PG&E 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PG&E Corporation and Pacific Gas and Electric Company

2009 ANNUAL REPORT

Table of contents

-

Page 1

PG&E Corporation and Pacific Gas and Electric Company 2009 ANNUAL REPORT -

Page 2

-

Page 3

TABLE OF CONTENTS A Letter to our Stakeholders Financial Statements PG&E Corporation and Pacific Gas and Electric Company Boards of Directors Officers of PG&E Corporation and Pacific Gas and Electric Company Shareholder Information 1 6 116 117 118 -

Page 4

-

Page 5

...worst job-loss and home-foreclosure rates. In response, PG&E has stepped up outreach and provided financial assistance to large numbers of customers through a wide assortment of programs. Across the hundreds of communities we serve, we also increased the support we provide through shareholder-funded... -

Page 6

... be the basis for a range of new energy management tools and capabilities, which are key to improving customer service, increasing reliability, expanding energy efficiency and demand response, and optimizing the use of renewable energy sources and, soon, electric vehicles. Last year also saw further... -

Page 7

... for the latest in clean, highly efficient gas-fired generation, the plant earned project-of-the-year accolades from Power Engineering magazine. Construction also progressed on two other conventional-fueled facilities, Humboldt Bay and Colusa Generating Station. Humboldt Bay is expected to be... -

Page 8

... of options, from direct financial assistance to flexible payment plans and help through energy efficiency programs. Among the most telling signs of success was the increased enrollment in PG&E's CARE Program, which assists income-qualified customers through discounts on their monthly energy bills... -

Page 9

... fact, we reaffirmed our commitment to become the nation's leading utility-and we set a goal to do so by 2014. We are defining this objective now more clearly than we ever have before, with high bars set for customer satisfaction, employee engagement, environmental leadership, and shareholder return... -

Page 10

... TABLE OF CONTENTS Financial Highlights Comparison of Five-Year Cumulative Total Shareholder Return Selected Financial Data Management's Discussion and Analysis PG&E Corporation and Pacific Gas and Electric Company Consolidated Financial Statements Notes to the Consolidated Financial Statements... -

Page 11

... tax refund for 1998 and 1999. Å $28 million of income, after tax, ($0.07 per common share) representing the recovery of costs previously incurred by PG&E Corporation's subsidiary, Pacific Gas and Electric Company ("Utility"), in connection with its hydroelectric generation facilities. Å $59... -

Page 12

... stock is traded on the New York Stock Exchange. The official New York Stock Exchange symbol for PG&E Corporation is "PCG." COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN (1) This graph compares the cumulative total return on PG&E Corporation common stock (equal to dividends plus stock... -

Page 13

... share Total assets Long-term debt (excluding current portion) Rate reduction bonds (excluding current portion) Energy recovery bonds (excluding current portion) Noncontrolling interest - preferred stock of subsidiary Pacific Gas and Electric Company For the Year Operating revenues Operating income... -

Page 14

..., and decommissioning of the Utility's nuclear generation facilities. The CPUC has jurisdiction over the rates and terms and conditions of service for the Utility's electric and natural gas distribution operations, electric generation, and natural gas transportation and storage. The FERC has... -

Page 15

... PG&E Corporation's and the Utility's results of operations and financial condition depend primarily on whether the Utility is able to operate its business within authorized revenue requirements, recover its authorized costs timely, and earn its authorized rate of return. A number of factors have... -

Page 16

...rate of return. The Utility's actual equity earnings could be more or less based on a number of factors, including the timing and amount of operating costs and capital expenditures. The CPUC periodically authorizes the aggregate amount of long-term debt and short-term debt that the Utility may issue... -

Page 17

... electric rates that can vary with the customer's time of use and are more closely aligned with wholesale electricity prices; • how the CPUC administers the conditions imposed on PG&E Corporation when it became the Utility's holding company; • the extent to which PG&E Corporation or the Utility... -

Page 18

... 31, 2009 2008 2007 Utility Electric operating revenues Natural gas operating revenues Total operating revenues Cost of electricity Cost of natural gas Operating and maintenance Depreciation, amortization, and decommissioning Total operating expenses Operating income Interest income Interest... -

