Motorola 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

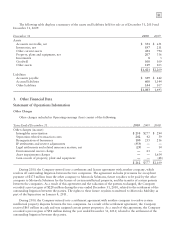

90

Counterparty Risk

The use of derivative financial instruments exposes the Company to counterparty credit risk in the event of

nonperformance by counterparties. However, the Company’s risk is limited to the fair value of the instruments

when the derivative is in an asset position. The Company actively monitors its exposure to credit risk. At present

time, all of the counterparties have investment grade credit ratings. The Company is not exposed to material credit

risk with any single counterparty. As of December 31, 2010, the Company was exposed to an aggregate credit risk

of approximately $1 million with all counterparties.

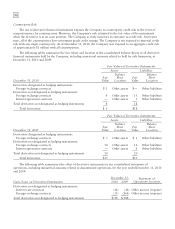

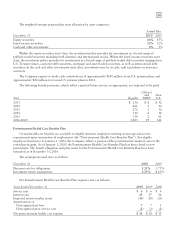

The following tables summarize the fair values and location in the consolidated balance sheets of all derivative

financial instruments held by the Company, including immaterial amounts related to held for sale businesses, at

December 31, 2010 and 2009:

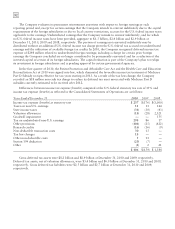

Fair Values of Derivative Instruments

Assets Liabilities

December 31, 2010

Fair

Value

Balance

Sheet

Location

Fair

Value

Balance

Sheet

Location

Derivatives designated as hedging instruments:

Foreign exchange contracts $ 1 Other assets $— Other liabilities

Derivatives not designated as hedging instruments:

Foreign exchange contracts 4 Other assets 15 Other liabilities

Interest agreement contracts — Other assets 3 Other liabilities

Total derivatives not designated as hedging instruments 4 18

Total derivatives $ 5 $18

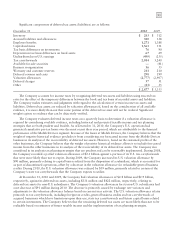

Fair Values of Derivative Instruments

Assets Liabilities

December 31, 2009

Fair

Value

Balance

Sheet

Location

Fair

Value

Balance

Sheet

Location

Derivatives designated as hedging instruments:

Foreign exchange contracts $ 5 Other assets $ 1 Other liabilities

Derivatives not designated as hedging instruments:

Foreign exchange contracts 10 Other assets 16 Other liabilities

Interest agreement contracts — Other assets 4 Other liabilities

Total derivatives not designated as hedging instruments 10 20

Total derivatives $15 $21

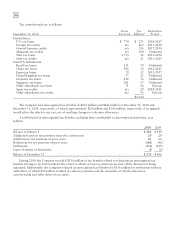

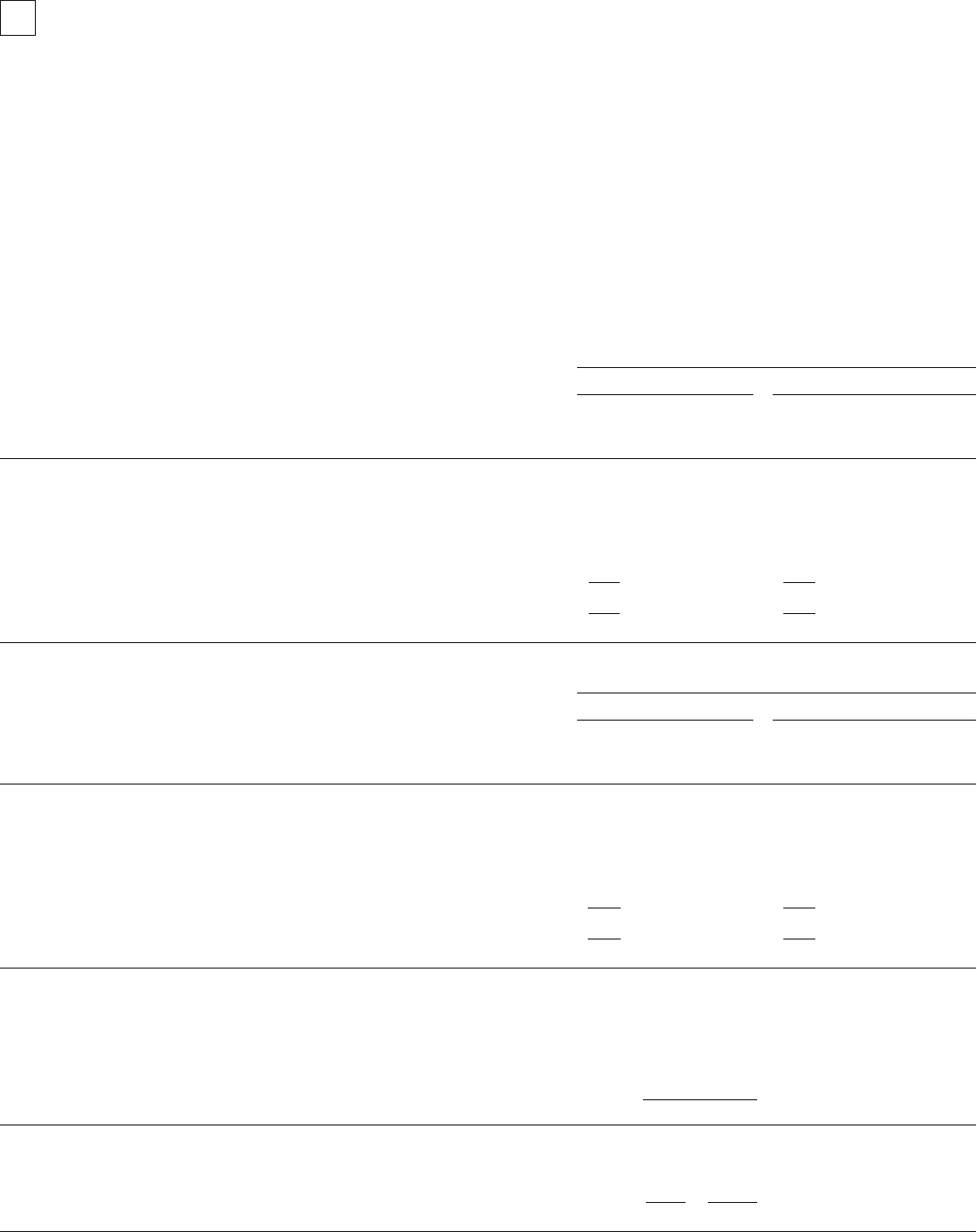

The following table summarizes the effect of derivative instruments in our consolidated statements of

operations, including immaterial amounts related to discontinued operations, for the year ended December 31, 2010

and 2009:

December 31, Statement of

Operations Location

Gain (Loss) on Derivative Instruments 2010 2009

Derivatives not designated as hedging instruments:

Interest rate contracts (16) (16) Other income (expense)

Foreign exchange contracts (33) (166) Other income (expense)

Total derivatives not designated as hedging instruments $(49) $(182)