PG&E 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

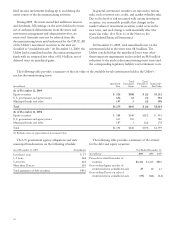

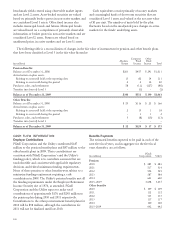

DEFINED CONTRIBUTION BENEFIT PLANS

PG&E Corporation and its subsidiaries also sponsor

defined contribution benefit plans. These plans are

qualified under applicable sections of the Code and

provide for tax-deferred salary deductions, after-tax

employee contributions, and employer contributions.

Employer contribution expense reflected in PG&E

Corporation’s Consolidated Statements of Income was as

follows:

(in millions) PG&E

Corporation Utility

Year ended December 31,

2009 $52 $51

2008 53 52

2007 47 46

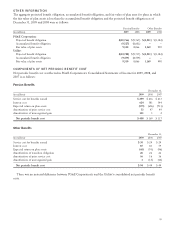

LONG-TERM INCENTIVE PLAN

The 2006 LTIP permits the award of various forms of

incentive awards, including stock options, stock

appreciation rights, restricted stock awards, restricted stock

units, performance shares, deferred compensation awards,

and other stock-based awards, to eligible employees of

PG&E Corporation and its subsidiaries. Non-employee

directors of PG&E Corporation are also eligible to receive

restricted stock and either stock options or restricted stock

units under the formula grant provisions of the 2006 LTIP.

A maximum of 12 million shares of PG&E Corporation

common stock (subject to adjustment for changes in capital

structure, stock dividends, or other similar events) have

been reserved for issuance under the 2006 LTIP, of which

9,703,937 shares were available for award at December 31,

2009.

Awards made under the PG&E Corporation Long-Term

Incentive Program before December 31, 2005 and still

outstanding continue to be governed by the terms and

conditions of the PG&E Corporation Long-Term Incentive

Program.

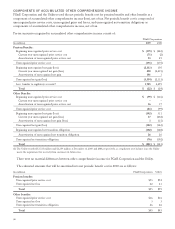

PG&E Corporation and the Utility use an estimated

annual forfeiture rate of 2.5% for stock options and

restricted stock and 3% for performance shares, based on

historic forfeiture rates, for purposes of determining

compensation expense for share-based incentive awards.

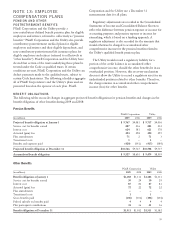

The following table provides a summary of total

compensation expense for PG&E Corporation and the

Utility for share-based incentive awards for the years ended

December 31, 2009 and 2008:

Year ended December 31, 2009

(in millions) PG&E

Corporation Utility

Stock Options $– $–

Restricted Stock 98

Restricted Stock Units 11 7

Performance Shares 37 26

Total Compensation Expense

(pre-tax) $57 $41

Total Compensation Expense

(after-tax) $34 $24

Year ended December 31, 2008

(in millions) PG&E

Corporation Utility

Stock Options $ 2 $ 2

Restricted Stock 22 15

Performance Shares 33 20

Total Compensation Expense

(pre-tax) $57 $37

Total Compensation Expense

(after-tax) $34 $22

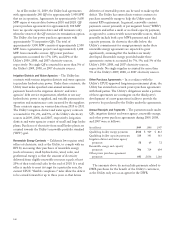

Stock Options

Other than the grant of options to purchase 14,543 shares

of PG&E Corporation common stock to non-employee

directors of PG&E Corporation in accordance with the

formula and nondiscretionary provisions of the 2006 LTIP,

no other stock options were granted during 2009. The

exercise price of stock options granted under the 2006 LTIP

and all other outstanding stock options is equal to the

market price of PG&E Corporation’s common stock on the

date of grant. Stock options generally have a 10-year term

and vest over four years of continuous service, subject to

accelerated vesting in certain circumstances.

101