Motorola 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

As a result of the Company’s separation into two independent, publicly traded companies, during the three

months ended December 31, 2010, the Company recognized a curtailment gain in one of its Non-U.S. plans,

resulting in the recognition of a gain in the Company’s consolidated statement of operations of $4 million. During

the same period, as a result of legislative changes that were finalized in December 2010, the Company changed the

index used to estimate cost of living increases. As a result, the Company recorded a $55 million gain in

Accumulated other comprehensive loss, net of tax. No gain or loss was recognized in the Company’s consolidated

statement of operations as a result of the amendment.

Certain actuarial assumptions such as the discount rate and the long-term rate of return on plan assets have a

significant effect on the amounts reported for net periodic cost and benefit obligation. The assumed discount rates

reflect the prevailing market rates of a universe of high-quality, non-callable, corporate bonds currently available

that, if the obligation were settled at the measurement date, would provide the necessary future cash flows to pay

the benefit obligation when due. The long-term rates of return on plan assets represents an estimate of long-term

returns on an investment portfolio consisting of a mixture of equities, fixed income, cash and other investments

similar to the actual investment mix. In determining the long-term return on plan assets, the Company considers

long-term rates of return on the asset classes (both historical and forecasted) in which the Company expects the plan

funds to be invested.

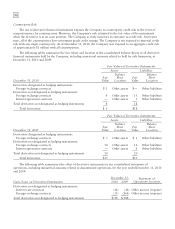

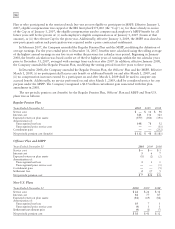

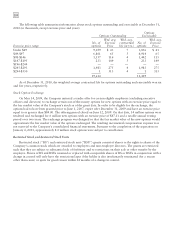

Weighted average actuarial assumptions used to determine costs for the plans were as follows:

2010 2009

December 31 U.S. Non U.S. U.S. Non U.S.

Discount rate 6.00% 5.39% 6.75% 6.23%

Investment return assumption (Regular Plan) 8.25% 6.86% 8.25% 6.86%

Investment return assumption (Officers’ Plan) 6.00% N/A 6.00% N/A

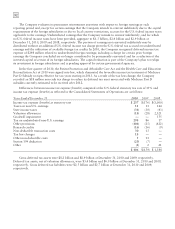

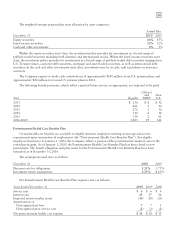

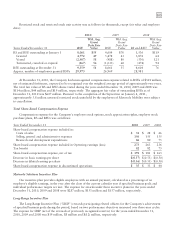

Weighted average actuarial assumptions used to determine benefit obligations for the plans were as follows:

2010 2009

December 31 U.S. Non U.S. U.S. Non U.S.

Discount rate 5.75% 5.07% 6.00% 5.46%

Future compensation increase rate (Regular Plan) 0.00% 2.61% 0.00% 4.28%

Future compensation increase rate (Officers’ Plan) 0.00% N/A 0.00% N/A

The accumulated benefit obligations for the plans were as follows:

2010 2009

December 31 Regular

Officers’

and

MSPP Non

U.S. Regular

Officers’

and

MSPP

Non

U.S.

Accumulated benefit obligation $6,129 $44 $1,482 $5,821 $52 $1,527

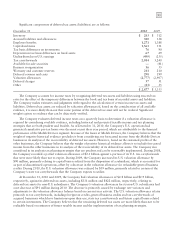

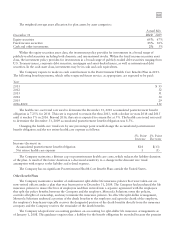

The Company has adopted a pension investment policy designed to meet or exceed the expected rate of return

on plan assets assumption. To achieve this, the pension plans retain professional investment managers that invest

plan assets in equity and fixed income securities and cash. In addition, some plans invest in insurance contracts. The

Company’s measurement date of its plan assets and obligations is December 31. The Company has the following

target mixes for these asset classes, which are readjusted periodically, when an asset class weighting deviates from

the target mix, with the goal of achieving the required return at a reasonable risk level:

Target Mix

Asset Category 2010 2009

Equity securities 63% 63%

Fixed income securities 35% 35%

Cash and other investments 2% 2%