAISO-imposed congestion charges in the

new day-ahead market. The CAISO releases CRRs through

an annual and monthly process, each of which includes an

allocation phase (in which load-serving entities are

allocated CRRs at no cost based on the customer demand

or “load” they serve) and an auction phase (in which CRRs

are priced at market and available to all market

participants). In 2009, the Utility acquired CRRs through

both allocation and auction. The costs associated with

CRRs are filed with the CPUC along with electric

procurement costs for recovery. The Utility is at risk to the

extent that the CPUC may in the future disallow portions

or the full costs of procurement transactions. CRRs are

considered derivative instruments and are recorded at fair

value within the Consolidated Balance Sheets.

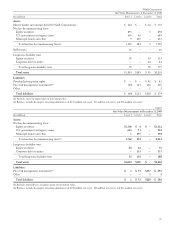

Natural Gas Procurement (Electric Portfolio)

The Utility’s electric procurement portfolio is exposed to

natural gas price risk primarily through the Utility-owned

natural gas generating facilities, tolling agreements, and

natural gas-indexed electricity procurement contracts. In

order to reduce the future cash flow variability associated

with fluctuating natural gas prices, the Utility purchases

financial instruments such as futures, swaps, and options.

83