Page 19

... as amounts charged to customers to recover the cost of electric procurement, public purpose, energy efficiency, and demand response programs. The Utility provides electricity to residential, industrial, agricultural, and small and large commercial customers through its own generation facilities and... -

Page 20

...its service territory. Core customers can purchase natural gas from either the Utility or alternate energy Cost of purchased power Fuel used in own generation facilities Total cost of electricity Average cost of purchased power per kWh(1) Total purchased power (in millions of kWh) (1) Kilowatt-hour... -

Page 21

...capital costs of new assets placed in service (such as the SmartMeterTM advanced metering project). The Utility's natural gas operating revenues increased by $133 million, or 4%, in 2008 compared to 2007, primarily due to an increase in costs of natural gas of $55 million and public purpose programs... -

Page 22

... gas facilities, customer billing and service expenses, the cost of public purpose programs, and administrative and general expenses. Operating and maintenance expenses are influenced by wage inflation; changes in liabilities for employee benefits; property taxes; the timing and length of Diablo... -

Page 23

... 2011 Gas Transmission and Storage rate case, and by the FERC in future TO rate cases. Interest Income The Utility's interest income decreased by $58 million, or 64%, in 2009 compared to 2008, primarily due to lower interest rates affecting various regulatory balancing accounts and regulatory assets... -

Page 24

.... The levels of the Utility's operating cash and short-term debt fluctuate as a result of seasonal demand for electricity and natural gas, volatility in energy commodity costs, collateral requirements related to price risk management activity, the timing and amount of tax payments or refunds, and... -

Page 25

... 401(k) plan and Dividend Reinvestment and Stock Purchase Plan, generating $219 million of cash. The equity issuances, combined with the proceeds from the issuance of $350 million of senior notes and other funds, allowed PG&E Corporation to contribute $718 million of cash to the Utility in 2009 to... -

Page 26

.... Utility Corporate credit rating Senior unsecured debt Credit facility Pollution control bonds backed by letters of credit Pollution control bonds backed by bond insurance Pollution control bonds - nonbacked Preferred stock Commercial paper program PG&E Energy Recovery Funding LLC Energy recovery... -

Page 27

... depends on electricity and 24 90 24 gas price movement. The Utility's operating cash flows also (27) (6) (46) will be impacted by electricity procurement costs and the timing of rate adjustments authorized to recover these Net cash provided by costs. The CPUC has established a balancing account... -

Page 28

... of cash used to purchase new nuclear decommissioning trust investments. The Utility's nuclear power facilities consist of two units at Diablo Canyon and the retired facility at Humboldt Bay. Nuclear decommissioning requires the safe removal of the nuclear facilities from service and the reduction... -

Page 29

... and water agencies Other power purchase agreements Natural gas supply and transportation Nuclear fuel Pension and other benefits(4) Capital lease obligations(5) Operating leases Preferred dividends(6) Other commitments PG&E Corporation Long-term debt(1): Fixed rate obligations $16,141 1,397... -

Page 30

... the extent and timing of such expenditures, were concluded in August 2009. It is anticipated that the CPUC will issue a final decision during the second quarter of 2010. PROPOSED NEW GENERATION FACILITIES The Utility's CPUC-approved long-term electricity procurement plan, covering 2007 through... -

Page 31

...of new long-term generation resources to meet customer demand as forecasted in the Utility's 2007-2016 long-term electricity procurement plan previously approved by the CPUC. One of the agreements submitted to the CPUC proposes that a 586 MW natural gas-fired facility be developed and constructed by... -

Page 32

...among other changes, setting rates for core and non-core customers based on forecast demand. The Utility's ability to recover its remaining revenue requirements would continue to depend on throughput volumes, gas prices, and the extent to which non-core customers and other shippers contract for firm... -

Page 33

... APPLICATION The NRC oversees the licensing, construction, operation, and decommissioning of nuclear facilities, including the two nuclear generating units at Diablo Canyon and the Utility's retired nuclear generating unit at Humboldt Bay. NRC regulations require extensive monitoring and review... -

