Motorola 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

revenue reflects the allocation of revenue to the multiple-elements using a relative selling price method with revenue

being ascribed to the post-contract customer support based on ESP.

Finally, there is a difference in the as reported revenue as compared to the pro forma basis revenue due to the

Company’s no longer using the residual method for allocating revenue to the delivered products in a multiple-

element arrangement when VSOE exists for the undelivered element but not the delivered element. This situation is

most prevalent for networks/system solutions that were sold with additional deliverables that are not in the scope of

contract accounting. Under the prior accounting guidance for revenue recognition, the Company would ascribe the

residual value to the contract accounting deliverable only when VSOE for the undelivered services or other products

in the arrangement could be determined.

Based on the Company’s current sales strategies, the newly adopted accounting guidance for revenue

recognition is not expected to have a significant effect on the timing and pattern of revenue recognition for sales in

periods after the initial adoption when applied to multiple-element arrangements, except for the continued impact

on smartphone revenue recognition. However, the Company expects that this new accounting guidance will

facilitate the Company’s efforts to optimize its product and service offerings due to better alignment of the

economics of an arrangement and the related accounting treatment. This may lead to the Company’s engaging in

new sales practices in the future. As these go-to-market strategies evolve, the Company may modify its pricing

practices in the future, which could result in changes in selling prices, including both VSOE and ESP. As a result, the

Company’s future revenue recognition for multiple-element arrangements could differ materially from the results

reported in the current period. The Company is currently unable to determine the impact that the newly adopted

accounting guidance for revenue recognition could have on its reported revenue as these go-to-market strategies

evolve.

Changes in costs estimates and the fair values of certain deliverables could negatively impact the Company’s

operating results. In addition, unforeseen conditions could arise over the contract term that may have a significant

impact on operating results.

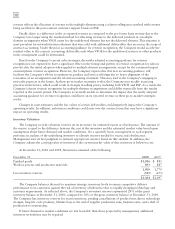

Inventory Valuation

The Company records valuation reserves on its inventory for estimated excess or obsolescence. The amount of

the reserve is equal to the difference between the cost of the inventory and the estimated market value based upon

assumptions about future demand and market conditions. On a quarterly basis, management in each segment

performs an analysis of the underlying inventory to identify reserves needed for excess and obsolescence.

Management uses its best judgment to estimate appropriate reserves based on this analysis. In addition, the

Company adjusts the carrying value of inventory if the current market value of that inventory is below its cost.

At December 31, 2010 and 2009, Inventories consisted of the following:

December 31 2010 2009

Finished goods $1,016 $ 883

Work-in-process and production materials 893 887

1,909 1,770

Less inventory reserves (545) (673)

$1,364 $1,097

The Company balances the need to maintain strategic inventory levels to ensure competitive delivery

performance to its customers against the risk of inventory obsolescence due to rapidly changing technology and

customer requirements. As reflected above, the Company’s inventory reserves represented 29% of the gross

inventory balance at December 31, 2010, compared to 38% of the gross inventory balance at December 31, 2009.

The Company has inventory reserves for excess inventory, pending cancellations of product lines due to technology

changes, long-life cycle products, lifetime buys at the end of supplier production runs, business exits, and a shift of

production to outsourcing.

If future demand or market conditions are less favorable than those projected by management, additional

inventory writedowns may be required.