Motorola 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

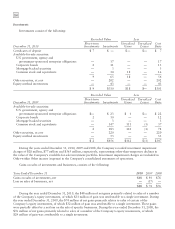

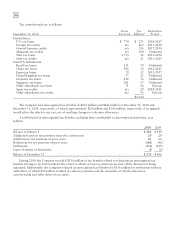

July 3, 2010. The $500 million of long-term debt repurchased included principal amounts of: (i) $65 million of the

$379 million then outstanding of the 6.50% Debentures due 2025 (the “2025 Debentures”), (ii) $75 million of the

$286 million then outstanding of the 6.50% Debentures due 2028 (the “2028 Debentures”), (iii) $222 million of the

$446 million then outstanding of the 6.625% Senior Notes due 2037 (the “2037 Senior Notes”), and

(iv) $138 million of the $252 million then outstanding of the 5.22% Debentures due 2097. After accelerating the

amortization of debt issuance costs and debt discounts, the Company recognized a loss of approximately $12 million

related to this debt tender in Other within Other income (expense) in the consolidated statements of operations.

During the year ended December 31, 2009, the Company repurchased $199 million of its outstanding long-

term debt for an aggregate purchase price of $133 million, including $4 million of accrued interest, all of which

occurred during the three months ended April 4, 2009. The $199 million of long-term debt repurchased included

principal amounts of: (i) $11 million of the $358 million then outstanding of the 7.50% Debentures due 2025,

(ii) $20 million of the $399 million then outstanding 2025 Debentures, (iii) $14 million of the $299 million then

outstanding 2028 Debentures, and (iv) $154 million of the $600 million then outstanding 2037 Senior Notes. The

Company recognized a gain of approximately $67 million related to these open market purchases in Other within

Other income (expense) in the consolidated statements of operations.

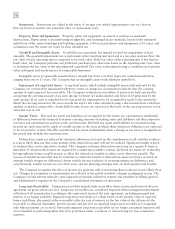

Aggregate requirements for long-term debt maturities during the next five years are as follows: 2011—

$605 million; 2012—$405 million; 2013—$5 million; 2014—$4 million; and 2015—$4 million.

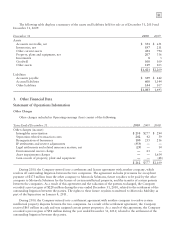

Credit Facilities

The Company had a domestic syndicated revolving credit facility (as amended from time to time, the “Credit

Facility”), scheduled to mature in December 2011. The size of the Credit Facility was the lesser of: (1) $1.5 billion,

or (2) an amount determined based on eligible domestic accounts receivable and inventory. If the Company elected

to borrow under the Credit Facility, only then and not before, it would be required to pledge its domestic accounts

receivables and, at its option, domestic inventory. The Credit Facility did not require the Company to meet any

financial covenants unless remaining availability under the Credit Facility was less than $225 million. As of and

during the year ended December 31, 2010, there were no outstanding borrowings under this Credit Facility.

At December 31, 2010, the commitment fee assessed against the daily average unused amount was 75 basis

points.

On January 4, 2011, the Company terminated the Credit Facility and entered into a new $1.5 billion unsecured

syndicated revolving credit facility (the “2011 Motorola Solutions Credit Agreement”) that is scheduled to expire on

June 30, 2014. The 2011 Motorola Solutions Credit Agreement includes a provision pursuant to which the

Company can increase the aggregate credit facility size up to a maximum of $2.0 billion by adding lenders or having

existing lenders increase their commitments. The Company must comply with certain customary covenants,

including maintaining maximum leverage and minimum interest coverage ratios as defined in the 2011 Motorola

Solutions Credit Agreement. The Company has no outstanding borrowings under the 2011 Motorola Solutions

Credit Agreement.

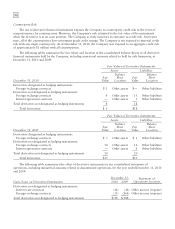

5. Risk Management

Derivative Financial Instruments

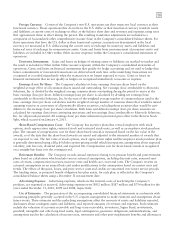

Foreign Currency Risk

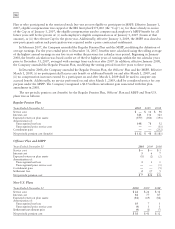

The Company uses financial instruments to reduce its overall exposure to the effects of currency fluctuations on

cash flows. The Company’s policy prohibits speculation in financial instruments for profit on exchange rate price

fluctuations, trading in currencies for which there are no underlying exposures, or entering into transactions for any

currency to intentionally increase the underlying exposure. Instruments that are designated as part of a hedging

relationship must be effective at reducing the risk associated with the exposure being hedged and are designated as

part of a hedging relationship at the inception of the contract. Accordingly, changes in the market values of hedge

instruments must be highly correlated with changes in market values of the underlying hedged items both at the

inception of the hedge and over the life of the hedge contract.

The Company’s strategy related to foreign exchange exposure management is to offset the gains or losses on the

financial instruments against losses or gains on the underlying operational cash flows or investments based on the

operating business units’ assessment of risk. The Company enters into derivative contracts for some of the