Motorola 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

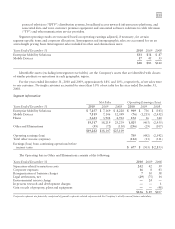

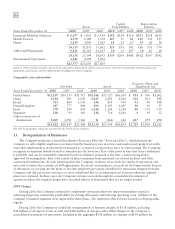

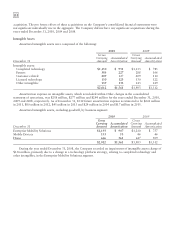

Goodwill

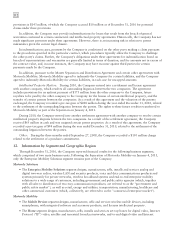

The following table displays a rollforward of the carrying amount of goodwill by reportable segment from

January 1, 2008 to December 31, 2010:

Enterprise

Mobility

Solutions

Mobile

Devices Home

Total

Company

Balances as of January 1, 2008:

Aggregate goodwill acquired $ 2,916 $ 19 $1,528 $ 4,463

Accumulated impairment losses — — (73) (73)

Goodwill, net of impairment losses 2,916 19 1,455 4,390

Goodwill acquired 60 15 12 87

Impairment losses (1,564) (55) — (1,619)

Adjustments 28 21 (179) (130)

Balance as of December 31, 2008:

Aggregate goodwill acquired 3,004 55 1,361 4,420

Accumulated impairment losses (1,564) (55) (73) (1,692)

Goodwill, net of impairment losses 1,440 — 1,288 2,728

Goodwill acquired — — — —

Impairment losses — — — —

Adjustments (11) — (3) (14)

Balance as of December 31, 2009:

Aggregate goodwill acquired 2,993 55 1,358 4,406

Accumulated impairment losses (1,564) (55) (73) (1,692)

Goodwill, net of impairment losses 1,429 — 1,285 2,714

Goodwill acquired — 78 33 111

Impairment losses — — — —

Adjustments — — — —

Balance as of December 31, 2010:

Aggregate goodwill acquired 2,993 133 1,391 4,517

Accumulated impairment losses (1,564) (55) (73) (1,692)

Goodwill, net of impairment losses $ 1,429 $ 78 $1,318 $ 2,825

During the year ended December 31, 2008, the Company finalized its assessment of the Internal Revenue Code

Section 382 Limitations (“IRC Section 382”) relating to the pre-acquisition tax loss carryforwards of its 2007

acquisitions. As a result of the IRC Section 382 studies, the Company recorded additional deferred tax assets and a

corresponding reduction in goodwill, which is reflected in the adjustment line above.

The Company conducts its annual assessment of goodwill for impairment in the fourth quarter of each year.

The goodwill impairment test is performed at the reporting unit level. A reporting unit is an operating segment or

one level below an operating segment. The Company has determined that the Mobile Devices segment meets the

requirement of a reporting unit. For the Enterprise Mobility Solutions segment, the Company has identified two

reporting units, the Government and Public Safety reporting unit and the Enterprise Mobility reporting unit. For the

Home segment, the Company has identified two reporting units, the Broadband Home Solutions reporting unit and

the Access Networks reporting unit. The Company performs extensive valuation analyses, utilizing both income and

market-based approaches, in its goodwill assessment process. The determination of the fair value of the reporting

units and other assets and liabilities within the reporting units requires the Company to make significant estimates

and assumptions. These estimates and assumptions primarily include, but are not limited to, the discount rate,

terminal growth rate, earnings before depreciation and amortization, and capital expenditures forecasts specific to

each reporting unit. Due to the inherent uncertainty involved in making these estimates, actual results could differ

from those estimates.

The Company has weighted the valuation of its reporting units at 75% based on the income approach and 25%

based on the market-based approach, consistent with prior periods. The Company believes that this weighting is