Motorola 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Plan or who participated in the restricted stock buy-out are not eligible to participate in MSPP. Effective January 1,

2007, eligible compensation was capped at the IRS limit plus $175,000 (the “Cap”) or, for those already in excess

of the Cap as of January 1, 2007, the eligible compensation used to compute such employee’s MSPP benefit for all

future years will be the greater of: (i) such employee’s eligible compensation as of January 1, 2007 (frozen at that

amount), or (ii) the relevant Cap for the given year. Additionally, effective January 1, 2009, the MSPP was closed to

new participants unless such participation was required under a prior contractual entitlement.

In February 2007, the Company amended the Regular Pension Plan and the MSPP, modifying the definition of

average earnings. For the years ended prior to December 31, 2007, benefits were calculated using the rolling average

of the highest annual earnings in any five years within the previous ten calendar year period. Beginning in January

2008, the benefit calculation was based on the set of the five highest years of earnings within the ten calendar years

prior to December 31, 2007, averaged with earnings from each year after 2007. In addition, effective January 2008,

the Company amended the Regular Pension Plan, modifying the vesting period from five years to three years.

In December 2008, the Company amended the Regular Pension Plan, the Officers’ Plan and the MSPP. Effective

March 1, 2009, (i) no participant shall accrue any benefit or additional benefit on and after March 1, 2009, and

(ii) no compensation increases earned by a participant on and after March 1, 2009 shall be used to compute any

accrued benefit. Additionally, no service performed on and after March 1, 2009, shall be considered service for any

purpose under the MSPP. The Company recognized a $237 million curtailment gain associated with this plan

amendment in 2008.

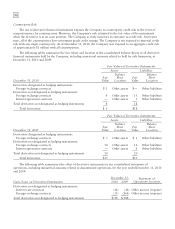

The net periodic pension cost (benefit) for the Regular Pension Plan, Officers’ Plan and MSPP and Non-U.S.

plans was as follows:

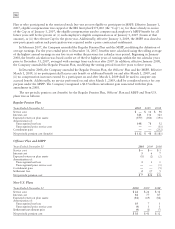

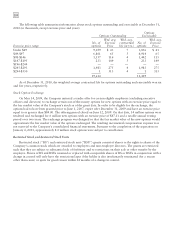

Regular Pension Plan

Years Ended December 31 2010 2009 2008

Service cost $— $14 $ 98

Interest cost 341 336 323

Expected return on plan assets (377) (380) (391)

Amortization of:

Unrecognized net loss 148 78 52

Unrecognized prior service cost —— (31)

Curtailment gain —— (232)

Net periodic pension cost (benefit) $ 112 $ 48 ($ 181)

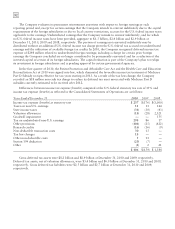

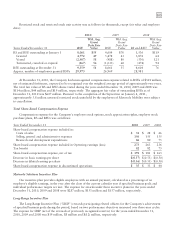

Officers’ Plan and MSPP

Years Ended December 31 2010 2009 2008

Service cost $— $— $ 3

Interest cost 367

Expected return on plan assets (1) (2) (2)

Amortization of:

Unrecognized net loss 331

Unrecognized prior service cost —— (1)

Curtailment gain —— (5)

Settlement loss 217 5

Net periodic pension cost $7 $24 $ 8

Non-U.S. Plans

Years Ended December 31 2010 2009 2008

Service cost $24 $26 $34

Interest cost 84 77 87

Expected return on plan assets (81) (69) (84)

Amortization of:

Unrecognized net loss 19 71

Unrecognized prior service cost (4) 11

Settlement/curtailment gain (4) (1) (7)

Net periodic pension cost $38 $41 $32