PG&E 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

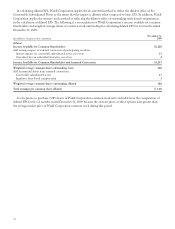

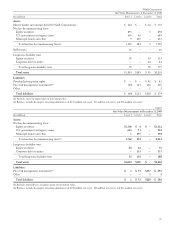

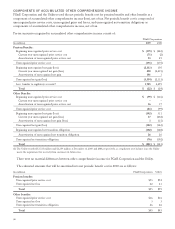

Utility

Fair Value Measurements at December 31, 2008

(in millions) Level 1 Level 2 Level 3 Total

Assets:

Nuclear decommissioning trusts(1)

Equity securities $ 893 $ — $ 5 $ 898

U.S. government and agency issues 603 86 — 689

Municipal bonds and other 9 203 — 212

Total nuclear decommissioning trusts(1) 1,505 289 5 1,799

Long-term disability trust

Equity securities 99 — 54 153

Corporate debt securities — — 24 24

Total long-term disability trust 99 — 78 177

Total assets $1,604 $289 $ 83 $1,976

Liabilities:

Price risk management instruments(2) (49) 123 156 230

Other —— 2 2

Total liabilities $ (49) $123 $158 $ 232

(1) Excludes taxes on appreciation of investment value.

(2) Balances include the impact of netting adjustments of $159 million to Level 1, $32 million to Level 2, and $76 million to Level 3.

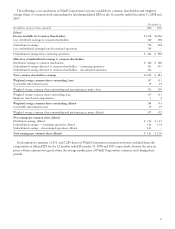

PG&E Corporation’s and the Utility’s fair value

measurements incorporate various factors, such as

nonperformance and credit risk adjustments. At

December 31, 2009, the nonperformance and credit risk

adjustment represented an immaterial amount of the net

price risk management value. PG&E Corporation and the

Utility utilize a mid-market pricing convention (the

midpoint between bid and ask prices) as a practical

expedient in valuing the majority of its derivative assets

and liabilities at fair value.

MONEY MARKET INVESTMENTS

PG&E Corporation invests in AAA-rated money market

funds that seek to maintain a stable net asset value. These

funds invest in high-quality, short-term, diversified money

market instruments, such as treasury bills, federal agency

securities, certificates of deposit, and commercial paper

with a maximum weighted average maturity of 60 days or

less. PG&E Corporation’s investments in these money

market funds are generally valued based on observable

inputs such as expected yield and credit quality and are

thus classified as Level 1 instruments. Approximately $189

million held in money market funds are recorded as Cash

and cash equivalents in PG&E Corporation’s Consolidated

Balance Sheets.

As of December 31, 2009, PG&E Corporation classified

approximately $4 million invested in one money market

fund as a Level 3 instrument because the fund manager

imposed restrictions on fund participants’ redemption

requests. PG&E Corporation’s investment in this money

market fund is recorded as Prepaid expenses and other in

PG&E Corporation’s Consolidated Balance Sheets.

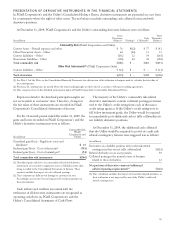

TRUST ASSETS

The nuclear decommissioning trusts, the rabbi trusts

related to the non-qualified deferred compensation plans,

and the long-term disability trust hold primarily equities,

debt securities, mutual funds, and life insurance policies.

These instruments are generally valued based on

unadjusted prices in active markets for identical

transactions or unadjusted prices in active markets for

similar transactions. The rabbi trusts are classified as

Current Assets-Prepaid expenses and other and Other

Noncurrent Assets – Other in PG&E Corporation’s

Consolidated Balance Sheets. The long-term disability trust

is presented as a net obligation as the projected obligation

exceeds plan assets as Noncurrent Liabilities – Other in

PG&E Corporation’s and the Utility’s Consolidated

Balance Sheets.

The Consolidated Balance Sheets of PG&E Corporation

and the Utility contain assets held in trust for the PG&E

Retirement Plan Master Trust, the Postretirement Life

Insurance Trust, and the Postretirement Medical Trusts

presented on a net basis. See Note 13 of the Notes to the

Consolidated Financial Statements for further discussion.

The pension assets are presented net of pension obligations

as Noncurrent Liabilities – Other in PG&E Corporation’s

and the Utility’s Consolidated Balance Sheets.

88