Motorola 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

The Company’s arrangements with multiple deliverables may also contain a stand-alone software deliverable

that is subject to the existing software revenue recognition guidance. The revenue for these multiple-element

arrangements is allocated to the software deliverable and the non-software deliverable(s) based on the relative

selling prices of all of the deliverables in the arrangement using the hierarchy in the new revenue accounting

guidance. In circumstances where the Company cannot determine VSOE or TPE of the selling price for all of the

deliverables in the arrangement, including the software deliverable, ESP is used for the purpose of allocating the

arrangement consideration.

The Company’s arrangements with multiple deliverables may be comprised entirely of deliverables that are all

still subject to the existing software revenue recognition guidance. For these arrangements, revenue is allocated to

the deliverables based on VSOE. Should VSOE not exist for the undelivered software element, revenue is deferred

until either the undelivered element is delivered or VSOE is established for the element, whichever occurs first.

When the fair value of a delivered element has not been established, but fair value exists for the undelivered

elements, the Company uses the residual method to recognize revenue if the fair value of all undelivered elements is

determinable. Under the residual method, the fair value of the undelivered elements is deferred and the remaining

portion of the arrangement consideration is allocated to the delivered elements and is recognized as revenue.

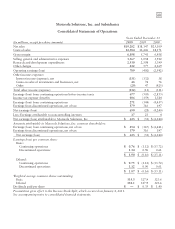

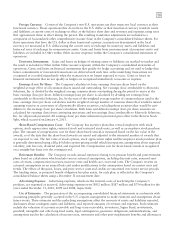

Net sales as reported and pro forma net sales that would have been reported during the year ended

December 31, 2010, if the transactions entered into or materially modified after January 1, 2010 were still subject

to the previous accounting guidance are shown in the following table (in millions):

Year Ended December 31, 2010 As Reported Pro Forma Basis

Net sales $19,282 $15,953

For the year ended December 31, 2010, the difference between the amount of revenue recorded under the new

accounting guidance for revenue recognition as compared to the pro forma amount that would have been recorded

under the prior accounting guidance relates primarily to sales of smart phones by the Company’s Mobile Devices

segment. The pro forma basis revenue reflects the recognition of revenue related to smart phones that contain a

service element and unspecified software upgrade rights under a subscription-based model under which revenue is

recognized ratably over the estimated expected life of the smart phone as the Company was unable to determine

VSOE for the undelivered element in the transaction. The as reported revenue reflects the allocation of revenue

related to smart phones shipped under arrangements executed during the year ended December 31, 2010 using ESP

for the device, the service and the unspecified software upgrade rights, resulting in a lower deferral of revenue than

under prior accounting guidance. Both the as reported revenue and the pro forma basis revenue contain the revenue

recognized under the subscription-based revenue recognition model related to smart phones that contain a service

element and unspecified software that shipped under arrangements executed during the year ended December 31,

2009.

In addition, the pro forma basis revenue reflects a reduction in net sales for multiple-element transactions that

contain an undelivered specified software product or and for which the Company does not have VSOE as all related

revenue would be deferred until the specified software product is delivered or the Company establishes VSOE for

the undelivered specified software product. The as reported revenue reflects the allocation of revenue to the multiple

elements using a relative selling price method with revenue being ascribed to the undelivered elements based on ESP.

Also, the pro forma basis revenue reflects a reduction in net sales for arrangements for which the Company does not

have VSOE for post-contract customer support being provided in a multiple-element arrangement. In these

instances, the net sales are being recognized ratably over the post-contract customer support period. The as reported

revenue reflects the allocation of revenue to the multiple-elements using a relative selling price method with revenue

being ascribed to the post-contract customer support based on ESP.

Finally, there is a difference in the as reported revenue as compared to the pro forma basis revenue due to the

Company’s no longer using the residual method for allocating revenue to the delivered products in a

multiple-element arrangement when VSOE exists for the undelivered element but not the delivered element. This

situation is most prevalent for networks/system solutions that were sold with additional deliverables that are not in

the scope of contract accounting. Under the prior accounting guidance for revenue recognition, the Company would

ascribe the residual value to the contract accounting deliverable only when VSOE for the undelivered services or

other products in the arrangement could be determined.