Motorola 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

Based on the Company’s current sales strategies, the newly adopted accounting guidance for revenue

recognition is not expected to have a significant effect on the timing and pattern of revenue recognition for sales in

periods after the initial adoption when applied to multiple-element arrangements, except for the continued impact

on smartphone revenue recognition. However, the Company expects that this new accounting guidance will

facilitate the Company’s efforts to optimize its product and service offerings due to better alignment of the

economics of an arrangement and the related accounting treatment. This may lead to the Company’s engaging in

new sales practices in the future. As these go-to-market strategies evolve, the Company may modify its pricing

practices in the future, which could result in changes in selling prices, including both VSOE and ESP. As a result, the

Company’s future revenue recognition for multiple-element arrangements could differ materially from the results

reported in the current period. The Company is currently unable to determine the impact that the newly adopted

accounting guidance for revenue recognition could have on its reported revenue as these go-to-market strategies

evolve.

Changes in cost estimates and the fair values of certain deliverables could negatively impact the Company’s

operating results. In addition, unforeseen conditions could arise over the contract term that may have a significant

impact on operating results.

Sales and Use Taxes—The Company records taxes imposed on revenue-producing transactions, including sales,

use, value added and excise taxes, on a net basis with such taxes excluded from revenue.

Cash Equivalents: The Company considers all highly-liquid investments purchased with an original maturity

of three months or less to be cash equivalents. At December 31, 2010, and 2009, restricted cash was $226 million

and $206 million, respectively.

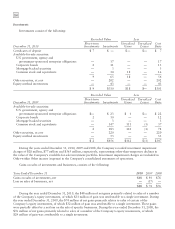

Sigma Fund: The Company and its wholly-owned subsidiaries invest a significant portion of their U.S.

dollar-denominated cash in a fund (the “Sigma Fund”) that allows the Company to efficiently manage its cash

around the world. The Sigma Fund portfolio is managed by four independent investment management firms. The

investment guidelines of the Sigma Fund require that purchased investments must be in high-quality, investment

grade (rated at least A/A-1 by Standard & Poor’s or A2/P-1 by Moody’s Investors Service), U.S. dollar-denominated

debt obligations, including certificates of deposit, commercial paper, government bonds, corporate bonds and asset-

and mortgage-backed securities. Under the Sigma Fund’s investment policies, except for debt obligations of the U.S.

government, agencies and government-sponsored enterprises, no more than 5% of the Sigma Fund portfolio is to

consist of debt obligations of any one issuer. The Sigma Fund’s investment policies further require that floating rate

investments must have a maturity at purchase date that does not exceed thirty-six months with an interest rate that

is reset at least annually. The average interest rate reset of the investments held by the funds must be 120 days or

less.

Investments in the Sigma Fund are carried at fair value. The Company primarily relies on valuation pricing

models and broker quotes to determine the fair value of investments in the Sigma Fund. The valuation models are

developed and maintained by third-party pricing services and use a number of standard inputs to the valuation

models, including benchmark yields, reported trades, broker/dealer quotes where the counterparty is standing ready

and able to transact, issuer spreads, benchmark securities, bids, offers and other reference data. For each asset class,

quantifiable inputs related to perceived market movements and sector news may be considered in addition to the

standard inputs.

Investments: Investments in equity and debt securities classified as available-for-sale are carried at fair value.

Debt securities classified as held-to-maturity are carried at amortized cost. Equity securities that are restricted for

more than one year or that are not publicly traded are carried at cost. Certain investments are accounted for using

the equity method if the Company has significant influence over the issuing entity.

The Company assesses declines in the fair value of investments to determine whether such declines are other-

than-temporary. This assessment is made considering all available evidence, including changes in general market

conditions, specific industry and individual company data, the length of time and the extent to which the fair value

has been less than cost, the financial condition and the near-term prospects of the entity issuing the security, and the

Company’s ability and intent to hold investment until recovery. Other-than-temporary impairments of investments

are recorded to Other within Other income (expense) in the Company’s consolidated statements of operations in the

period in which they become impaired.