Page 34

...33% renewable portfolio standard ("RPS") by 2020, increasing energy efficiency goals, expanding the use of combined heat and power facilities, and developing a multi-sector cap-and-trade program. The CARB is required to adopt regulations to implement the scoping plan no later than January 1, 2011 to... -

Page 35

...qualifying GHG-emitting facilities to submit annual GHG emissions reports beginning in 2011. PG&E Corporation and the Utility provide detailed GHG emissions data in their annual Corporate Responsibility Report, available on their websites. As a result of the time necessary for a thorough third-party... -

Page 36

... are accounted for as leases. PRICE RISK The Utility is exposed to commodity price risk as a result of its electricity procurement activities, including the procurement of natural gas and nuclear fuel necessary for electricity generation and natural gas procurement for core customers. As long as... -

Page 37

..., energy trading companies, financial institutions, and oil and natural gas production companies located in the United States and Canada. If a counterparty failed to perform on its contractual obligation to deliver electricity or gas, then the Utility may find it necessary to procure electricity or... -

Page 38

...Utility estimates costs using sitespecific information, but also considers historical experience for costs incurred at similar sites depending on the level of information available. Estimated costs are composed of the direct costs of the remediation effort and the costs of compensation for employees... -

Page 39

...receive qualified and non-qualified non-contributory defined benefit pension plans. Retired employees and their eligible dependents of PG&E Corporation and its subsidiaries receive contributory medical plans, and certain retired employees participate in life insurance plans (referred to collectively... -

Page 40

... allocations of the employee benefit trusts, resulting in a weighted average rate of return on plan assets. Fixed income returns were projected based on real maturity and credit spreads added to a long-term inflation rate. Equity returns were estimated based on estimates of dividend yield and real... -

Page 41

.... 2009-17. Health care cost trend rate Discount rate Rate of return on plan assets 0.5% (0.5)% (0.5)% $6 6 5 $39 84 - RISK FACTORS RISKS RELATED TO PG&E CORPORATION As a holding company, PG&E Corporation depends on cash distributions and reimbursements from the Utility to meet its debt service... -

Page 42

...plans, and nuclear decommissioning trusts. PG&E Corporation and the Utility provide defined benefit pension plans and other postretirement benefits for eligible employees and retirees. The Utility also maintains three trusts for the purposes of providing funds to decommission its nuclear facilities... -

Page 43

... risks, and the rate at which the Utility invests and recovers capital will directly affect net income. The Utility's ability to develop new generation facilities and to invest in its electric and gas systems is subject to many risks, including risks related to obtaining regulatory approval... -

Page 44

...financial condition particularly depends on its ability to recover in rates, in a timely manner, the costs of electricity and natural gas purchased for its customers, its operating expenses, and an adequate return of and on the capital invested in its utility assets, including the costs of long-term... -

Page 45

energy efficiency and demand response programs; and the acquisition, retirement, or closure of generation facilities. The amount of electricity the Utility would need to purchase would immediately increase if there were an unexpected outage at Diablo Canyon or any of its other significant generation... -

Page 46

...anywhere in the CAISO-controlled electricity grid) is equal to three times the cost of the new capacity that the Utility should have secured. The CPUC has set this penalty at $120 per kW-year. The CPUC also adopted "local" resource adequacy requirements for specific regions in which locally-situated... -

Page 47

... the number of the Utility's customers declines due to municipalization or other forms of bypass and the Utility's rates are not adjusted in a timely manner to allow it to fully recover its investment in electricity and natural gas facilities and electricity procurement costs, PG&E Corporation's and... -

Page 48

...in its rates in a timely manner, PG&E Corporation's and the Utility's financial condition, results of operations, and cash flows would be materially adversely affected. Economic downturn and the resulting drop in demand for energy commodities has reduced the prices of electricity and natural gas and... -

Page 49

...levels. In December 2009, the EPA issued a finding that GHG emissions cause or contribute to air pollution that endangers public health and welfare. The impact of events or conditions caused by climate change could range widely, from highly localized to worldwide, and the extent to which the Utility... -

