Motorola 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

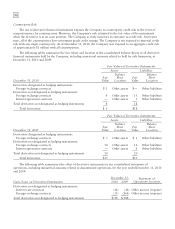

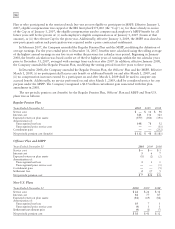

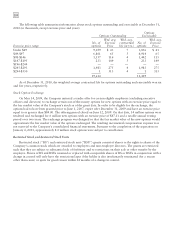

The status of the Company’s plans is as follows:

2010 2009

Regular

Officers’

and

MSPP Non

U.S. Regular

Officers’

and

MSPP

Non

U.S.

Change in benefit obligation:

Benefit obligation at January 1 $ 5,821 $ 52 $1,576 $ 5,110 $116 $1,221

Service cost —— 24 14 — 26

Interest cost 341 3 84 336 6 77

Plan amendments — — (115) —— 2

Settlement/curtailment —— 2 — — (7)

Actuarial (gain) loss 173 4 54 592 (20) 214

Foreign exchange valuation adjustment — — (71) —— 87

Employee contributions —— 5 —— 6

Tax payments — (3) — — (1) —

Benefit payments (206) (12) (54) (231) (49) (50)

Benefit obligation at December 31 6,129 44 1,505 5,821 52 1,576

Change in plan assets:

Fair value at January 1 3,898 17 1,147 3,295 56 957

Return on plan assets 466 1 124 754 1 123

Company contributions 150 7 47 80 10 39

Employee contributions —— 5 —— 6

Foreign exchange valuation adjustment — — (43) —— 72

Tax payments from plan assets — (1) — — (1) —

Benefit payments from plan assets (206) (12) (54) (231) (49) (50)

Fair value at December 31 4,308 12 1,226 3,898 17 1,147

Funded status of the plan (1,821) (32) (279) (1,923) (35) (429)

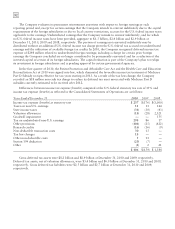

Unrecognized net loss 2,799 11 323 2,863 13 342

Unrecognized prior service cost — — (99) —— 6

Prepaid (accrued) pension cost $ 978 $(21) $ (55) $ 940 $ (22) $ (81)

Components of prepaid (accrued) pension cost:

Non-current benefit liability $(1,821) $(32) $ (279) $(1,923) $ (35) $ (429)

Deferred income taxes 1,033 4 35 1,062 6 24

Accumulated other comprehensive income (loss) 1,766 7 189 1,801 7 324

Prepaid (accrued) pension cost $ 978 $(21) $ (55) $ 940 $ (22) $ (81)

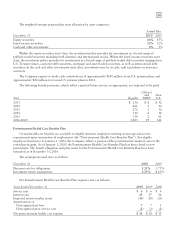

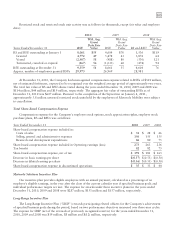

It is estimated that the net periodic cost for 2011 will include amortization of the unrecognized net loss and

prior service costs for the Regular Plan, Officers’ and MSPP Plans, and Non-U.S. Plans, currently included in

Accumulated other comprehensive loss, of $187 million, $2 million, and $4 million, respectively.

The Company uses a five-year, market-related asset value method of amortizing asset-related gains and losses.

Prior service costs are being amortized over periods ranging from 10 to 12 years. Benefits under all pension plans

are valued based upon the projected unit credit cost method.

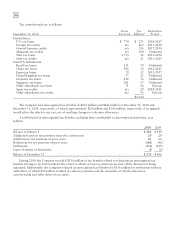

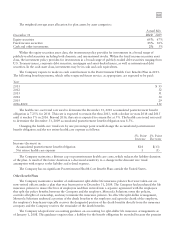

During March of 2010, the Company recognized a curtailment gain in one of its Non-U.S. plans resulting in a

reduction of the amounts recognized in Accumulated other comprehensive loss of $22 million. No gain or loss was

recognized in the Company’s consolidated statement of operations as a result of the curtailment.

In August 2010, the Company created separate Non-U.S. plans in certain locations, pursuant to the Company’s

separation into two independent, publicly traded companies. The portion of existing pension assets and benefit

obligations relating to employees covered by the newly-created plans were transferred to those plans. Prior to this

transfer the pension assets and benefit obligations were remeasured resulting in an adjustment to Accumulated other

comprehensive loss of $28 million, net of taxes of $13 million.