Motorola 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

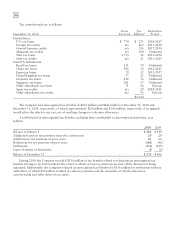

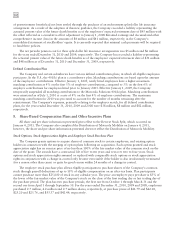

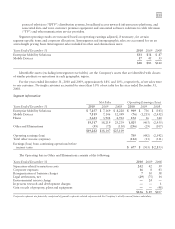

The following table summarizes information about stock options outstanding and exercisable at December 31,

2010 (in thousands, except exercise price and years):

Options Outstanding

Options

Exercisable

Exercise price range

No. of

options

Wtd. avg.

Exercise

Price

Wtd. avg.

contractual

life (in yrs.)

No. of

options

Wtd. avg.

Exercise

Price

Under $49 9,059 $ 43 7 3,856 $ 41

$49-$97 6,801 65 5 4,914 65

$98-$146 1,537 116 4 1,442 115

$147-$195 233 149 5 233 149

$196-$244 — — — — —

$245-$293 1,983 275 4 1,983 275

$294-$330 1 313 4 1 313

19,614 12,429

As of December 31, 2010, the weighted average contractual life for options outstanding and exercisable was six

and five years, respectively.

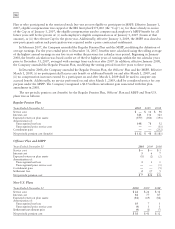

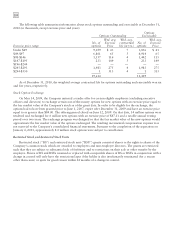

Stock Option Exchange

On May 14, 2009, the Company initiated a tender offer for certain eligible employees (excluding executive

officers and directors) to exchange certain out-of-the-money options for new options with an exercise price equal to

the fair market value of the Company’s stock as of the grant date. In order to be eligible for the exchange, the

options had to have been granted prior to June 1, 2007, expire after December 31, 2009 and have an exercise price

equal to or greater than $84.00. The offering period closed on June 12, 2009. On that date, 14 million options were

tendered and exchanged for 6 million new options with an exercise price of $47.11 and a ratable annual vesting

period over two years. The exchange program was designed so that the fair market value of the new options would

approximate the fair market value of the options exchanged. The resulting incremental compensation expense was

not material to the Company’s consolidated financial statements. Pursuant to the completion of the separation on

January 4, 2011, approximately 8.0 million stock options were subject to cancellation.

Restricted Stock and Restricted Stock Units

Restricted stock (“RS”) and restricted stock unit (“RSU”) grants consist of shares or the rights to shares of the

Company’s common stock which are awarded to employees and non-employee directors. The grants are restricted

such that they are subject to substantial risk of forfeiture and to restrictions on their sale or other transfer by the

employee. Shares of RS and RSUs assumed or replaced with comparable shares of RS or RSUs in conjunction with a

change in control will only have the restrictions lapse if the holder is also involuntarily terminated (for a reason

other than cause) or quits for good reason within 24 months of a change in control.