PG&E 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

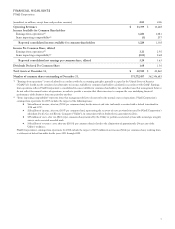

SELECTED FINANCIAL DATA

(in millions, except per share amounts) 2009 2008 2007 2006 2005

PG&E Corporation(1)

For the Year

Operating revenues $13,399 $14,628 $13,237 $12,539 $11,703

Operating income 2,299 2,261 2,114 2,108 1,970

Income from continuing operations 1,234 1,198 1,020 1,005 920

Earnings per common share from continuing operations, basic 3.25 3.23 2.79 2.78 2.37

Earnings per common share from continuing operations, diluted 3.20 3.22 2.78 2.76 2.34

Dividends declared per common share(2) 1.68 1.56 1.44 1.32 1.23

At Year-End

Book value per common share(3) $ 26.68 $ 24.64 $ 22.91 $ 21.24 $ 19.94

Common stock price per share 44.65 38.71 43.09 47.33 37.12

Total assets 42,945 40,860 36,632 34,803 34,074

Long-term debt (excluding current portion) 10,381 9,321 8,171 6,697 6,976

Rate reduction bonds (excluding current portion) ————290

Energy recovery bonds (excluding current portion) 827 1,213 1,582 1,936 2,276

Noncontrolling interest – preferred stock of subsidiary 252 252 252 252 252

Pacific Gas and Electric Company

For the Year

Operating revenues $13,399 $14,628 $13,238 $12,539 $11,704

Operating income 2,302 2,266 2,125 2,115 1,970

Income available for common stock 1,236 1,185 1,010 971 918

At Year-End

Total assets 42,709 40,537 36,310 34,371 33,783

Long-term debt (excluding current portion) 10,033 9,041 7,891 6,697 6,696

Rate reduction bonds (excluding current portion) ————290

Energy recovery bonds (excluding current portion) 827 1,213 1,582 1,936 2,276

(1) Matters relating to discontinued operations are discussed in the section entitled “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and in Note 9 of the Notes to the Consolidated Financial Statements.

(2) The Board of Directors of PG&E Corporation declared a cash dividend of $0.30 per quarter for the first three quarters of 2005. In the fourth quarter

of 2005, the Board of Directors increased the quarterly cash dividend to $0.33 per share. Beginning in the first quarter of 2007, the Board of

Directors increased the quarterly cash dividend to $0.36 per share. Beginning in the first quarter of 2008, the Board of Directors increased the

quarterly cash dividend to $0.39 per share. Beginning in the first quarter of 2009, the Board of Directors increased the quarterly cash dividend to

$0.42 per share. The Utility paid quarterly dividends on common stock held by PG&E Corporation of $624 million in 2009. The Utility paid

quarterly dividends on common stock held by PG&E Corporation and a wholly owned subsidiary aggregating to $589 million in 2008 and $547

million in 2007. See Note 6 of the Notes to the Consolidated Financial Statements.

(3) Book value per common share includes the effect of participating securities. The dilutive effect of outstanding stock options and restricted stock is

further disclosed in Note 8 of the Notes to the Consolidated Financial Statements.

9