PG&E 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

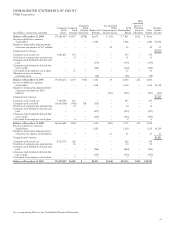

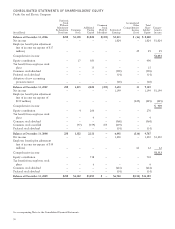

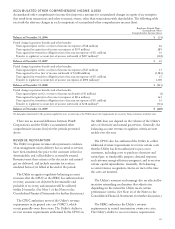

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Pacific Gas and Electric Company

(in millions)

Preferred

Stock

Without

Mandatory

Redemption

Provisions Common

Stock

Additional

Paid-in

Capital

Common

Stock

Held by

Subsidiary Reinvested

Earnings

Accumulated

Other

Comprehensive

Income

(Loss)

Total

Share-

holders’

Equity

Compre-

hensive

Income

Balance at December 31, 2006 $258 $1,398 $1,822 $(475) $5,213 $ (16) $ 8,200

Net income — — — — 1,024 — 1,024 $1,024

Employee benefit plan adjustment

(net of income tax expense of $17

million) — — — — — 29 29 29

Comprehensive income $1,053

Equity contribution — 17 383 — — — 400

Tax benefit from employee stock

plans — — 15 — — — 15

Common stock dividend — — — — (509) — (509)

Preferred stock dividend — — — — (14) — (14)

Adoption of new accounting

pronouncement — — — — (20) — (20)

Balance at December 31, 2007 258 1,415 2,220 (475) 5,694 13 9,125

Net income — — — — 1,199 — 1,199 $1,199

Employee benefit plan adjustment

(net of income tax expense of

$159 million) — — — — — (229) (229) (229)

Comprehensive income $ 970

Equity contribution — 4 266 — — — 270

Tax benefit from employee stock

plans — — 4 — — — 4

Common stock dividend — — — — (568) — (568)

Common stock cancelled — (97) (159) 475 (219) — —

Preferred stock dividend — — — — (14) — (14)

Balance at December 31, 2008 258 1,322 2,331 — 6,092 (216) 9,787

Net income — — — — 1,250 — 1,250 $1,250

Employee benefit plan adjustment

(net of income tax expense of $10

million) — — — — — 62 62 62

Comprehensive income $1,312

Equity contribution — — 718 — — — 718

Tax benefit from employee stock

plans — — 6 — — — 6

Common stock dividend — — — — (624) — (624)

Preferred stock dividend — — — — (14) — (14)

Balance at December 31, 2009 $258 $1,322 $3,055 $ — $6,704 $(154) $11,185

See accompanying Notes to the Consolidated Financial Statements.

58