PG&E 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

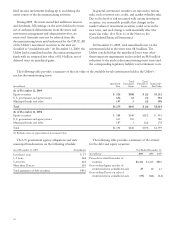

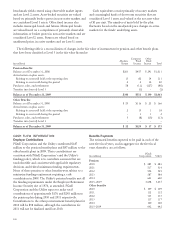

The fair value of each stock option on the date of grant

is estimated using the Black-Scholes valuation method. The

weighted average grant date fair value of options granted

using the Black-Scholes valuation method was $5.95, $4.46,

and $7.81 per share in 2009, 2008, and 2007, respectively.

The significant assumptions used for shares granted in

2009, 2008, and 2007 were:

2009 2008 2007

Expected stock price

volatility 28.8% 18.9% 16.5%

Expected annual

dividend payment $1.68 $1.56 $1.44

Risk-free interest rate 2.30% 2.77% 4.73%

Expected life 5.3 years 5.4 years 5.4 years

Expected volatilities are based on historical volatility of

PG&E Corporation’s common stock. The expected

dividend payment is the dividend yield at the date of grant.

The risk-free interest rate for periods within the contractual

term of the stock option is based on the U.S. Treasury rates

in effect at the date of grant. The expected life of stock

options is derived from historical data that estimates stock

option exercises and employee departure behavior.

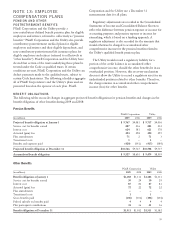

The following table summarizes total intrinsic value (fair

market value of PG&E Corporation’s stock less stock

option strike price) of options exercised for PG&E

Corporation and the Utility in 2009, 2008, and 2007:

(in millions) PG&E

Corporation Utility

2009:

Intrinsic value of options exercised $18 $13

2008:

Intrinsic value of options exercised $13 $ 9

2007:

Intrinsic value of options exercised $59 $34

The tax benefit from stock options exercised totaled $6

million, $4 million, and $20 million for the years ended

December 31, 2009, 2008, and 2007 respectively, of which

$5 million, $3 million, and $10 million was recorded by

the Utility.

The following table summarizes stock option activity for PG&E Corporation and the Utility for 2009:

Options Shares Weighted Average

Exercise Price

Weighted

Average

Remaining

Contractual

Term Aggregate

Intrinsic Value

Outstanding at January 1 2,968,261 $23.45

Granted(1) 14,543 $35.53

Exercised (1,005,063) $22.53

Forfeited or expired (2,400) $29.76

Outstanding at December 31 1,975,341 $23.99 3.38 $40,812,560

Expected to vest at December 31 27,583 $38.24 8.18 $ 204,479

Exercisable at December 31 1,947,758 $23.79 3.31 $40,635,663

(1) No stock options were awarded to employees in 2009; however, certain non-employee directors of PG&E Corporation were awarded stock options.

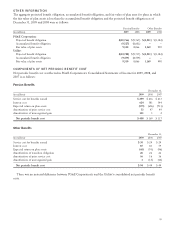

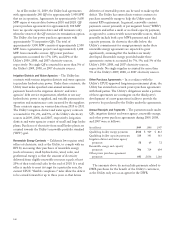

The following table summarizes stock option activity for the Utility for 2009:

Options Shares Weighted Average

Exercise Price

Weighted

Average

Remaining

Contractual

Term Aggregate

Intrinsic Value

Outstanding at January 1(1) 2,494,868 $22.99

Granted ––

Exercised (711,652) $22.13

Forfeited or expired (2,400) $29.76

Outstanding at December 31(1) 1,780,816 $23.62 3.29 $37,446,306

Expected to vest at December 31 – $ – – $ –

Exercisable at December 31 1,780,816 $23.62 3.29 $37,446,306

(1) Includes net employee transfers of 185,045 shares between PG&E Corporation and the Utility during 2009.

102