PG&E 2009 Annual Report Download - page 65

Download and view the complete annual report

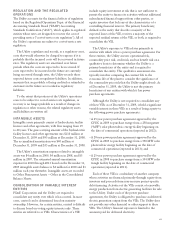

Please find page 65 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.REGULATION AND THE REGULATED

OPERATIONS

The Utility accounts for the financial effects of regulation

based on the Regulated Operations Topic of the Financial

Accounting Standards Board (“FASB”) Accounting

Standards Codification (“ASC”), which applies to regulated

entities whose rates are designed to recover the cost of

providing service (“cost-of-service rate regulation”). All of

the Utility’s operations are subject to cost-of-service rate

regulation.

The Utility capitalizes and records, as a regulatory asset,

costs that would otherwise be charged to expense if it is

probable that the incurred costs will be recovered in future

rates. The regulatory assets are amortized over future

periods when the costs are expected to be recovered. If

costs expected to be incurred in the future are currently

being recovered through rates, the Utility records those

expected future costs as regulatory liabilities. In addition,

amounts that are probable of being credited or refunded to

customers in the future are recorded as regulatory

liabilities.

To the extent that portions of the Utility’s operations

cease to be subject to cost-of-service rate regulation, or

recovery is no longer probable as a result of changes in

regulation or other reasons, the related regulatory assets

and liabilities are written off.

INTANGIBLE ASSETS

Intangible assets primarily consist of hydroelectric facility

licenses and other agreements, with lives ranging from 19

to 40 years. The gross carrying amount of the hydroelectric

facility licenses and other agreements was $110 million at

December 31, 2009 and $95 million at December 31, 2008.

The accumulated amortization was $40 million at

December 31, 2009 and $35 million at December 31, 2008.

The Utility’s amortization expense related to intangible

assets was $4 million in 2009, $4 million in 2008, and $3

million in 2007. The estimated annual amortization

expense for 2010 through 2013 based on the December 31,

2009 intangible assets balance is $4 million for 2010 and $3

million each year thereafter. Intangible assets are recorded

to Other Noncurrent Assets — Other in the Consolidated

Balance Sheets.

CONSOLIDATION OF VARIABLE INTEREST

ENTITIES

PG&E Corporation and the Utility are required to

consolidate any entity over which it has control. In most

cases, control can be determined based on majority

ownership. However, for certain entities, control is difficult

to discern based on voting equity interests only. These

entities are referred to as VIEs. Characteristics of a VIE

include equity investment at risk that is not sufficient to

permit the entity to finance its activities without additional

subordinated financial support from other parties, or

equity investors that lack any of the characteristics of a

controlling financial interest. The primary beneficiary,

defined as the entity that absorbs a majority of the

expected losses of the VIE, receives a majority of the

expected residual returns of the VIE, or both, is required to

consolidate the VIE.

The Utility’s exposure to VIEs relates primarily to

entities with which it has a power purchase agreement. For

those entities, the Utility assesses operational risk,

commodity price risk, credit risk, and tax benefit risk on a

qualitative basis to determine whether the Utility is a

primary beneficiary of the entity and is required to

consolidate the entity. This qualitative assessment also

typically involves comparing the contract life to the

economic life of the plant to consider the significance of

the commodity price risk that the Utility might absorb. As

of December 31, 2009, the Utility is not the primary

beneficiary of any entities with which it has power

purchase agreements.

Although the Utility is not required to consolidate any

of these VIEs as of December 31, 2009, it held a significant

variable interest in three VIEs as a result of being a party to

the following power purchase agreements:

• A 25-year power purchase agreement approved by the

CPUC in 2009 to purchase energy from a 250-megawatt

(“MW”) solar photovoltaic energy facility beginning on

the date of commercial operations (expected in 2012);

• A 20-year power purchase agreement approved by the

CPUC in 2009 to purchase energy from a 550 MW solar

photovoltaic energy facility beginning on the date of

commercial operations (expected in 2013); and

• A 25-year power purchase agreement approved by the

CPUC in 2008 to purchase energy from a 554 MW solar

trough facility beginning on the date of commercial

operations (expected in 2011).

Each of these VIEs is a subsidiary of another company

whose activities are financed primarily through equity from

investors and proceeds from non-recourse project-specific

debt financing. Activities of the VIEs consist of renewable

energy production from electric generating facilities for sale

to the Utility. Under each of the power purchase

agreements, the Utility is obligated to purchase as-delivered

electric generation output from the VIEs. The Utility does

not provide any other financial or other support to these

VIEs. The Utility’s financial exposure is limited to the

amounts paid for delivered electricity.

61