Page 50

... a GHG emission performance standard. In November 2009, the CARB issued preliminary draft regulations to establish a cap-and-trade program that would set a declining ceiling on GHG emissions and allow companies to buy and sell emission allowances or offsets to meet it. Depending on the final form of... -

Page 51

... costs would increase. Further, such events may cause the Utility to be in a short position and the Utility would need to purchase electricity from more expensive sources. In addition, the Utility's nuclear power operations are subject to the availability of adequate nuclear fuel supplies on terms... -

Page 52

...or capacity at the facility. If the Utility cannot obtain, renew, or comply with necessary governmental permits, authorizations, or licenses, or if the Utility cannot recover any increased costs of complying with additional license requirements or any other associated costs in its rates in a timely... -

Page 53

CONSOLIDATED STATEMENTS OF INCOME PG&E Corporation Year Ended December 31, 2009 2008 2007 (in millions, except per share amounts) Operating Revenues Electric Natural gas Total operating revenues Operating Expenses Cost of electricity Cost of natural gas Operating and maintenance Depreciation, ... -

Page 54

... in 2009 and $76 million in 2008) Accrued unbilled revenue Regulatory balancing accounts Inventories: Gas stored underground and fuel oil Materials and supplies Income taxes receivable Prepaid expenses and other Total current assets Property, Plant, and Equipment Electric Gas Construction work... -

Page 55

... customer refunds Regulatory balancing accounts Other Interest payable Income taxes payable Deferred income taxes Other Total current liabilities Noncurrent Liabilities Long-term debt Energy recovery bonds Regulatory liabilities Pension and other postretirement benefits Asset retirement obligations... -

Page 56

... Allowance for equity funds used during construction Deferred income taxes and tax credits, net Other changes in noncurrent assets and liabilities Effect of changes in operating assets and liabilities: Accounts receivable Inventories Accounts payable Disputed claims and customer refunds Income taxes... -

Page 57

... Stock-based compensation amortization Common stock dividends declared and paid Common stock dividends declared but not yet paid Tax benefit from employee stock plans Adoption of new accounting pronouncement Balance at December 31, 2007 Income available for common shareholders Employee benefit plan... -

Page 58

... INCOME Pacific Gas and Electric Company Year ended December 31, 2009 2008 2007 (in millions) Operating Revenues Electric Natural gas Total operating revenues Operating Expenses Cost of electricity Cost of natural gas Operating and maintenance Depreciation, amortization, and decommissioning Total... -

Page 59

... million in 2009 and $76 million in 2008) Accrued unbilled revenue Related parties Regulatory balancing accounts Inventories: Gas stored underground and fuel oil Materials and supplies Income taxes receivable Prepaid expenses and other Total current assets Property, Plant, and Equipment Electric Gas... -

Page 60

...customer refunds Related parties Regulatory balancing accounts Other Interest payable Income tax payable Deferred income taxes Other Total current liabilities Noncurrent Liabilities Long-term debt Energy recovery bonds Regulatory liabilities Pension and other postretirement benefits Asset retirement... -

Page 61

... Allowance for equity funds used during construction Deferred income taxes and tax credits, net Other changes in noncurrent assets and liabilities Effect of changes in operating assets and liabilities: Accounts receivable Inventories Accounts payable Disputed claims and customer refunds Income taxes... -

Page 62

... Total Share- Compreholders' hensive Equity Income Balance at December 31, 2006 Net income Employee benefit plan adjustment (net of income tax expense of $17 million) Comprehensive income Equity contribution Tax benefit from employee stock plans Common stock dividend Preferred stock dividend... -

Page 63

...primary purpose is to hold interests in energy-based businesses. PG&E Corporation conducts its business principally through Pacific Gas and Electric Company ("Utility"), a public utility operating in northern and central California. The Utility generates revenues mainly through the sale and delivery... -

