Motorola 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

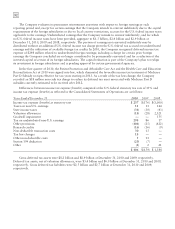

The Company evaluates its permanent reinvestment assertions with respect to foreign earnings at each

reporting period and, except for certain earnings that the Company intends to reinvest indefinitely due to the capital

requirements of the foreign subsidiaries or due to local country restrictions, accrues for the U.S. federal income taxes

applicable to the earnings. Undistributed earnings that the Company intends to reinvest indefinitely, and for which

no U.S. federal income taxes have been provided, aggregate to $1.3 billion, $2.4 billion and $2.9 billion at

December 31, 2010, 2009 and 2008, respectively. The portion of earnings not reinvested indefinitely may be

distributed without an additional U.S. federal income tax charge given the U.S. federal tax accrued on undistributed

earnings and the utilization of available foreign tax credits. In 2010, the Company recognized deferred income tax

expense of $298 million related to undistributed foreign earnings; including a charge for certain prior foreign

earnings the Company concluded are no longer considered to be permanently reinvested and for a reduction of the

invested capital of certain of its foreign subsidiaries. The capital reduction is part of the Company’s plan to realign

its investment in foreign subsidiaries and is pending approval by certain governmental agencies.

In the first quarter of 2010, the Patient Protection and Affordable Care Act and the Health Care and Education

Reconciliation Act of 2010 were signed into law, which eliminated the favorable income tax treatment of Medicare

Part D Subsidy receipts effective for tax years starting in 2013. As a result of the tax law change, the Company

recorded an $18 million non-cash tax charge to reduce its deferred tax asset associated with Medicare Part D

subsidies currently estimated to be received after 2012.

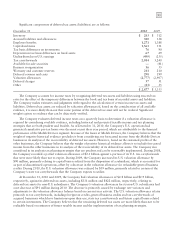

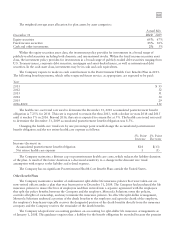

Differences between income tax expense (benefit) computed at the U.S. federal statutory tax rate of 35% and

income tax expense (benefit) as reflected in the Consolidated Statements of Operations are as follows:

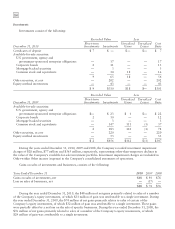

Years Ended December 31 2010 2009 2008

Income tax expense (benefit) at statutory rate $ 237 $(176) $(1,000)

Taxes on non-U.S. earnings 11 11 144

State income taxes (34) (30) (43)

Valuation allowances (18) (28) 2,321

Goodwill impairment —— 555

Tax on undistributed non-U.S. earnings 298 86 17

Other provisions (104) (25) (422)

Research credits (16) (16) (9)

Non-deductible transaction costs 30 13 —

Tax law changes 18 ——

Other non-deductible costs 511 —

Section 199 deduction (20) (7) —

Other (1) 221

$ 406 $(159) $ 1,584

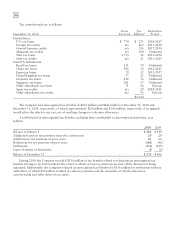

Gross deferred tax assets were $8.2 billion and $8.9 billion at December 31, 2010 and 2009, respectively.

Deferred tax assets, net of valuation allowances, were $5.4 billion and $6.0 billion at December 31, 2010 and 2009,

respectively. Gross deferred tax liabilities were $2.5 billion and $2.7 billion at December 31, 2010 and 2009,

respectively.