Motorola 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

dividends to holders of its common stock, all of which was paid during the first quarter of 2009, related to the

payment of a dividend declared in November 2008. In February 2009, the Company announced that its Board of

Directors suspended the declaration of quarterly cash dividends on the Company’s common stock.

During the year ended December 31, 2010, the Company paid $23 million of dividends to a minority

shareholder in connection with a subsidiary’s common stock.

Par Value Change: On May 4, 2009, the Company’s stockholders approved a change in the par value of

Motorola Solutions common stock from $3.00 per share to $.01 per share. The change did not have an impact on

the amount of the Company’s Total stockholders’ equity, but it did result in a reclassification of $6.9 billion

between Common stock and Additional paid-in capital.

Motorola Mobility Separation: On January 4, 2011, the separation of Motorola Mobility from Motorola

Solutions was completed. On January 4, 2011, the stockholders of record as of the close of business on

December 21, 2010 received one (1) share of Motorola Mobility common stock for each eight (8) shares of

Motorola, Inc. common stock held as of the Record Date. The Separation was completed pursuant to an Amended

and Restated Master Separation and Distribution Agreement, effective as of July 31, 2010, among Motorola, Inc.,

Motorola Mobility Holdings and Motorola Mobility, Inc.

Reverse Stock Split: On November 30, 2010, the Company announced the timing and details regarding the

Separation and the approval of a reverse stock split at a ratio of 1-for-7. Immediately following the Distribution of

Motorola Mobility common stock, the Company completed a 1-for-7 reverse stock split. All consolidated per share

information presented gives effect to the Reverse Stock Split.

4. Debt and Credit Facilities

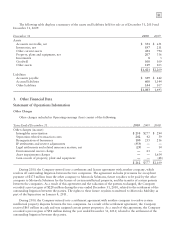

Long-Term Debt

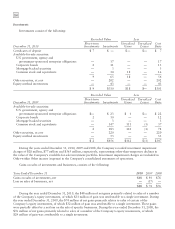

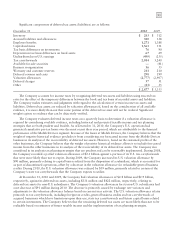

December 31 2010 2009

7.625% notes due 2010 $— $ 527

8.0% notes due 2011 600 600

5.375% senior notes due 2012 400 400

6.0% senior notes due 2017 399 399

6.5% debentures due 2025 313 377

7.5% debentures due 2025 346 346

6.5% debentures due 2028 209 283

6.625% senior notes due 2037 224 444

5.22% debentures due 2097 89 196

Other long-term debt 149 214

2,729 3,786

Adjustments, primarily unamortized gains on interest rate swap terminations 70 110

Less: current portion (605) (531)

Long-term debt $2,194 $3,365

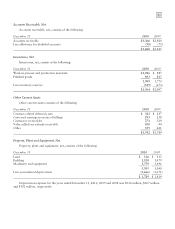

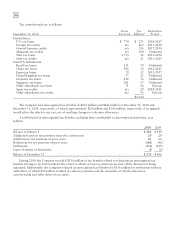

Other Short-Term Debt

December 31 2010 2009

Notes to banks $— $5

Add: current portion of long-term debt 605 531

Notes payable and current portion of long-term debt $605 $536

Weighted average interest rates on short-term borrowings throughout the year 3.1% 3.1%

In November 2010, the Company repaid, at maturity, the entire $527 million aggregate principal amount

outstanding of its 7.625% Notes due November 15, 2010. During the year ended December 31, 2010, the Company

repurchased approximately $500 million of its outstanding long-term debt for a purchase price of $477 million,

excluding approximately $5 million of accrued interest, all of which occurred during the three months ended