Motorola 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

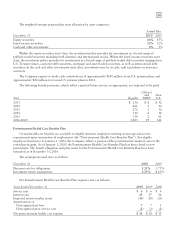

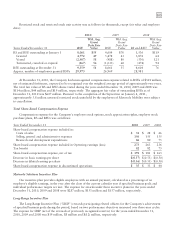

Non-U.S. Plans

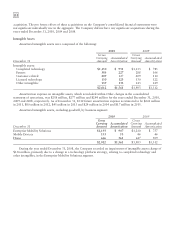

December 31, 2010 Level 1 Level 2 Level 3 Total

Common stock and equivalents $339 $ — $— $ 339

Commingled equity funds — 389 — 389

Corporate bonds — 98 — 98

Government and agency obligations — 91 — 91

Commingled bond funds — 236 — 236

Short-term investment funds — 1 — 1

Insurance contracts — — 61 61

Total investment securities $339 $815 $61 $1,215

Cash 8

Accrued income receivable 3

Fair value plan assets $1,226

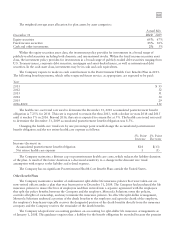

The following table summarizes the changes in fair value of the Non-U.S. pension plan assets measured using

Level 3 inputs:

2010

Balance at January 1 $65

Gain on assets held 1

Foreign exchange valuation adjustment (5)

Balance at December 31 $61

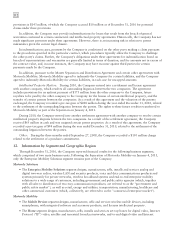

Postretirement Health Care Benefits Plan

December 31, 2010 Level 1 Level 2 Level 3 Total

Common stock and equivalents $48 $ — $— $ 48

Commingled equity funds — 62 — 62

U.S. government and agency obligations — 4 — 4

Corporate bonds — 7 — 7

Mortgage-backed bonds — 8 — 8

Asset-backed bonds — 2 — 2

Commingled bond funds — 34 — 34

Commingled short-term investment funds — 4 — 4

Invested cash — 1 — 1

Fair value plan assets $48 $122 — $170

The table above includes securities on loan as part of a securities lending arrangement of $4 million of common

stock and equivalents, $2 million of U.S. government and agency obligations and $1 million of corporate bonds. All

securities on loan are fully cash collateralized.

Valuation Methodologies

Level 1—Quoted market prices in active markets are available for investments in common and preferred stock

and common stock equivalents. As such, these investments are classified within Level 1.

Level 2—The securities classified as Level 2 are comprised primarily of corporate, government, agency and

government-sponsored enterprise bonds. The Company primarily relies on valuation pricing models, recent bid

prices, and broker quotes to determine the fair value of these securities. The valuation models for Level 2 assets are

developed and maintained by third party pricing services and use a number of standard inputs to the valuation

model including benchmark yields, reported trades, broker/dealer quotes where the party is standing ready and able

to transact, issuer spreads, benchmark securities, bids, offers and other reference data. The valuation model may

prioritize these inputs differently at each balance sheet date for any given security, based on the market conditions.