PG&E 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

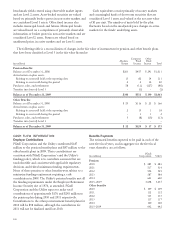

FAIR VALUE MEASUREMENTS

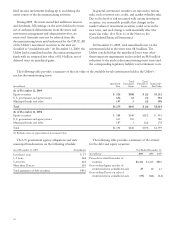

The following table presents the fair value of plan assets for pension and other benefit plans by major asset category for

the year ended December 31, 2009. (For a discussion of the levels and their inputs see Note 11 of the Notes to the

Consolidated Financial Statements.)

Fair Value Measurements as of December 31, 2009

(in millions) Level 1 Level 2 Level 3 Total

Pension Benefits:

U.S. Equity $ 411 $2,065 $ — $ 2,476

Non-U.S. Equity 316 1,018 — 1,334

Global Equity 162 317 — 479

Absolute Return — — 340 340

Fixed Income:

U.S. Government 585 262 — 847

Corporate 25 2,455 531 3,011

Other (8) 233 190 415

Cash Equivalents 378 31 — 409

Total $1,869 $6,381 $1,061 $ 9,311

Other Benefits:

U.S. Equity $ 88 $ 218 $ — $ 306

Non-U.S. Equity 81 68 — 149

Global Equity —8— 8

Absolute Return — — 32 32

Fixed Income:

U.S. Government 40 15 — 55

Corporate 82 275 124 481

Other (1) 13 17 29

Cash Equivalents 111 — — 111

Total $ 401 $ 597 $ 173 $ 1,171

Other Assets 17

Total Plan Assets at Fair Value $10,499

The U.S., Non-U.S., and combined Global Equity

categories include equity investments in common stock

and commingled funds comprised of equity across multiple

industries and regions of the world. Equity investments in

common stock are actively traded on a public exchange

and are therefore considered Level 1 assets. These equity

investments are generally valued based on unadjusted

prices in active markets for identical securities.

Commingled funds are maintained by investment

companies for large institutional investors and are not

publicly traded. Commingled funds are comprised

primarily of underlying equity securities that are publicly

traded on exchanges, and price quotes for the assets held

by these funds are readily observable and available.

Therefore, these commingled funds are categorized as Level

2 assets.

The Absolute Return category includes portfolios of

hedge funds that are valued based on a variety of

proprietary and non-proprietary valuation methods,

including unadjusted prices for publicly-traded securities in

active markets. Hedge funds are considered Level 3 assets.

The Fixed Income category includes U.S. government

securities, corporate securities, and other fixed income

securities. U.S. government fixed income primarily consists

of U.S. Treasury notes and U.S. governments bonds that

are valued based on unadjusted prices in active markets for

identical transactions and are considered Level 1 assets.

Corporate fixed income primarily includes investment

grade bonds of U.S. issuers across multiple industries that

are valued based on a compilation of primarily observable

information or broker quotes in non-active markets. These

securities are classified as Level 2 assets. Corporate fixed

income also includes one commingled fund comprised of

private corporate debt instruments. The fund is valued

using pricing models and valuation inputs that are

unobservable and is considered a Level 3 asset. Other fixed

income primarily includes pass-through and asset-backed

securities. Pass-through securities are valued based on

99