Page 64

... class of property. The Utility's composite depreciation rate was 3.43% in 2009, 3.38% in 2008, and 3.28% in 2007. Estimated Useful Lives Electricity generating facilities Electricity distribution facilities Electricity transmission Natural gas distribution facilities Natural gas transportation... -

Page 65

... primarily through equity from investors and proceeds from non-recourse project-specific debt financing. Activities of the VIEs consist of renewable energy production from electric generating facilities for sale to the Utility. Under each of the power purchase agreements, the Utility is obligated... -

Page 66

...leased property to pre-lease condition. Additionally, the Utility has recorded AROs related to gas distribution, gas transmission, electric distribution, and electric transmission system assets. Detailed studies of the cost to decommission the Utility's nuclear power plants are conducted every three... -

Page 67

...to purchase electricity and natural gas; to fund public purpose, demand response, and customer energy efficiency programs; and to recover certain capital expenditures. Generally, the balancing account revenue recognition criteria are met at the time the costs are incurred. The Utility's revenues and... -

Page 68

..., PG&E Corporation files a combined state income tax return in California. PG&E Corporation and the Utility are parties to a tax-sharing agreement under which the Utility determines its income tax provision (benefit) on a stand-alone basis. NUCLEAR DECOMMISSIONING TRUSTS The Utility classifies its... -

Page 69

... use in pricing the assets or liabilities. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, or the "exit price." PG&E Corporation and the Utility utilize a fair... -

Page 70

... volume or the level of activity for an asset or a liability has significantly decreased or when transactions are not orderly when compared with normal market conditions. In particular, this FSP calls for adjustments to quoted prices or historical transaction data when estimating fair value in such... -

Page 71

...: (in millions) Balance at December 31, 2009 2008 Pension benefits Energy recovery bonds Deferred income tax Utility retained generation Environmental compliance costs Price risk management Unamortized loss, net of gain, on reacquired debt Other Total long-term regulatory assets $1,386 1,124... -

Page 72

... Public purpose programs Recoveries in excess of ARO Other Total long-term regulatory liabilities $2,933 508 488 196 $4,125 $2,735 442 226 254 $3,657 The regulatory liability for the Utility's cost of removal obligations represents differences between amounts collected in rates for asset... -

Page 73

... the difference between electric transmission wheeling 69 (in millions) Utility generation Distribution revenue adjustment mechanism Energy procurement costs Gas fixed cost Transmission revenue Public purpose programs Energy recovery bonds Other Total regulatory balancing accounts, net $ 355 152... -

Page 74

... and refunds to customers plus interest. The public purpose programs balancing accounts primarily track the recovery of the authorized public purpose program revenue requirement and the actual cost of such programs. The public purpose programs primarily consist of the energy efficiency programs; low... -

Page 75

... be remarketed in a fixed or variable rate mode. (4) At December 31, 2009, interest rates on these bonds and the related loans ranged from 0.18% to 0.24%. (5) Each series of these bonds is supported by a separate direct-pay letter of credit that expires on October 29, 2011. The Utility may choose to... -

Page 76

...on separate direct-pay letters of credit for each series issued by a financial institution. All of the pollution control bonds were used to finance or refinance pollution control facilities at the Geysers geothermal power plant or at the Utility's Diablo Canyon nuclear power plant and were issued as... -

Page 77

...term borrowings and outstanding credit facilities at December 31, 2009: (in millions) Authorized Borrower Facility Termination Date Facility Limit Letters of Credit Outstanding Cash Borrowings At December 31, 2009 Commercial Paper Backup Availability PG&E Corporation Utility Total credit facilities... -

Page 78

... certain conditions are met. The fees and interest rates that PG&E Corporation pays under the revolving credit facility vary depending on the Utility's unsecured debt ratings issued by Standard & Poor's ("S&P") ratings service and Moody's Investors Service ("Moody's"). The revolving credit facility... -

Page 79

... 31, 2009, 670,552 shares were granted as restricted stock as share-based compensation awarded under the PG&E Corporation Long-Term Incentive Program and the 2006 Long-Term Incentive Plan ("2006 LTIP"), and 6,773,290 shares were issued upon the exercise of employee stock options, for the account of... -

