Motorola 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

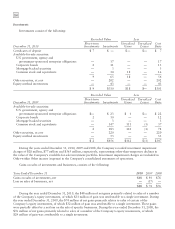

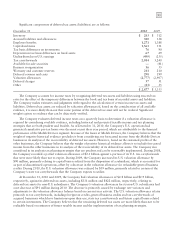

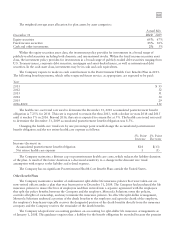

Tax carryforwards are as follows:

December 31, 2010

Gross

Tax Loss

Tax

Effected

Expiration

Period

United States:

U.S. tax losses $ 774 $ 271 2018-2027

Foreign tax credits n/a 863 2017-2019

General business credits n/a 326 2017-2030

Minimum tax credits n/a 109 Unlimited

State tax losses 1,733 52 2011-2030

State tax credits n/a 21 2011-2025

Non-U.S. Subsidiaries:

Brazil tax losses 231 78 Unlimited

China tax losses 208 52 2012-2015

Japan tax losses 79 32 2015-2017

United Kingdom tax losses 77 21 Unlimited

Germany tax losses 252 72 Unlimited

Singapore tax losses 101 17 Unlimited

Other subsidiaries tax losses 71 16 Various

Spain tax credits n/a 29 2018-2022

Other subsidiaries tax credits n/a 55 Various

$2,014

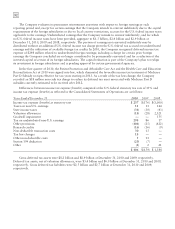

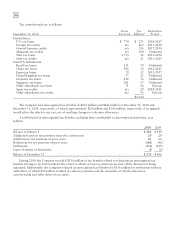

The Company had unrecognized tax benefits of $234 million and $466 million at December 31, 2010 and

December 31, 2009, respectively, of which approximately $20 million and $100 million, respectively, if recognized,

would affect the effective tax rate, net of resulting changes to valuation allowances.

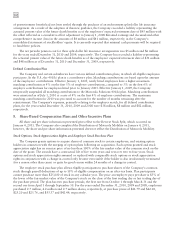

A roll-forward of unrecognized tax benefits, including those attributable to discontinued operations, is as

follows:

2010 2009

Balance at January 1 $ 466 $ 914

Additions based on tax positions related to current year 29 29

Additions for tax positions of prior years 61 60

Reductions for tax positions of prior years (161) (96)

Settlements (156) (439)

Lapse of statute of limitations (5) (2)

Balance at December 31 $ 234 $ 466

During 2010, the Company recorded $150 million of tax benefits related to reductions in unrecognized tax

benefits relating to facts that indicate the extent to which certain tax positions are more-likely-than-not of being

sustained. Additionally, the Company reduced its unrecognized tax benefits by $156 million for settlements with tax

authorities, of which $59 million resulted in cash tax payments and the remainder of which reduced tax

carryforwards and other deferred tax assets.