PG&E 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 11: FAIR VALUE

MEASUREMENTS

PG&E Corporation and the Utility determine the fair value

of certain assets and liabilities based on assumptions that

market participants would use in pricing the assets or

liabilities. PG&E Corporation and the Utility utilize a fair

value hierarchy that prioritizes the inputs to valuation

techniques used to measure fair value and give precedence

to observable inputs in determining fair value. An

instrument’s level within the hierarchy is based on the

lowest level of any significant input to the fair value

measurement. The following levels were established for

each input:

•Level 1: “Inputs that are quoted prices (unadjusted) in

active markets for identical assets or liabilities that the

reporting entity has the ability to access at the

measurement date.” Active markets are those in which

transactions for the asset or liability occur with sufficient

frequency and volume to provide pricing information on

an ongoing basis. Instruments classified as Level 1 consist

of financial instruments such as exchange-traded

derivatives (other than options), listed equities, and U.S.

government treasury securities.

•Level 2: “Inputs other than quoted prices included in

Level 1 that are observable for the asset or liability, either

directly or indirectly.” Instruments classified as Level 2

consist of financial instruments such as non-exchange-

traded derivatives (other than options) valued using

exchange inputs and exchange-traded derivatives (other

than options) for which the market is not active.

•Level 3: “Unobservable inputs for the asset or liability.”

These are inputs for which there is no market data

available or observable inputs that are adjusted using

Level 3 assumptions. Instruments classified as Level 3

consist primarily of financial and physical instruments

such as options, non-exchange-traded derivatives valued

using broker quotes, and new and/or complex

instruments that have immature or limited markets.

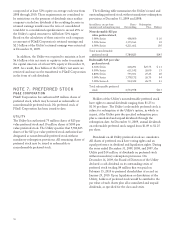

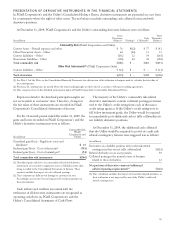

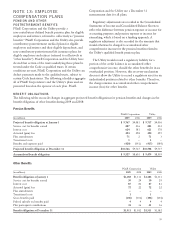

The following table sets forth the fair value hierarchy by level of PG&E Corporation’s and the Utility’s recurring fair

value financial instruments as of December 31, 2009 and 2008. The instruments are classified based on the lowest level of

input that is significant to the fair value measurement. PG&E Corporation’s and the Utility’s assessment of the

significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of fair

value assets and liabilities and their placement within the fair value hierarchy levels.

PG&E Corporation

Fair Value Measurements at December 31, 2009

(in millions) Level 1 Level 2 Level 3 Total

Assets:

Money market investments (held by PG&E Corporation) $ 189 $ — $ 4 $ 193

Nuclear decommissioning trusts

Equity securities 1,106 6 — 1,112

U.S. government and agency issues 653 51 — 704

Municipal bonds and other 1 197 — 198

Total nuclear decommissioning trusts(1) 1,760 254 — 2,014

Rabbi trusts-equity securities 81 — — 81

Long-term disability trust

Equity securities 52 23 — 75

Corporate debt securities — 113 — 113

Total long-term disability trust 52 136 — 188

Total assets $2,082 $390 $ 4 $2,476

Liabilities:

Dividend participation rights $—$—$12$12

Price risk management instruments(2) 3 73 217 293

Other —— 3 3

Total liabilities $ 3 $ 73 $232 $ 308

(1) Excludes deferred taxes on appreciation of investment value.

(2) Balances include the impact of netting adjustments of $108 million to Level 1, $48 million to Level 2, and $32 million to Level 3.

86