Page 80

... $1.50 per share. The Utility's redeemable preferred stock is subject to redemption at the Utility's option, in whole or in part, if the Utility pays the specified redemption price plus accumulated and unpaid dividends through the redemption date. At December 31, 2009, annual dividends on redeemable... -

Page 81

... securities. All of the participating securities participate in dividends on a 1:1 basis with shares of common stock. The following is a reconciliation of PG&E Corporation's income available for common shareholders and weighted average shares of common stock outstanding for calculating basic EPS... -

Page 82

... $ 3.20 Stock options to purchase 7,285 shares of PG&E Corporation common stock were excluded from the computation of diluted EPS for the 12 months ended December 31, 2009 because the exercise prices of these options were greater than the average market price of PG&E Corporation common stock during... -

Page 83

... 2.78 Stock options to purchase 11,935, and 7,285 shares of PG&E Corporation common stock were excluded from the computation of diluted EPS for the 12 months ended December 31, 2008 and 2007, respectively, because the exercise prices of these options were greater than the average market price of PG... -

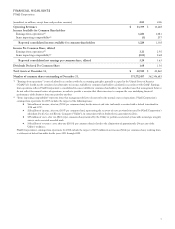

Page 84

... follows: PG&E Corporation Year Ended December 31, 2009 2008 2007 2009 2008 Utility 2007 Federal statutory income tax rate Increase (decrease) in income tax rate resulting from: State income tax (net of federal benefit) Effect of regulatory treatment of fixed asset differences Tax credits, net IRS... -

Page 85

.... In September 2009, the IRS released standards related to the treatment of indirect service costs for the 2005-2007 audit period, enabling PG&E Corporation to recognize a net tax benefit of $17 million. PG&E Corporation also participates in the Compliance Assurance Process ("CAP"), a real-time IRS... -

Page 86

...the purchase and sale of electricity and natural gas. The Utility uses both derivative and non-derivative contracts in managing its customers' exposure to commodity-related price risk, including: • forward contracts that commit the Utility to purchase a commodity in the future; • swap agreements... -

Page 87

... of new energy efficiency and demand response programs, direct access, and community choice aggregation; • the acquisition, retirement, or closure of generation facilities; and • changes in market prices that make it more economical to purchase power in the market rather than use the Utility... -

Page 88

... instruments and are recorded at fair value within the Consolidated Balance Sheets. The Utility manages natural gas price risk associated with its electric procurement portfolio in accordance with its risk management strategies included in electricity procurement plans approved by the CPUC. The... -

Page 89

... in customers' rates. Therefore, changes in the fair value of these instruments are recorded in PG&E Corporation's Consolidated Statements of Income. For the 12-month period ended December 31, 2009, the gains and losses recorded on PG&E Corporation's and the Utility's derivative instruments... -

Page 90

... issues Municipal bonds and other Total nuclear decommissioning trusts(1) Rabbi trusts-equity securities Long-term disability trust Equity securities Corporate debt securities Total long-term disability trust Total assets Liabilities: Dividend participation rights Price risk management instruments... -

Page 91

...Utility Fair Value Measurements at December 31, 2009 Level 1 Level 2 Level 3 Total (in millions) Assets: Nuclear decommissioning trusts Equity securities U.S. government and agency issues Municipal bonds and other Total nuclear decommissioning trusts(1) Long-term disability trust Equity securities... -

Page 92

...in PG&E Corporation's Consolidated Balance Sheets. TRUST ASSETS The nuclear decommissioning trusts, the rabbi trusts related to the non-qualified deferred compensation plans, and the long-term disability trust hold primarily equities, debt securities, mutual funds, and life insurance policies. These... -

Page 93

... (exchange-traded and OTC) are valued using the Black's Option Pricing Model and classified as Level 3 measurements primarily due to volatility inputs. The Utility holds CRRs to hedge financial risk of CAISO-imposed congestion charges in the day-ahead markets. The Utility's demand response contracts... -

