Motorola 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

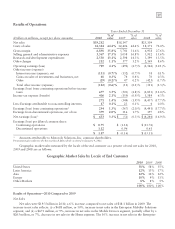

The following table displays the net charges incurred by business segment:

Year Ended December 31, 2010 2009 2008

Enterprise Mobility Solutions $68 $66 $21

Mobile Devices 34 184 25

Home 29 18 216

131 268 262

Corporate 730 38

$138 $298 $300

Cash payments for exit costs and employee separations in connection with these reorganization plans were

$153 million in 2010, as compared to $393 million in 2009. The $100 million reorganization of businesses accrual

at December 31, 2010, includes: (i) $65 million relating to employee separation costs that are expected to be paid in

2011, and (ii) $35 million relating to lease termination obligations that are expected to be paid over a number of

years.

Liquidity and Capital Resources

The Company increased the aggregate of our: (i) cash and cash equivalents balances, (ii) Sigma Fund and short-

term investments, and (iii) long-term Sigma Fund, by $904 million from $8.0 billion as of December 31, 2009 to

$8.9 billion as of December 31, 2010. Conversely, the Company decreased the aggregate of our: (i) notes payable

and the current portion of long-term debt, and (ii) long-term debt, by approximately $1.1 billion from $3.9 billion

as of December 31, 2009 to $2.8 billion as of December 31, 2010.

As highlighted in the consolidated statements of cash flows, the Company’s liquidity and available capital

resources are impacted by four key components: (i) cash and cash equivalents, (ii) operating activities, (iii) investing

activities, and (iv) financing activities.

Cash and Cash Equivalents

At December 31, 2010, the Company’s cash and cash equivalents (which are highly-liquid investments with an

original maturity of three months or less) were $4.2 billion, an increase of $1.3 billion compared to $2.9 billion at

December 31, 2009. At December 31, 2010, $1.2 billion of this amount was held in the U.S. and $3.0 billion was

held by the Company or its subsidiaries in other countries. At December 31, 2010, restricted cash was $226 million

(including $166 million held outside the U.S.), compared to $206 million (including $143 million held outside the

U.S.) at December 31, 2009.

The Company continues to analyze and review various repatriation strategies to continue to efficiently

repatriate funds. In 2010, the Company repatriated approximately $1.1 billion in funds to the U.S. from

international jurisdictions with minimal cash tax cost. The Company has approximately $3.3 billion of earnings in

foreign subsidiaries that are not permanently reinvested and may be repatriated without additional U.S. federal

income tax charges to the Company’s consolidated statements of operations, given the U.S. Federal tax provisions

accrued on undistributed earnings and the utilization of available foreign tax credits. On a cash basis, these

repatriations from the Company’s non-U.S. subsidiaries could require the payment of additional foreign taxes.

Repatriation of some of these funds could be subject to delay for local country approvals and could have potential

adverse tax consequences.

On January 4, 2011, the separation of Motorola Mobility from Motorola Solutions was completed. As part of

the Separation, the Company contributed $3.2 billion of cash and cash equivalents to Motorola Mobility and has an

obligation to fund an additional $300 million, upon receipt of cash distributions as a result of future capital

reductions of an overseas subsidiary.