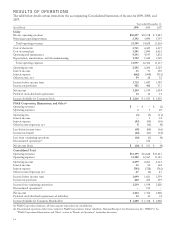

PG&E 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The following table summarizes PG&E Corporation’s

and the Utility’s cash positions:

December 31,

(in millions) 2009 2008

PG&E Corporation $ 193 $ 167

Utility 334 52

Total consolidated cash and cash

equivalents 527 219

Utility restricted cash 633 1,290

Total consolidated cash, including restricted

cash $1,160 $1,509

Restricted cash primarily consists of cash held in escrow

pending the resolution of the remaining disputed claims

filed in the Utility’s reorganization proceeding under

Chapter 11. PG&E Corporation and the Utility maintain

separate bank accounts. PG&E Corporation and the Utility

primarily invest their cash in money market funds.

Credit Facilities

The following table summarizes PG&E Corporation’s and the Utility’s outstanding commercial paper and credit facilities

at December 31, 2009:

(in millions) At December 31, 2009

Authorized Borrower Facility Termination

Date Facility

Limit

Letters

of Credit

Outstanding Cash

Borrowings

Commercial

Paper

Backup Availability

PG&E Corporation Revolving credit facility February 2012 $ 187(1) $ – $– N/A $ 187

Utility Revolving credit facility February 2012 1,940(2) 252 – $ 333 1,355

Total credit facilities $2,127 $252 $– $ 333 $1,542

(1) Includes an $87 million sublimit for letters of credit and a $100 million sublimit for “swingline” loans, defined as loans that are made available ona

same-day basis and are repayable in full within 30 days.

(2) Includes a $921 million sublimit for letters of credit and a $200 million sublimit for swingline loans.

At December 31, 2009, PG&E Corporation and the

Utility were in compliance with all covenants under these

revolving credit facilities. (See Note 4 of the Notes to the

Consolidated Financial Statements for further detail.)

2009 Financings

The following table summarizes PG&E Corporation’s and

the Utility’s debt issuances in 2009:

(in millions) Issue Date Amount

PG&E Corporation

Senior Notes

5.75%, due 2014 March 12 $ 350

Utility

Senior Notes

6.25%, due 2039 March 6 550

Floating rate, due 2010 June 11 500

5.40%, due 2040 November 18 550

Total Utility senior notes 1,600

Pollution control bonds

Series 2009 A and B, variable rates,

due 2026 September 1 149

Series 2009 C and D, variable rates,

due 2016 September 1 160

Total pollution control bonds 309

Total Utility debt 1,909

Total debt issuances in 2009 $2,259

The net proceeds from the various Utility senior notes

in 2009 were used to finance capital expenditures and for

general working capital and other corporate purposes. The

net proceeds from the pollution control bonds were used

to repurchase the corresponding series of 2008 pollution

control bonds. (See Note 4 of the Notes to the

Consolidated Financial Statements for further detail.)

During 2009, PG&E Corporation issued 6,773,290

shares of common stock upon the exercise of employee

stock options and under its 401(k) plan and Dividend

Reinvestment and Stock Purchase Plan, generating $219

million of cash. The equity issuances, combined with the

proceeds from the issuance of $350 million of senior notes

and other funds, allowed PG&E Corporation to contribute

$718 million of cash to the Utility in 2009 to ensure that

the Utility had adequate capital to fund its capital

expenditures and to maintain the 52% common equity

ratio authorized by the CPUC.

Future Financing Needs

The amount and timing of the Utility’s future financing

needs will depend on various factors, including the

conditions in the capital markets, the timing and amount

of forecasted capital expenditures, and the amount of cash

internally generated through normal business operations,

among other factors. The Utility’s future financing needs

21