Page 94

...PG&E Corporation Only Nuclear Decommissioning Trusts Equity Securities(1) PG&E Corporation and the Utility LongLongTerm Term Disability Disability Corp. Equity Debt Securities Securities Other Total (in millions) Money Market Dividend Participation Rights Price Risk Management Instruments Asset... -

Page 95

... used exclusively for decommissioning and dismantling the Utility's nuclear facilities. The trusts maintain substantially all of their investments in debt and equity securities. The CPUC has authorized the qualified and non-qualified trusts to invest a maximum of 60% of its funds in publicly traded... -

Page 96

...the fair value of the available-for-sale investments held in the Utility's nuclear decommissioning trusts: Amortized Cost Total Unrealized Gains Total Unrealized Losses Estimated(1) Fair Value (in millions) As of December 31, 2009 Equity securities U.S. government and agency issues Municipal bonds... -

Page 97

... dependents, and non-contributory postretirement life insurance plans for eligible employees and retirees (referred to collectively as "other benefits"). PG&E Corporation and the Utility have elected that certain of the trusts underlying these plans be treated under the Code as qualified trusts... -

Page 98

... tables reconcile aggregate changes in plan assets during 2009 and 2008: Pension Benefits (in millions) PG&E Corporation 2009 2008 Utility 2009 2008 Fair value of plan assets at January 1 Actual return on plan assets Company contributions Benefits and expenses paid Fair value of plan assets at... -

Page 99

... BENEFIT COST Net periodic benefit cost as reflected in PG&E Corporation's Consolidated Statements of Income for 2009, 2008, and 2007 is as follows: Pension Benefits (in millions) 2009 December 31, 2008 2007 Service cost for benefits earned Interest cost Expected return on plan assets Amortization... -

Page 100

... income for PG&E Corporation and the Utility. The estimated amounts that will be amortized into net periodic benefit cost in 2010 are as follows: (in millions) PG&E Corporation Utility Pension benefits: Unrecognized prior service cost Unrecognized net loss Total Other benefits: Unrecognized... -

Page 101

... POLICIES AND STRATEGIES of return on plan assets. Fixed income returns were The financial position of PG&E Corporation's and the projected based on real maturity and credit spreads added Utility's funded employee benefit plans is driven by the to a long-term inflation rate. Equity returns were... -

Page 102

...income portfolio market values, interest rate changes also influence liability valuations as discount rates move with current bond yields. To manage this risk, PG&E Corporation's and the Utility's trusts hold significant allocations to fixed income investments that include U.S. government securities... -

Page 103

... portfolios of hedge funds that are valued based on a variety of proprietary and non-proprietary valuation methods, including unadjusted prices for publicly-traded securities in active markets. Hedge funds are considered Level 3 assets. The Fixed Income category includes U.S. government securities... -

Page 104

... been classified as Level 3 in the fair value hierarchy: Absolute Return Corporate Fixed Income Other Fixed Income (in millions) Total Pension Benefits: Balance as of December 31, 2008 Actual return on plan assets: Relating to assets still held at the reporting date Relating to assets sold during... -

Page 105

...continue to be governed by the terms and conditions of the PG&E Corporation Long-Term Incentive Program. (in millions) Year ended December 31, 2008 PG&E Corporation Utility Stock Options Restricted Stock Performance Shares Total Compensation Expense (pre-tax) Total Compensation Expense (after-tax... -

Page 106

... in 2009; however, certain non-employee directors of PG&E Corporation were awarded stock options. The following table summarizes stock option activity for the Utility for 2009: Weighted Average Remaining Contractual Term Options Shares Weighted Average Exercise Price Aggregate Intrinsic Value... -

Page 107

... stock activity for the Utility for 2009: Number of Shares of Restricted Stock Weighted Average Grant-Date Fair Value Nonvested at January 1(1) Granted Vested Forfeited Nonvested at December 31 944,798 - (460,137) (10,640) 474,021 $40.20 - $37.91 $37.47 $47.27 (1) Includes net employee transfers... -

Page 108

...&E Corporation, of which $42 million related to Utility employees. The number of performance shares that were outstanding at December 31, 2009 was 1,547,113, of which 1,139,970 was related to Utility employees. Outstanding performance shares are classified as a liability on the Consolidated Balance... -

