Motorola 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

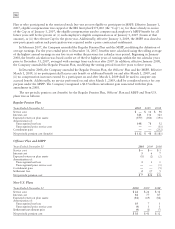

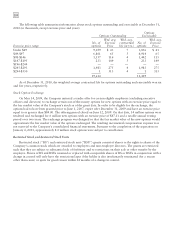

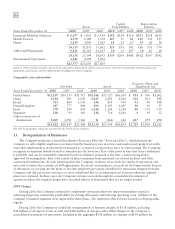

Restricted stock and restricted stock unit activity was as follows (in thousands, except fair value and employee

data):

2010 2009 2008

Years Ended December 31 RSU

Wtd. Avg.

Grant

Date Fair

Value RSU

Wtd Avg.

Grant

Date Fair

Value RS and RSU

Wtd Avg.

Grant

Date Fair

Value

RS and RSU outstanding at January 1 8,061 $55 4,604 $76 1,536 $119

Granted 4,772 49 5,478 43 3,872 64

Vested (2,407) 58 (988) 80 (330) 121

Terminated, canceled or expired (867) 56 (1,033) 60 (474) 94

RSU outstanding at December 31 9,559 51 8,061 55 4,604 76

Approx. number of employees granted RSUs 29,973 26,969 28,981

At December 31, 2010, the Company had unrecognized compensation expense related to RSUs of $301 million,

net of estimated forfeitures, expected to be recognized over the weighted average period of approximately two years.

The total fair value of RS and RSU shares vested during the years ended December 31, 2010, 2009 and 2008 was

$114 million, $44 million and $19 million, respectively. The aggregate fair value of outstanding RSUs as of

December 31, 2010 was $607 million. Pursuant to the completion of the Separation on January 4, 2011,

approximately 3.8 million unvested restricted stock units held by the employees of Motorola Mobility were subject

to cancellation.

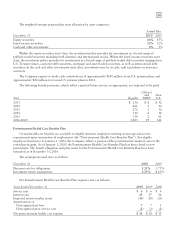

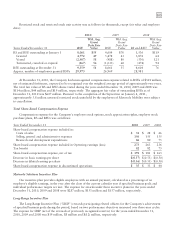

Total Share-Based Compensation Expense

Compensation expense for the Company’s employee stock options, stock appreciation rights, employee stock

purchase plans, RS and RSUs was as follows:

Year Ended December 31 2010 2009 2008

Share-based compensation expense included in:

Costs of sales $31$28$26

Selling, general and administrative expenses 156 155 135

Research and development expenditures 86 80 75

Share-based compensation expense included in Operating earnings (loss) 273 263 236

Tax benefit 82 82 73

Share-based compensation expense, net of tax $ 191 $ 181 $ 163

Decrease in basic earnings per share $(0.57) $(0.55) $(0.50)

Decrease in diluted earning per share $(0.56) $(0.55) $(0.50)

Share-based compensation expense in discontinued operations $35$33$44

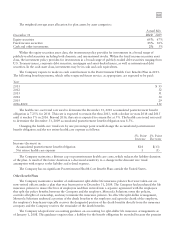

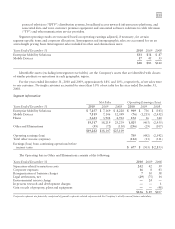

Motorola Solutions Incentive Plan

Our incentive plan provides eligible employees with an annual payment, calculated as a percentage of an

employee’s eligible earnings, in the year after the close of the current calendar year if specified business goals and

individual performance targets are met. The expense for awards under these incentive plans for the years ended

December 31, 2010, 2009 and 2008 were $287 million, $153 million and $137 million, respectively.

Long-Range Incentive Plan

The Long-Range Incentive Plan (“LRIP”) rewards participating elected officers for the Company’s achievement

of specified business goals during the period, based on two performance objectives measured over three-year cycles.

The expense for LRIP (net of the reversals of previously recognized reserves) for the years ended December 31,

2010, 2009 and 2008 was $19 million, $8 million and $(12) million, respectively.