Motorola 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

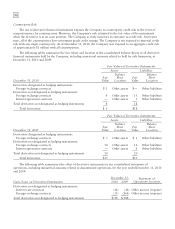

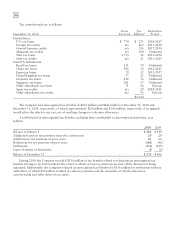

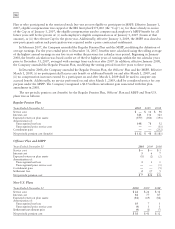

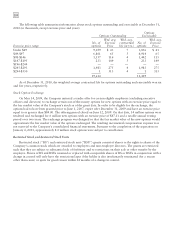

The funded status of the plan is as follows:

2010 2009

Change in benefit obligation:

Benefit obligation at January 1 $ 461 $ 429

Service cost 66

Interest cost 23 27

Actuarial (gain) loss (17) 32

Benefit payments (26) (33)

Benefit obligation at December 31 447 461

Change in plan assets:

Fair value at January 1 174 168

Return on plan assets 20 35

Company contributions ——

Benefit payments made with plan assets (24) (29)

Fair value at December 31 170 174

Funded status of the plan (277) (287)

Unrecognized net loss 204 231

Unrecognized prior service cost (1) (3)

Accrued postretirement health care cost $ (74) $ (59)

Components of accrued postretirement health care cost:

Years Ended December 31 2010 2009

Non-current liability $(277) $(287)

Tax impact of Medicare Part D subsidy law change 18 —

Deferred income taxes 72 101

Accumulated other comprehensive income 113 127

Accrued postretirement health care cost $ (74) $ (59)

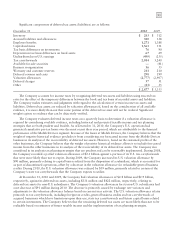

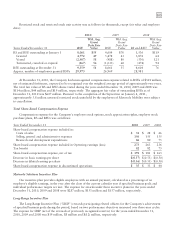

During the first quarter of 2010, the Patient Protection and Affordable Care Act and the Health Care and

Education Reconciliation Act of 2010 were signed into law, which eliminated the favorable income tax treatment of

Medicare Part D Subsidy receipts effective for tax years starting in 2013. As a result of the tax law change, the

Company recorded an $18 million non-cash tax charge to reduce its deferred tax asset associated with Medicare

Part D subsidies currently estimated to be received after 2012.

It is estimated that the net periodic cost for the Postretirement Health Care Benefits Plan in 2011 will include

amortization of the unrecognized net loss and prior service costs, currently included in Accumulated other

comprehensive loss, of $11 million.

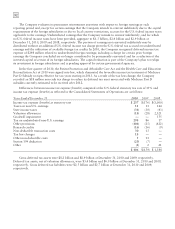

The Company has adopted an investment policy for plan assets designed to meet or exceed the expected rate of

return on plan assets assumption. To achieve this, the plan retains professional investment managers that invest plan

assets in equity and fixed income securities and cash. The Company uses long-term historical actual return

experience with consideration of the expected investment mix of the plans’ assets, as well as future estimates of

long-term investment returns, to develop its expected rate of return assumption used in calculating the net periodic

cost and the net retirement healthcare expense. The Company has the following target mixes for these asset classes,

which are readjusted at least periodically, when an asset class weighting deviates from the target mix, with the goal

of achieving the required return at a reasonable risk level:

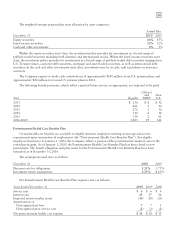

Target Mix

Asset Category 2010 2009

Equity securities 65% 65%

Fixed income securities 34% 34%

Cash and other investments 1% 1%