Motorola 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

appropriate since it is often difficult to find other appropriate market participants that are similar to our reporting

units and it is the Company’s view that future discounted cash flows are more reflective of the value of the reporting

units.

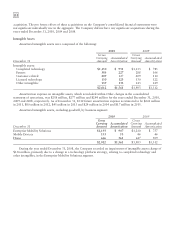

Based on the results of the 2009 and 2010 annual assessments of the recoverability of goodwill, the fair values

of all reporting units exceeded their book values, indicating that there was no impairment of goodwill.

Based on the results of step one of the 2008 annual assessment of the recoverability of goodwill, the fair values

of the Broadband Home Solutions and the Access Networks reporting units exceeded their book values, indicating

that there was no impairment of goodwill at these reporting units. However, the fair value of the Enterprise

Mobility and Mobile Devices reporting units were below their respective book values, indicating a potential

impairment of goodwill and the requirement to perform step two of the analysis for the reporting unit. The

Company acquired the main components of the Enterprise Mobility reporting unit in 2007 at which time the book

and fair value of the reporting unit was the same. Because of this fact, the Enterprise Mobility reporting unit was

most likely to experience a decline in its fair value below its book value as a result of lower values in the overall

market due to the deteriorating macroeconomic environment and the market’s view of its near term impact on the

reporting unit. The decline in the fair value of the Mobile Devices reporting unit below its book value was a result

of the deteriorating macroeconomic environment, lower than expected revenues and cash flows as a result of the

decision to consolidate platforms announced in the fourth quarter of 2008, and the uncertainty around the

reporting unit’s future cash flow. For the year ended December 31, 2008, the Company determined that the

goodwill relating to the Enterprise Mobility and Mobile Devices reporting units was impaired, resulting in a charges

of $1.6 billion and $55 million, respectively, in the Enterprise Mobility Solutions and Mobile Devices reportable

segments.

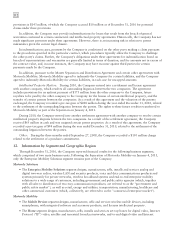

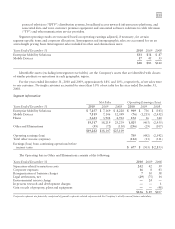

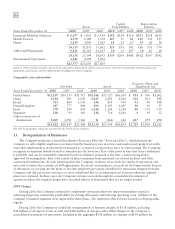

15. Valuation and Qualifying Accounts

The following table presents the valuation and qualifying account activity for the years ended December 31,

2010, 2009 and 2008:

Balance at

January 1

Charged to

Earnings Used Adjustments

Balance at

December 31

2010

Reorganization of Businesses $122 $ 171 $ (153) $ (40) $100

Allowance for Doubtful Accounts 75 49 (11) (15) 98

Allowance for Losses on Long-term

Receivables 9 3 (2) (7) 3

Inventory Reserves 673 218 (263) (83) 545

Warranty Reserves 209 372 (301) (31) 249

Customer Reserves 321 1,131 (919) (160) 373

2009

Reorganization of Businesses $231 $ 356 $ (393) $ (72) $122

Allowance for Doubtful Accounts 114 27 (44) (22) 75

Allowance for Losses on Long-term

Receivables 7 6 — (4) 9

Inventory Reserves 622 358 (268) (39) 673

Warranty Reserves 268 278 (290) (47) 209

Customer Reserves 496 1,007 (1,021) (161) 321

2008

Reorganization of Businesses $187 $ 349 $ (260) $ (45) $231

Allowance for Doubtful Accounts 99 47 (18) (14) 114

Allowance for Losses on Long-term

Receivables 5 5 — (3) 7

Inventory Reserves 254 664 (326) 30 622

Warranty Reserves 383 414 (445) (84) 268

Customer Reserves 782 1,435 (1,347) (374) 496

Adjustments include translation adjustments.