PG&E 2009 Annual Report Download - page 76

Download and view the complete annual report

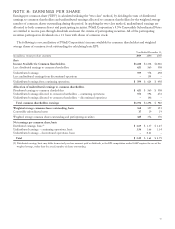

Please find page 76 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Corporation’s Consolidated Statements of Income as a

non-operating expense or income (in Other income

(expense), net). (See Notes 10 and 11 of the Notes to the

Consolidated Financial Statements for further discussion of

these instruments.)

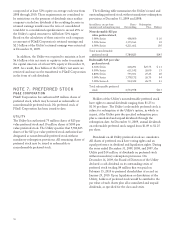

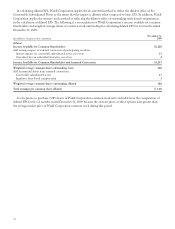

On January 13, 2009, PG&E Corporation, upon request

by an investor, converted $28 million of Convertible

Subordinated Notes into 1,855,865 shares, at the

conversion price of $15.09 per share. Additionally, on

July 1, 2009, PG&E Corporation, upon request by an

investor, converted $5 million of Convertible

Subordinated Notes into 331,404 shares, at the conversion

price of $15.09 per share.

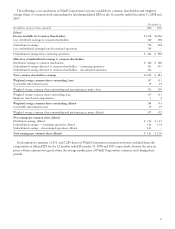

UTILITY

Senior Notes

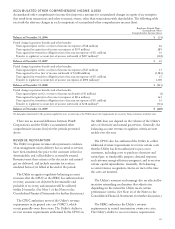

At December 31, 2009, the Utility had outstanding $8.6

billion of senior notes with various interest rates and

maturity dates, including the following issuances made

during 2009.

On March 6, 2009, the Utility issued $550 million

principal amount of 6.25% Senior Notes due March 1,

2039.

On June 11, 2009, the Utility issued $500 million

principal amount of Floating Rate Senior Notes due

June 10, 2010. The interest rate for the Floating Rate Senior

Notes is equal to the three-month London Interbank

Offered Rate plus 0.95% and resets quarterly. At

December 31, 2009, the interest rate on the Floating Rate

Senior Notes was 1.21%.

On November 18, 2009, the Utility issued $550 million

principal amount of 5.40% Senior Notes due January 15,

2040.

The Utility’s senior notes are unsecured and rank

equally with the Utility’s other senior unsecured and

unsubordinated debt. Under the indenture for the senior

notes, the Utility has agreed that it will not incur secured

debt or engage in sales leaseback transactions (except for

(1) debt secured by specified liens, and (2) aggregate other

secured debt and sales and leaseback transactions not

exceeding 10% of the Utility’s net tangible assets, as

defined in the indenture) unless the Utility provides that

the senior notes will be equally and ratably secured.

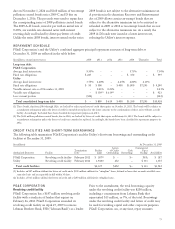

Pollution Control Bonds

The California Pollution Control Financing Authority and

the California Infrastructure and Economic Development

Bank have issued various series of tax-exempt pollution

control bonds for the benefit of the Utility. Under the

pollution control bond loan agreements related to the

Series 1996 A bonds, the Series 2004 A–D bonds, and the

Series 2008 F and G bonds, the Utility is obligated to pay

on the due dates an amount equal to the principal;

premium, if any; and interest on these bonds to the

trustees for these bonds. With respect to the Series 1996 C,

E, and F bonds; the Series 1997 B bonds; and the Series

2009 A–D bonds, the Utility reimburses the letter of credit

providers for their payments to the trustee for these bonds,

or if a letter of credit provider fails to pay under its

respective letter of credit, the Utility is obligated to pay the

principal; premium, if any; and interest on those bonds.

All payments on the Series 1996 C, E, and F bonds; the

Series 1997 B bonds; and the Series 2009 A–D bonds are

made through draws on separate direct-pay letters of credit

for each series issued by a financial institution.

All of the pollution control bonds were used to finance

or refinance pollution control facilities at the Geysers

geothermal power plant or at the Utility’s Diablo Canyon

nuclear power plant and were issued as “exempt facility

bonds” within the meaning of Section 142(a) of the

Internal Revenue Code of 1954, as amended (“Code”). The

Utility agrees not to take any action or fail to take any

action if any such action or inaction would cause the

interest on the bonds to be taxable or to be other than

exempt facility bonds.

In 1999, the Utility sold the Geysers geothermal power

plant to Geysers Power Company, LLC pursuant to

purchase and sale agreements stating that Geysers Power

Company, LLC will use the bond-financed facilities solely

as pollution control facilities within the meaning of

Section 103(b)(4)(F) of the Code. Although Geysers Power

Company, LLC subsequently filed a petition for

reorganization under Chapter 11, it assumed the purchase

and sale agreements under its Chapter 11 plan of

reorganization that became effective on January 31, 2008.

The Utility has no knowledge that Geysers Power

Company, LLC intends to cease using the bond-financed

facilities solely as pollution control bonds facilities within

the meaning of Section 103(b)(4)(F) of the Code.

The Utility has obtained credit support from insurance

companies for the Series 1996 A bonds and the Series 2004

A–D bonds such that if the Utility does not pay the

principal and interest on any series of these insured bonds,

the bond insurer for that series will pay the principal and

interest.

On September 1, 2009, the California Infrastructure and

Economic Development Bank issued $149 million of

tax-exempt pollution control bonds series 2009 A and B

72