Motorola 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

approvals. During the second quarter of 2010, the Company completed the sale of our Israel-based wireless network

operator. During the first quarter of 2009, the Company completed the sales of: (i) Good Technology, and (ii) the

Company’s former biometrics business unit, which included its Printrak trademark.

After taxes, the Company had earnings from discontinued operations of $379 million, or $1.12 per diluted

share, in 2010, compared to earnings from discontinued operations of $316 million, or $0.96 per diluted share, in

2009.

Results of Operations—2009 Compared to 2008

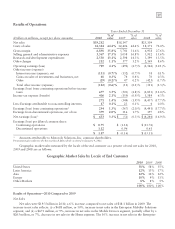

Net Sales

Net sales were $18.1 billion in 2009, down 28% compared to net sales of $25.1 billion in 2008. The decrease

in net sales reflects: (i) a $5.0 billion, or 41%, decrease in net sales in the Mobile Devices segment, (ii) a $1.0 billion,

or 21%, decrease in net sales in the Home segment, and (iii) a $1.1 billion, or 13%, decrease in net sales in the

Enterprise Mobility Solutions segment. The 41% decrease in net sales in the Mobile Devices segment was primarily

driven by a 45% decrease in unit shipments, partially offset by an 8% increase in ASP. The 21% decrease in net

sales in the Home segment was primarily driven by a 24% decrease in net revenues of set-top boxes, reflecting:

(i) an 18% decrease in unit shipments of set-top boxes, and (ii) a lower ASP due to an unfavorable shift in product

mix. The 13% decrease in net sales in the Enterprise Mobility Solutions segment reflects a 21% decrease in net sales

to the commercial enterprise market and a 10% decrease in net sales to the government and public safety market.

Gross Margin

Gross margin was $5.7 billion, or 31.6% of net sales, in 2009, compared to $6.9 billion, or 27.6% of net sales,

in 2008. Gross margin decreased in all segments. The decrease in gross margin in the Mobile Devices segment was

primarily driven by the 41% decrease in net sales, partially offset by: (i) supply chain efficiencies, primarily

including lower excess inventory charges in 2009 than in 2008, when the charges included a $370 million charge

due to a decision to consolidate software and silicon platforms, and (ii) the absence in 2009 of a comparable

$150 million charge in 2008 related to settlement of a purchase commitment. The decrease in gross margin in the

Enterprise Mobility Solutions segment was primarily driven by the 13% decrease in net sales and an unfavorable

product mix. The decrease in gross margin in the Home segment was primarily driven by the 21% decrease in net

sales, partially offset by a favorable product mix.

The increase in gross margin as a percentage of net sales in 2009 compared to 2008 was primarily driven by

increases in gross margin percentage in the Mobile Devices segment, partially offset by a decrease in gross margin

percentage in the Enterprise Mobility Solutions and Home segments. The Company’s overall gross margin as a

percentage of net sales can be impacted by the proportion of overall net sales generated by its various businesses. In

2009, the proportion of overall sales by our Mobile Devices business was smaller than in previous years. Since

Mobile Devices has the lowest gross margin percentage of the Company’s businesses, this positively impacted

overall gross margin percentage in 2009.

Selling, General and Administrative Expenses

SG&A expenses decreased 22% to $3.1 billion, or 16.8% of net sales, in 2009, compared to $3.9 billion, or

15.6% of net sales, in 2008. SG&A expenses decreased in the Mobile Devices and Enterprise Mobility Solutions

segments and increased slightly in the Home segment. The decrease in SG&A expenses in the Mobile Devices

segment was primarily driven by lower marketing expenses and savings from cost-reduction initiatives. The decrease

in SG&A expenses in the Enterprise Mobility Solutions segment was primarily due to savings from cost-reduction

initiatives. The slight increase in SG&A expenses in the Home segment was primarily due to increased

administrative expenses, partially offset by savings from cost-reduction initiatives. SG&A expenses as a percentage

of net sales increased in all segments.

Research and Development Expenditures

Research and development (“R&D”) expenditures decreased 24% to $2.6 billion, or 14.3% of net sales, in

2009, compared to $3.4 billion, or 13.5% of net sales, in 2008. R&D expenditures decreased in all segments,

primarily due to savings from cost-reduction initiatives. R&D expenditures as a percentage of net sales increased in

all segments. The Company participates in very competitive industries with constant changes in technology and,

accordingly, the Company continues to believe that a strong commitment to R&D is required to drive long-term

growth.