Motorola 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

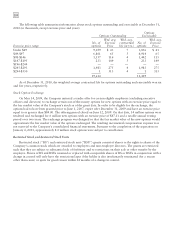

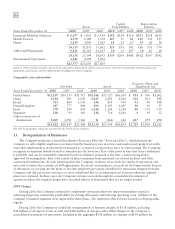

114

Assets

Capital

Expenditures

Depreciation

Expense

Years Ended December 31 2010 2009 2008 2010 2009 2008 2010 2009 2008

Enterprise Mobility Solutions $ 6,297 $ 5,801 $ 6,114 $182 $124 $150 $143 $158 $159

Mobile Devices 4,179 2,589 3,559 125 35 84 119 131 157

Home 3,839 3,441 3,929 18 32 67 54 62 58

14,315 11,831 13,602 325 191 301 316 351 374

Other and Eliminations 9,841 11,563 11,253 10 13 107 (4) 16 18

24,156 23,394 24,855 $335 $204 $408 $312 $367 $392

Discontinued Operations 1,421 2,209 3,014

$25,577 $25,603 $27,869

Assets in Other include primarily cash and cash equivalents, Sigma Fund, deferred income taxes, short-term investments, property, plant and

equipment, investments, and the administrative headquarters of the Company.

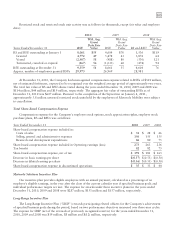

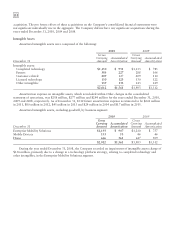

Geographic area information

Net Sales Assets

Property, Plant, and

Equipment, net

Years Ended December 31 2010 2009 2008 2010 2009 2008 2010 2009 2008

United States $11,107 $10,513 $13,715 $18,386 $17,327 $16,619 $ 915 $ 856 $1,002

China 1,128 905 1,250 2,465 2,295 2,803 212 161 198

Brazil 913 849 1,550 836 855 993 91 98 108

United Kingdom 687 577 909 896 1,143 1,047 30 34 35

Israel 270 299 443 1,344 1,324 1,269 40 172 139

Singapore 108 93 116 218 716 1,862 419 32

Other nations, net of

eliminations 5,069 4,911 7,126 11 (266) 262 437 479 498

$19,282 $18,147 $25,109 $24,156 $23,394 $24,855 $1,729 $1,819 $2,012

Net sales by geographic region are measured by the locale of end customer.

13. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the “Severance Plan”), which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in the

event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. The Company

recognizes termination benefits based on formulas per the Severance Plan at the point in time that future settlement

is probable and can be reasonably estimated based on estimates prepared at the time a restructuring plan is

approved by management. Exit costs consist of future minimum lease payments on vacated facilities and other

contractual terminations. At each reporting date, the Company evaluates its accruals for employee separation and

exit costs to ensure the accruals are still appropriate. In certain circumstances, accruals are no longer needed because

of efficiencies in carrying out the plans or because employees previously identified for separation resigned from the

Company and did not receive severance or were redeployed due to circumstances not foreseen when the original

plans were initiated. In these cases, the Company reverses accruals through the consolidated statements of

operations where the original charges were recorded when it is determined they are no longer needed.

2010 Charges

During 2010, the Company continued to implement various productivity improvement plans aimed at

achieving long-term, sustainable profitability by driving efficiencies and reducing operating costs. All three of the

Company’s business segments were impacted by these plans. The employees affected were located in all geographic

regions.

During 2010, the Company recorded net reorganization of business charges of $138 million, including

$38 million of charges in Costs of sales and $100 million of charges under Other charges in the Company’s

consolidated statements of operations. Included in the aggregate $138 million are charges of $150 million for