Motorola 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

Sales of Receivables

From time to time, the Company sells accounts receivable and long-term receivables on a non-recourse basis to

third parties under one-time arrangement while others are sold to third parties under committed facilities that

involve contractual commitments from these parties to purchase qualifying receivables up to an outstanding

monetary limit. Committed facilities may be revolving in nature and, typically, must be renewed annually. The

Company may or may not retain the obligation to service the sold accounts receivable and long-term receivables.

As of December 31, 2010, the Company had a $200 million revolving receivable sales facility, maturing June

2011, for the sale of accounts receivable, which was fully available. The initial cash proceeds received by the

Company for the sale of these receivables is capped at the lower of $200 million or eligible receivables less reserves.

At December 31, 2009, the Company had a $200 million committed revolving credit facility for the sale of accounts

receivable, of which $140 million was available. The Company had no significant committed facilities for the sale of

long-term receivables at December 31, 2010 and 2009, respectively. At December 31, 2008, the Company had $532

million of committed revolving facilities for the sale of accounts receivable, of which $35 million was available. In

addition, as of December 31, 2008, the Company had $435 million of committed facilities associated with the sale

of long-term receivables primarily for a single customer, of which $173 million was available.

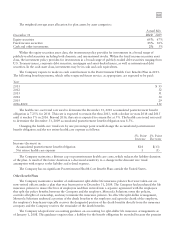

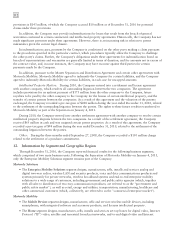

The following table summarizes the proceeds received from non-recourse sales of accounts receivable and long-

term receivables for the years ended December 31, 2010, 2009 and 2008:

Years Ended December 31 2010 2009 2008

Cumulative annual proceeds received from one-time sales:

Accounts receivable sales proceeds $716 $1,000 $2,124

Long-term receivables sales proceeds 69 72 281

Total proceeds from one-time sales 785 1,072 2,405

Cumulative annual proceeds received from sales under committed facilities 70 233 1,281

Total proceeds from receivables sales $855 $1,305 $3,686

At December 31, 2010, the Company retained servicing obligations for $440 million of sold accounts

receivables and $277 million of long-term receivables, compared to $195 million of accounts receivables and $297

million of long-term receivables at December 31, 2009.

Under certain arrangements, the value of accounts receivable sold is supported by credit insurance purchased

from third-party insurance companies, less deductibles or self-insurance requirements under the insurance policies.

Under these arrangements, the Company’s total credit exposure, less insurance coverage, to outstanding accounts

receivable that have been sold was $9 million and $27 million at December 31, 2010 and 2009, respectively.

Credit Quality of Customer Financing Receivables and Allowance for Credit Losses

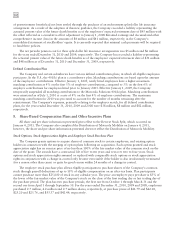

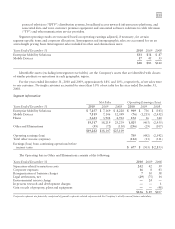

An aging analysis of financing receivables at December 31, 2010 and December 31, 2009 is as follows:

December 31, 2010

Total

Long-term

Receivable

Current Billed

Due

Past Due

Under 90 Days

Past Due

Over 90 Days

Municipal leases secured tax exempt $ 16 $ — $ — $ —

Commercial loans and leases secured $ 67 $ 1 $ — $ —

Commercial loans unsecured $ 203 $ — $ 2 $ 2

Total long-term receivables $ 286 $ 1 $ 2 $ 2