Page 109

...CPUC required California investor-owned electric utilities to enter into long-term power purchase agreements with QFs and approved the applicable terms and conditions, prices, and eligibility requirements. These agreements require the Utility to pay for energy and capacity. Energy payments are based... -

Page 110

... of electricity from small hydro plants are counted towards the Utility's renewable portfolio standard ("RPS") goal. Renewable Energy Contracts - California law requires retail Utility's CPUC-approved long-term procurement plans, the Utility has entered into several power purchase agreements with... -

Page 111

...Canada and the United States to serve its core customers. The contract lengths and natural gas sources of the Utility's portfolio of natural gas procurement contracts can fluctuate based on market conditions. The Utility also contracts for natural gas transportation to transport natural gas from the... -

Page 112

... through 2014, while contracts for fuel fabrication services provide for 100% coverage of reactor requirements through 2011. The Utility relies on a number of international producers of nuclear fuel in order to diversify its sources and provide security of supply. Pricing terms are also diversified... -

Page 113

... from the DOE will be credited to customers. Nuclear Insurance The Utility has several types of nuclear insurance for the two nuclear operating units at Diablo Canyon and for its retired nuclear generation facility at Humboldt Bay Unit 3. The Utility has insurance coverage for property damages and... -

Page 114

... Utility's natural gas compressor site located in Topock, Arizona, near the California border; • $86 million related to remediation at divested generation facilities; • $113 million related to remediation costs for the Utility's generation and other facilities and for third-party disposal sites... -

Page 115

...Hinkley natural gas compressor site is not recoverable under this mechanism.) In addition, the CPUC and the FERC have authorized the Utility to recover in rates approximately $130 million relating to remediation costs at fossil decommissioning sites and certain of the Utility's transmission stations... -

Page 116

...earnings per common share, diluted Common stock price per share: High Low Utility Operating revenues Operating income Net income Income available for common shareholders 2008 PG&E Corporation Operating revenues Operating income Income from continuing operations Net income Income available for common... -

Page 117

... Utility's related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2009. As stated in their report, which is included in this annual report, Deloitte & Touche LLP also has audited PG&E Corporation's and the Utility... -

Page 118

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of PG&E Corporation and Pacific Gas and Electric Company San Francisco, California We have audited the accompanying consolidated balance sheets of PG&E Corporation and subsidiaries (the "Company") and... -

Page 119

...Pacific Gas and Electric Company and subsidiaries as of December 31, 2009 and 2008, and the respective results of their operations and their cash flows for each of the three years in the period ended December 31, 2009, in conformity with accounting principles generally accepted in the United States... -

Page 120

BOARDS OF DIRECTORS OF PG&E CORPORATION AND PACIFIC GAS AND ELECTRIC COMPANY David R. Andrews Senior Vice President, Government Affairs, General Counsel, and Secretary, Retired, PepsiCo, Inc. Lewis Chew Senior Vice President, Finance and Chief Financial Officer, National Semiconductor Corporation C.... -

Page 121

..., Power Generation Vice President and Chief Risk and Audit Officer GABRIEL B. TOGNERI Senior Vice President, Energy Procurement GEISHA J. WILLIAMS STEVEN E. MALNIGHT Vice President, Renewable Energy PLACIDO J. MARTINEZ Vice President, Investor Relations Senior Vice President, Energy Delivery... -

Page 122

... stock exchange. Issue Newspaper Symbol(1) First Preferred Cumulative, Par Value $25 Per Share manner. They simply know that a broker holds a number of shares that may be held for any number of investors. If you hold your stock in a street name account, you receive all tax forms, publications... -

Page 123

..., free of charge, of PG&E Corporation's and Pacific Gas and Electric Company's joint Annual Report on Form 10-K for the year ended December 31, 2009, which has been filed with the Securities and Exchange Commission, please contact the Corporate Secretary's Office or visit our website at www.pgecorp... -

Page 124

Cert no. SCS-COC-000648