PG&E 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

service providers. The Utility does not procure natural gas

for non-core customers. When the Utility provides both

transportation and natural gas supply, the Utility refers to

the combined service as “bundled natural gas service.” In

2009, core customers represented over 99% of the Utility’s

total customers and 38% of its total natural gas deliveries,

while non-core customers comprised less than 1% of the

Utility’s total customers and 62% of its total natural gas

deliveries.

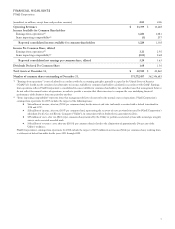

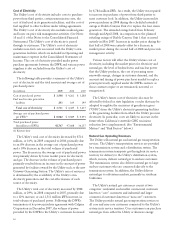

The following table provides a summary of the Utility’s

natural gas operating revenues:

(in millions) 2009 2008 2007

Bundled natural gas revenues $2,794 $3,557 $3,417

Transportation service-only revenues 348 333 340

Total natural gas operating

revenues $3,142 $3,890 $3,757

Average bundled revenue per Mcf(1)

of natural gas sold $11.04 $13.52 $12.94

Total bundled natural gas sales

(in millions of Mcf) 253 263 264

(1) One thousand cubic feet

The Utility’s total natural gas operating revenues

decreased by $748 million, or 19%, in 2009 compared to

2008, primarily due to a $799 million decrease in the total

cost of natural gas. This cost is passed through to

customers and generally does not impact net income. (See

“Cost of Natural Gas” below.) Natural gas operating

revenues, excluding items passed through to customers,

increased by $51 million. This was primarily due to $53

million of increase in authorized base revenues consisting

of $22 million for the 2009 attrition adjustments, $10

million as a result of the 2007 Gas Accord IV Settlement

Agreement, and $21 million representing additional

authorized revenue requirements to recover the capital

costs of new assets placed in service (such as the

SmartMeterTM advanced metering project).

The Utility’s natural gas operating revenues increased by

$133 million, or 4%, in 2008 compared to 2007, primarily

due to an increase in costs of natural gas of $55 million

and public purpose programs of $24 million, which are

passed through to customers and generally do not have an

impact on earnings. Natural gas operating revenues,

excluding items passed through to customers, increased by

$54 million, primarily due to a $22 million increase in base

revenue requirements as a result of attrition adjustments

authorized in the 2007 GRC and an increase in natural gas

revenue requirements of $25 million to fund the

SmartMeterTM advanced metering project.

The Utility’s natural gas operating revenues for 2010 are

expected to increase by $22 million due to attrition

adjustments that were authorized by the CPUC in the 2007

GRC. The Utility’s future natural gas operating revenues

for 2011 through 2014 will depend on the amount of

revenue requirements authorized by the CPUC in the

Utility’s 2011 GRC and the Gas Transmission and Storage

rate case. (See “Regulatory Matters” below.) In addition, the

Utility expects future natural gas operating revenues to

increase to the extent that the CPUC approves the Utility’s

separately funded projects. (See “Capital Expenditures”

below.) Finally, the CPUC has not yet determined how the

existing energy efficiency incentive mechanism will be

modified, so the amount of incentive revenues that the

Utility may earn for the implementation of its programs in

2009 and future years is uncertain. (See “Regulatory

Matters” below.)

Cost of Natural Gas

The Utility’s cost of natural gas includes the purchase costs

of natural gas, transportation costs on interstate pipelines,

and gas storage costs but excludes the transportation costs

on intrastate pipelines for core and non-core customers,

which are included in Operating and maintenance expense

in the Consolidated Statements of Income. The Utility’s

cost of natural gas also includes realized gains and losses on

price risk management activities. (See Notes 10 and 11 of

the Notes to the Consolidated Financial Statements.)

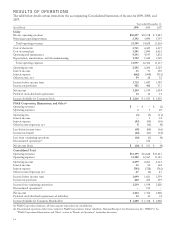

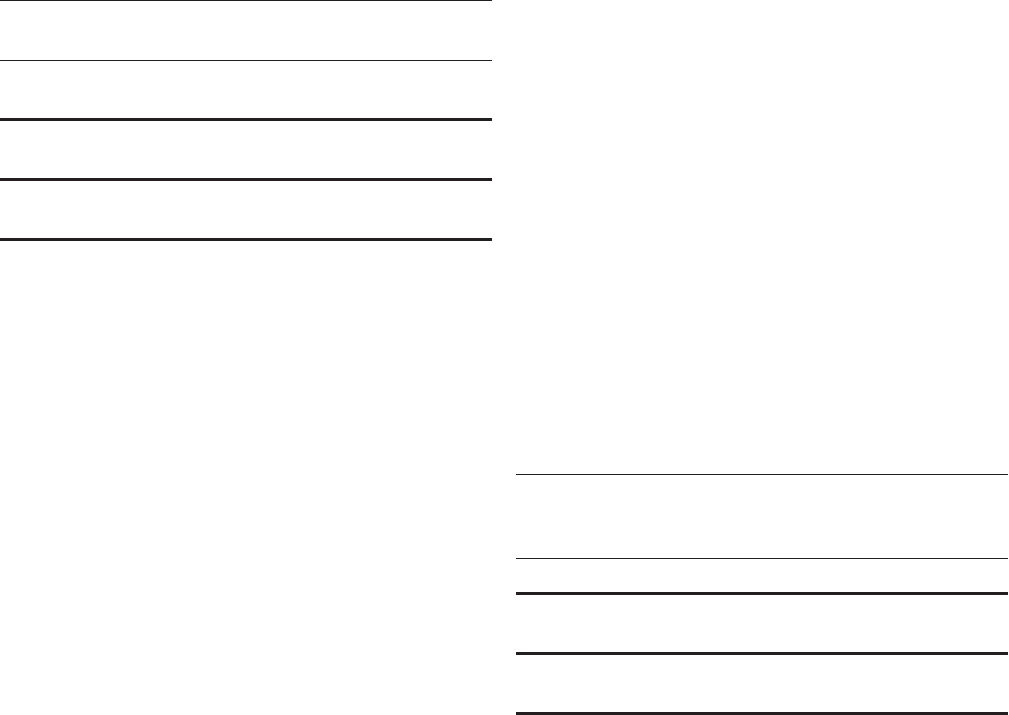

The following table provides a summary of the Utility’s

cost of natural gas:

(in millions) 2009 2008 2007

Cost of natural gas sold $1,130 $1,955 $1,859

Transportation cost of natural gas

sold 161 135 176

Total cost of natural gas $1,291 $2,090 $2,035

Average cost per Mcf of natural gas

sold $ 4.47 $ 7.43 $ 7.04

Total natural gas sold

(in millions of Mcf) 253 263 264

The Utility’s total cost of natural gas decreased by $799

million, or 38%, in 2009 compared to 2008, primarily due

to decreases in the average market price of natural gas.

The Utility’s total cost of natural gas increased by $55

million, or 3%, in 2008 compared to 2007, primarily due to

increases in the average market price of natural gas

purchased. The increase was partially offset by a $23

million refund that the Utility received as part of a

settlement with TransCanada’s Gas Transmission

Northwest Corporation related to 2007 gas transmission

capacity rates.

17